I worked for twenty-seven years with Reckitt & Colman/RB/Reckitt, a great company with amazing brands and people,

Three years after retiring, I've observed that many businesses lack the simple yet effective structures and frameworks that made RB a great operating company.

Known as RB between 2000 and 2019, the company became one of the world's top-performing consumer products companies in shareholder returns, market share, and financial metrics from 2000 to 2015. This success stemmed from a carefully crafted operating model developed by CEO Bart Becht and his team, followed by Rakesh Kapoor and his team.

I'm sharing the frameworks that drove this success. These principles are universal and can benefit any organization. Both my former RB colleagues and competitors will recognize these concepts and could likely expand on them.

Any company implementing these principles can transform into a formidable competitor with a strong achievement-oriented culture.

Category-Driven Long-Term Growth Model:

Play in categories with low penetration but high growth potential.

Enter early and set pricing to enable high gross margin percentages.

Build penetration steadily over decades through sustained innovation, brand awareness, and product availability.

Utilize higher gross margins to invest much more than competitors on Advertising, supporting category penetration (and brand awareness)

This drives disproportionate growth and, in the long term, a highly disproportionate share of the category’s profit pool.

Leverage high-growth contribution with retailers for disproportionate placement and support, as these categories drive significant growth and margin for them.

Create an annual cadence of innovation with rapid cycles of rollout and reiteration.

Summarise annual learnings into a category growth model for each category. Use this model to drive actions, KPIs, and focus within the markets, with a yearly feedback loop to improve the model.

Financially driven company:

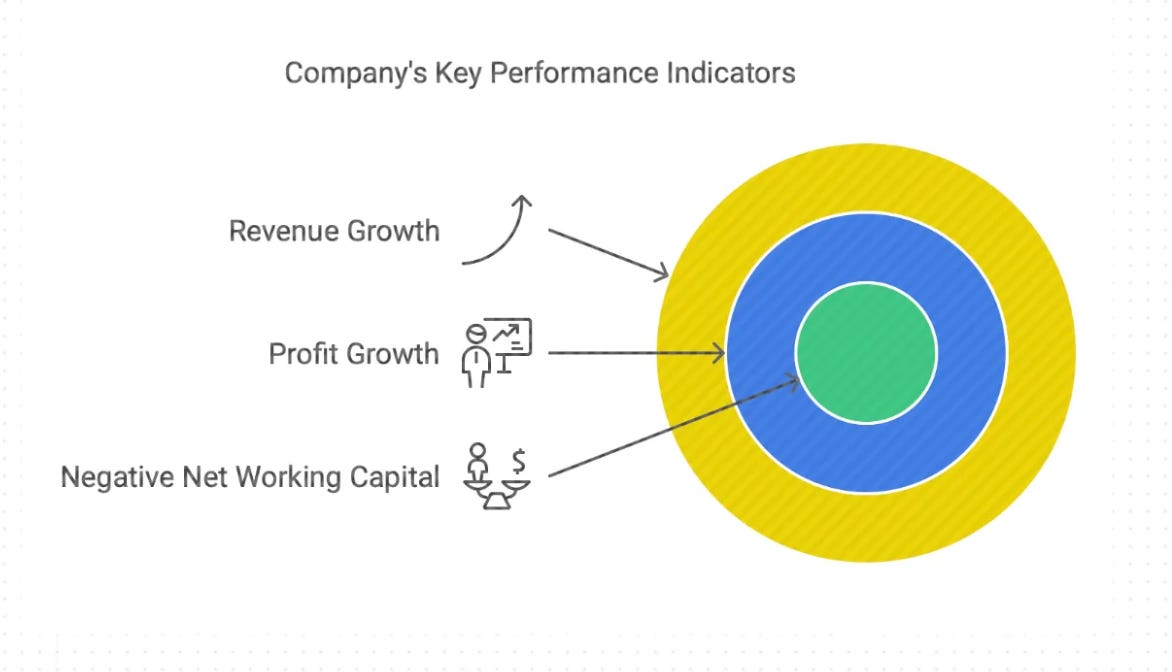

The company focuses on only three key performance indicators (KPIs):

Revenue growth

Profit growth – either operating profit growth or GM% growth, depending on roles

Negative net working capital

Every individual has targets that contribute to each of these three KPIs.

One of the core skills of leadership is setting the right ‘stretch’ in these targets so that people feel they are achievable. These targets are rolled out before the start of the year and are not changed for the year.

Everyone is reviewed financially. Marketers own their P&L and need to be P&L experts.

Standard P&L formats are required in every review—no selective financial charts allowed.

Simplified P&Ls are not accepted. Every P&L must start with Gross Sales (at the highest price per SKU to customer), with all discounts listed under trade spend.

P&Ls include columns for Year-to-date, balance-to-go, and running rates.

P&Ls are segmented by Area, country, category, segment, brand, customer, and channel levels.

P&Ls are accessible to all functions within their geographical/category scope, and everyone is expected to understand them thoroughly.

There is a strong emphasis on productivity. These productivity savings serve as self-generated "fuel for growth"—this is what enables the company to invest and win. Without productivity gains, there is no ability to invest and compete.

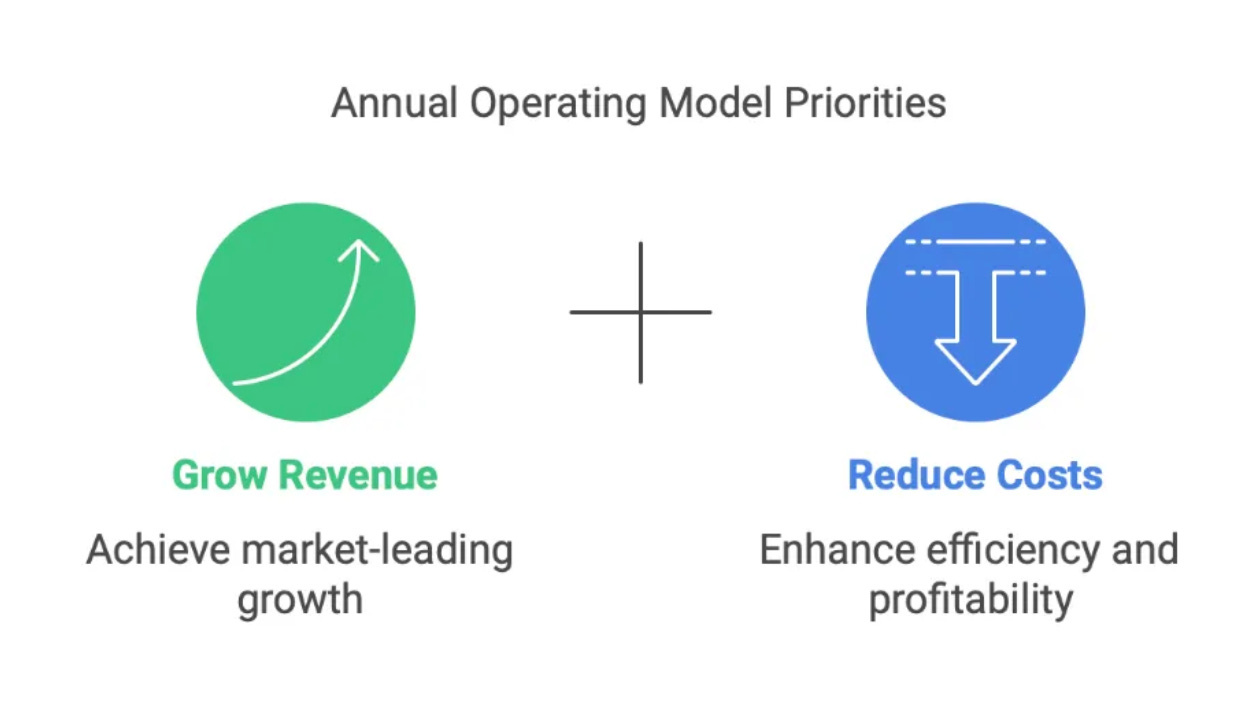

Simple Annual Operating Model Priorities:

Grow revenue ahead of market: Gain market share by 50-100 basis points (bps) annually

Reduce costs consistently: Target and incentivize cost reductions in both product and non-product costs, prioritizing larger cost lines first.

For non-product expenses, specialists run auctions and use sophisticated procurement methods for high-value spending like media buys. By leveraging global scale in these auctions, the company gains significant cost advantages over competitors on major expenses—even when its overall size is smaller.

For product costs, the company aims for a 50 basis point annual improvement in Gross Margin through the "squeeze program," pursuing savings in procurement and non-customer-facing specifications.

The dedicated "squeeze team" focuses on delivering cost savings while maintaining or improving customer experience. Marketing leads this team, using market research tools to validate product performance.

The squeeze savings are split equally each year—half go to the profit line, and half are reinvested in marketing.

Markets run the P&Ls; the global team runs the strategy and long-term.

Markets are profit centres and run the day-to-day business:

Markets own sales

Markets own their P&L

Markets operate independently within an annual operating plan framework

A small central team develops sales capabilities, success models, channel strategies, and eCommerce and manages relationships with the top 3 global retailers

The global category team, organized by product category, manages innovation, brand equity, and long-term profitability.

Functions support the business and align fully with the markets' needs. Their challenging cost envelopes don't permit them to create large, costly global bureaucracies.

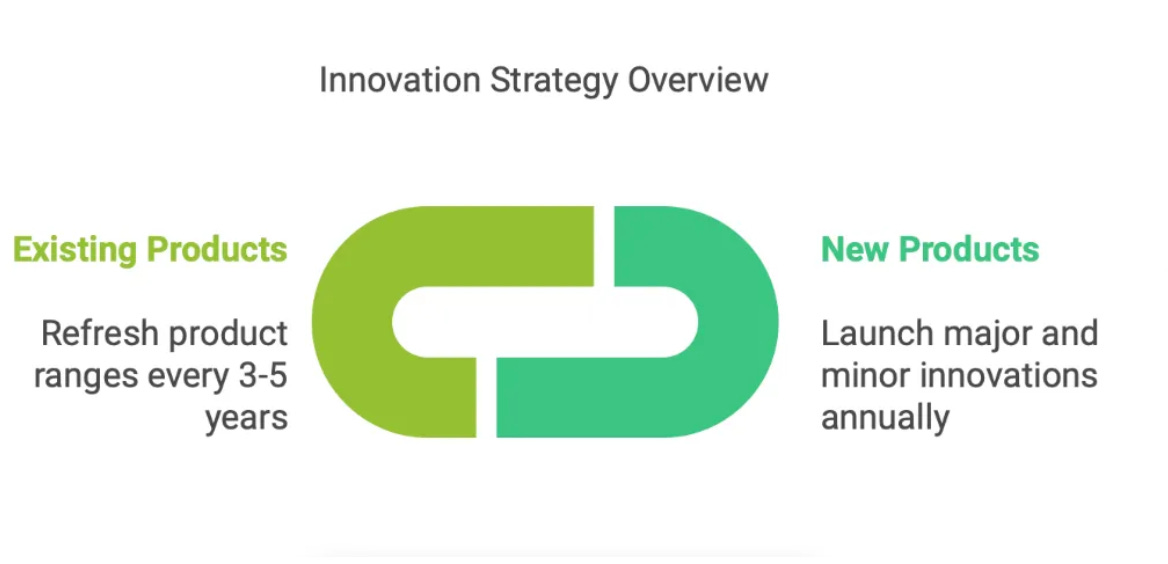

Innovation is at the centre of growth and competitiveness:

Innovation Cadence:

New Products (NPD): Launch one major innovation per year in core categories/brands, plus 2-3 minor innovations to expand the range.

Existing Products (EPD): Update the graphics and claims of each product range every 3-5 years.

Roll out globally and scale fast in every market—markets must implement the innovations. While they can adjust the launch mix to improve local success chances, they don't have the option to reject innovations with a "not invented here" mindset.

Innovation Organization Structure:

The global brand team leads innovation, with Marketing at the helm and direct access to CEOs, EVPs, and presidents.

A 'Power brand team' — comprising the Central Marketing lead and GMs from the most significant category businesses — approves category/brand strategy and innovation plans in quarterly meetings.

R&D reports to Marketing, ensuring resources focus on market-ready products instead of speculative projects.

Innovation decisions are based on concrete data and research, not intuition.

A transparent process exists to identify and integrate promising external technologies and ideas into the company.

R&D operates in two divisions: 'Creation' and 'Implementation,' with implementation teams working alongside supply in local markets.

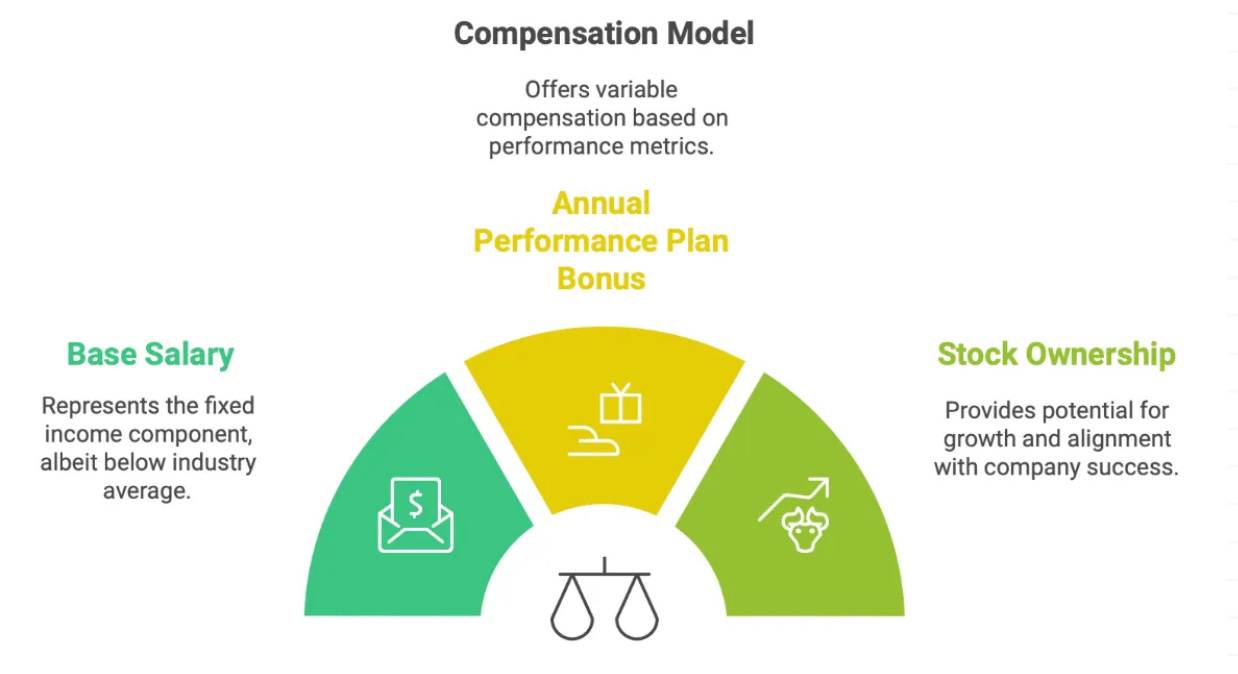

Incentivise to drive individual and collective behaviour.

The compensation model consists of three parts: a base salary (below the industry average), an Annual Performance Plan bonus (APP) ranging from 0 to 1.5-2 times the base salary depending on target achievement, and stock ownership. While employees receive lower base pay, strong performers could earn significantly above industry averages through bonuses and long-term wealth is built through stock ownership and compounding.

Salaries reach the 75th percentile when the target bonus is achieved, fall at or below the 50th percentile for underperformance, and exceed the 90th percentile when bonuses are maximized.

This model creates a natural selection effect: competing companies can afford to hire RB's low performers (who earn minimal bonuses) but struggle to match the total compensation of high performers (who consistently earn large bonuses). This structure naturally encourages low performers to seek opportunities elsewhere.

The company mandated widespread stock ownership.

Managers invested their entire life savings in the company, creating a strong alignment with shareholder interests.

Senior management was required to maintain industry-leading stock ownership levels of 2x to 5x their annual salary.

Share Awards:

Annual restricted shares were granted based on management grade.

Annual stock options were typically double the restricted share amount.

Special one-time awards were given upon promotion to T400 or T40 to help meet share ownership requirements.

The senior management incentive structure is highly leveraged, with multipliers that can increase salary to 3X at the maximum level.

The Annual Performance Plan (APP) bases incentives on net revenue (NR), profit, and net working capital (NWC) for operating managers. At the same time, marketing's metrics include NR, gross margin (GM), and innovation pipeline performance.

Individual targets typically range from 0.9x to 1.3x of the plan, with clear paths for achievement and influence over key drivers.

The APP scheme effectively motivates individuals through a simple formula:

APP amount = Salary × "On target incentive" × Multiplier.

For Top 400 (T400) managers, the bonus equals salary × 40% × Multiplier (0 to 3.57), with a maximum bonus of 1.5× salary. For example, a T400 manager with a $500,000 base salary can earn up to $715,000 in APP ($500K × 0.4 × 3.57), bringing total compensation to $1,215,000.

For Top 40 (T40) managers, the "On target incentive" increases to 60-70%, with the same multiplier. A T40 manager with a $500,000 base salary can earn up to $1,250,000 in APP ($500K × 0.7 × 3.57), reaching total compensation of $1,750,000.

Multiplier:

Net revenue: 0.5 to 1.89, with "on financial target" plan revenue growth around 1-1.1.

Profit: 0 to 1.89, with "on financial target" plan profit around 1; missing profit targets can result in a multiplier of 0, leading to no APP for the year.

Net working capital: 0.7 to 1; meeting target equals 1, serving as a penalty for missing NWC goals.

When achieving 100% of APP targets (typically set well above financial targets) across revenue, profit, and working capital, the maximum multiplier is 3.57 (1.89 × 1.89 × 1).

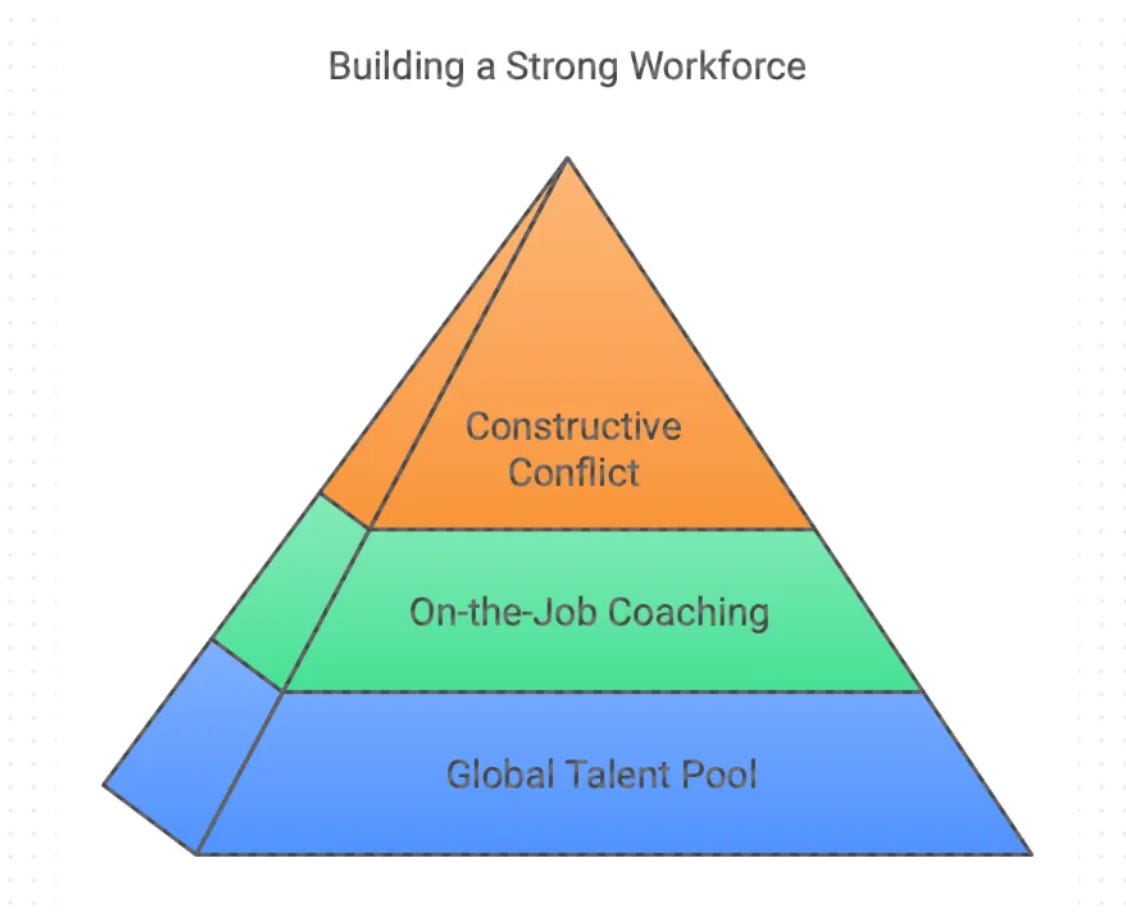

People can be developed through creating a deep global talent pool, systematic on-the-job coaching, and constructive conflict.

Global Talent Pool

The careers of the top 400 Managers are managed globally, without ties to any home country, and require global mobility.

The Executive Committee, led by the CEO and EVPs/Presidents, makes all decisions about this group.

These managers are encouraged to work in different countries. This cross-pollinates ideas and experience, developing them into strong leaders who excel in diverse cultures. It also creates a global network of colleagues who collaborate and compete over the years.

These relationships result in a system of deep roots and relations between people, and this is a very effective retention mechanism for key talent.

On-job coaching during rigorous business reviews:

Key Mechanism: On-job coaching

Key Forum: System of business reviews at all levels

Functional capabilities (e.g., marketing, copy, concept development) through annual training programs

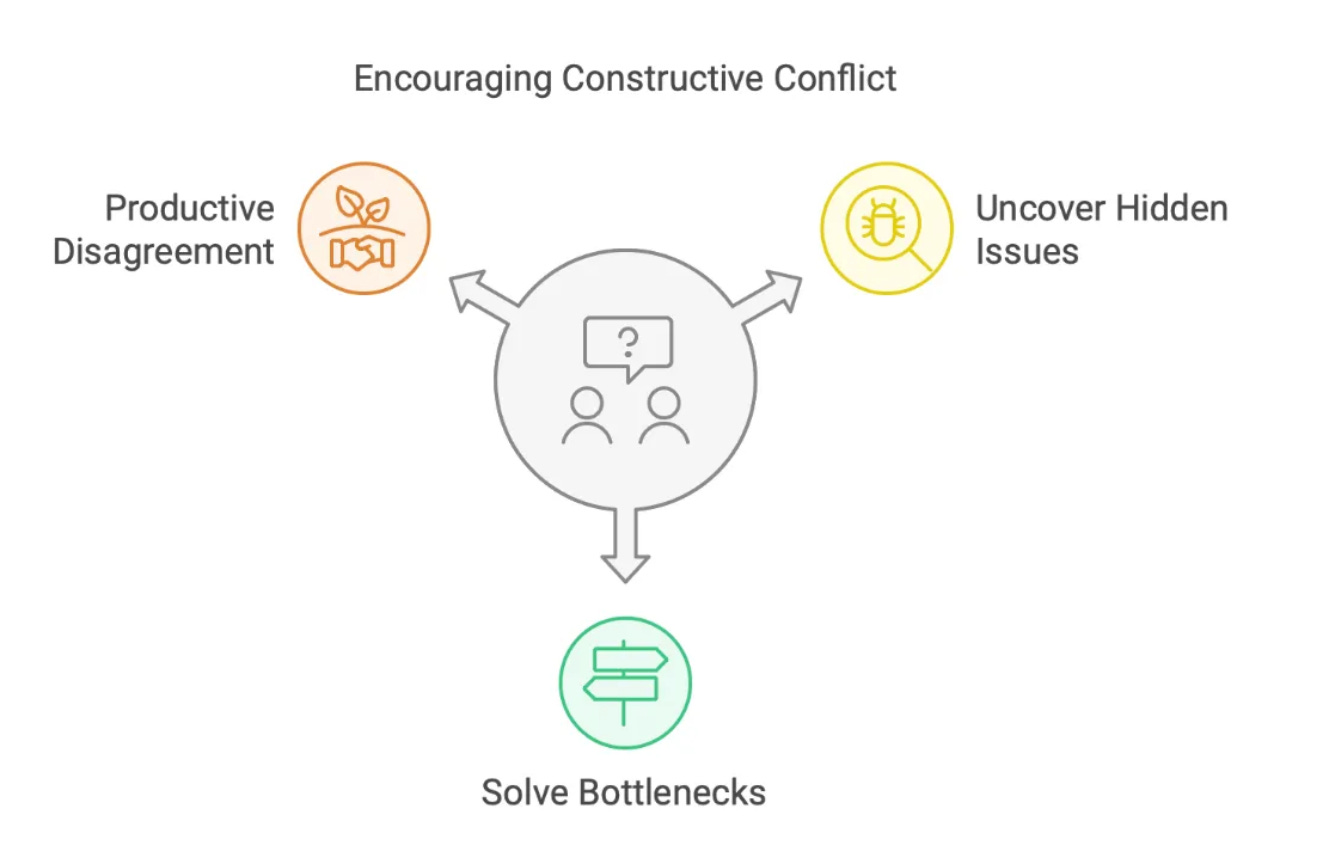

The company's operating model embedded constructive conflict to surface issues, ensure senior engagement, and drive solutions:

When launching products, most decisions involve two stakeholders—for example, sales and marketing in a country or global versus local perspectives.

RB established forums where stakeholders could surface differing views and reach an agreement. When agreement wasn't possible, issues were escalated quickly rather than allowed to linger.

With its flat organization, most issues could be escalated to an executive committee member for resolution. If two EC members disagreed, the CEO would make the final decision.

Once a decision was made, everyone implemented it—following the principle of "80% agreement, 100% commitment."

One consistent operating model and cadence.

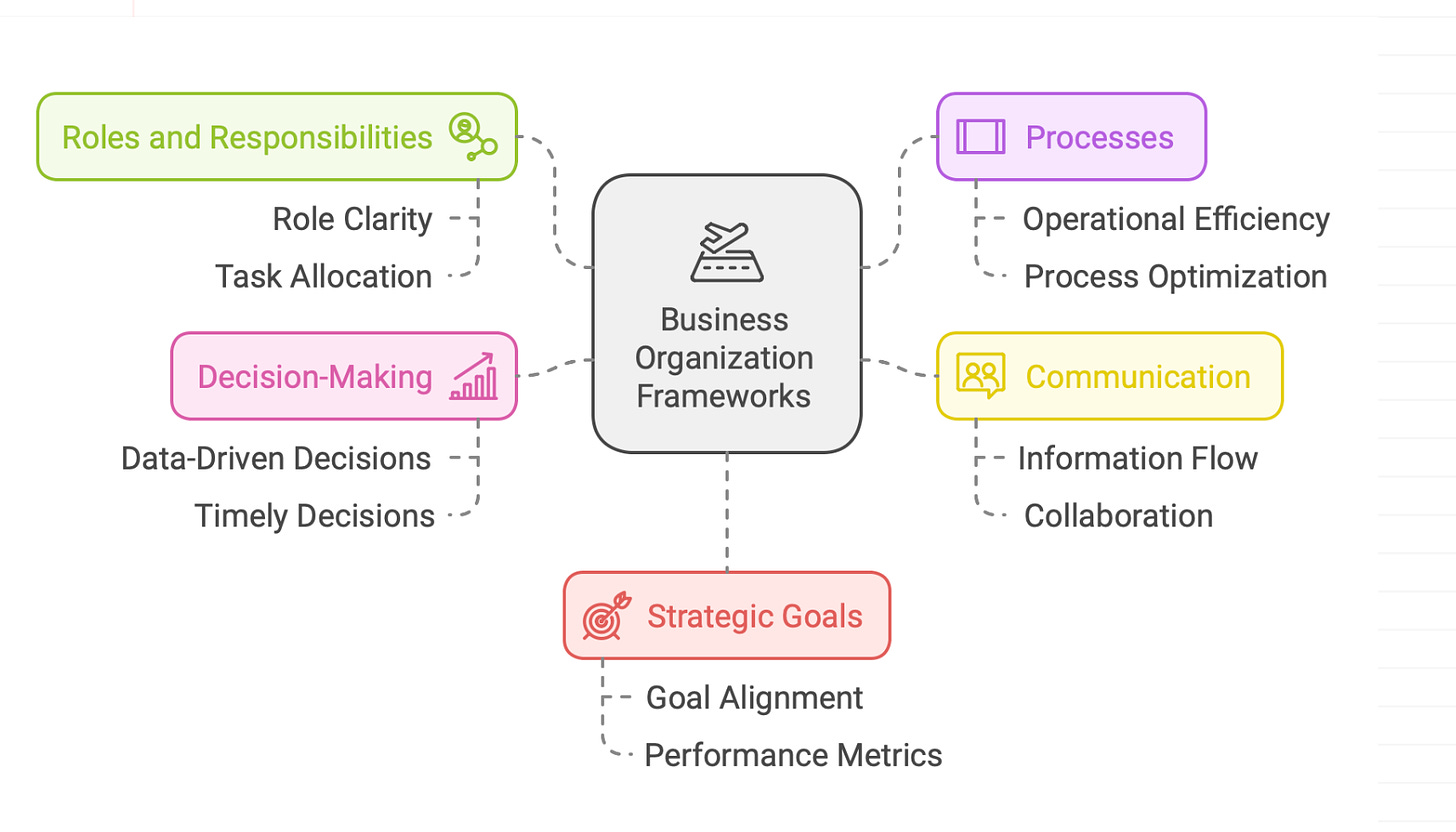

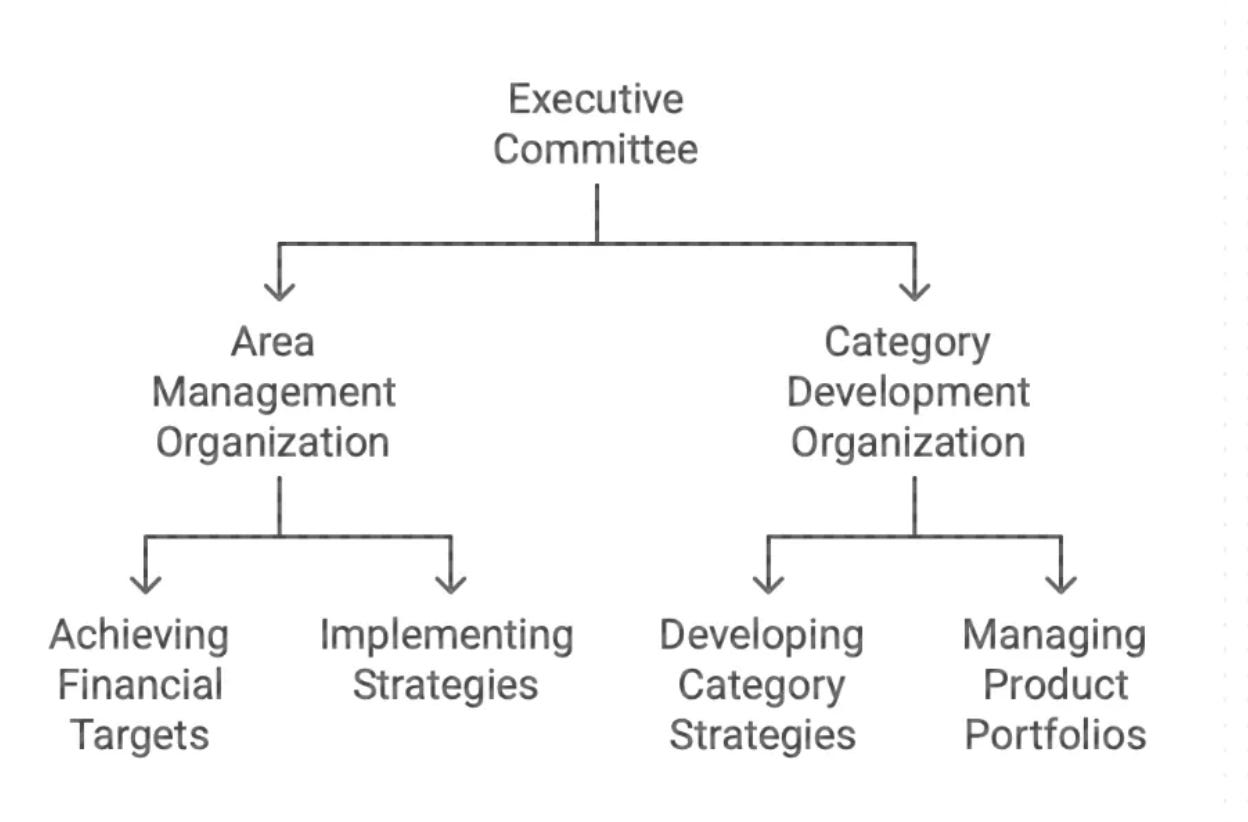

The organization structure was set up with three key pillars:

The Executive Committee consists of the CEO and direct team. This team reports to the Board of Directors and is chaired by the CEO. The group sets corporate vision and strategy, long—and short-term financial objectives, major initiatives, category strategies, acquisitions and divestitures, operating structure, systems and processes, succession planning, and compensation philosophy.

The Area Management Organization: Responsible for local business P&L and financial performance targets through local and global initiatives within the agreed corporate and category framework. Area management is responsible for:

Achieving the numbers

Rolling out power brands into white spots in line with qualified entry models

Implementing category strategy and rolling out NPD/EPD initiatives

Defining and achieving best-in-class execution

Developing and realizing customer and regional sales development strategies

Developing talent for sharing within the group

Implementing functional standards and processes in Supply, HR, IS, and Finance systems

The Category Development Organization: Contributes to medium- and long-term sustainable growth by:

Developing category mission, vision, and strategy

Proposing long-range financial objectives and strategic initiatives to the EC

Filling the pipeline—developing and funding new product development and marketing initiatives to increase innovation quality

Improving portfolio economics—managing across regions and brands to grow margin-enhancing products and initiatives; leading category squeeze with supply chain and Area Management

Aligning company resources in R&D, marketing, market research, and media

Building and maintaining brand equities

Developing and sharing success models for power brands with Area Management and sales

Identifying and recommending new business opportunities, including geographical extensions, alliances, acquisitions, or new business areas

Global Business Management:

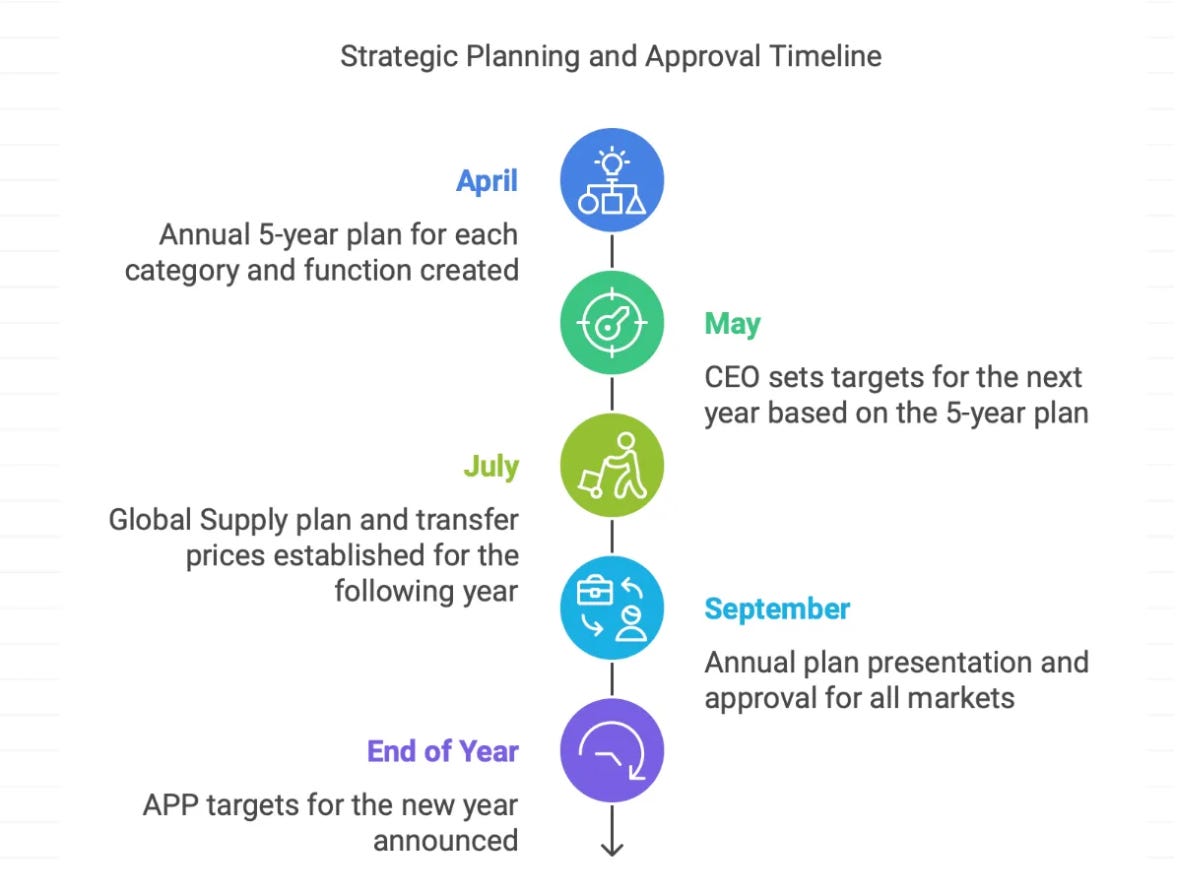

Strategic Process

An annual 5-year plan for each category and function was created in April.

CEO sets targets for the next year in May based on the 5-year plan.

Global Supply plan and transfer prices established for the following year by July.

The annual plan presentation and approval for all markets is in September. APP targets for the new year are announced before the end of the year.

Global Management Process:

The business is managed through two key forums—the Executive Committee (EC) and Operating Committee (OC)

EC: Approves category missions, visions, strategic success models, and significant category initiatives based on Category teams' recommendations.

OC: Aligns implementation and best practices of the company's top 20 projects and drives execution of key company programs.

Regional/Area Management:

Regular business reviews are used to manage the operational business. These reviews are extremely detailed and data-driven, diving deep into numbers, operations, brands, communications, and people.

Preparing for these reviews compels participants to master both strategic elements of their business and operational details through rigorous analysis. The high-calibre discussions have created a global cadre of exceptional leaders who embody RB's distinct culture.

Business Review Cadence:

Large Markets (USA/China/India): 4 times per year with EVP/President, 2 times with CEO.

Medium Markets (UK/Brazil/ASEAN/ME/Germany/France/Russia): 2 times per year with President/EVP, 4 times with SVP, CEO once every 2 years.

Small Markets: 4 times yearly with SVP, once every 3 years with President/EVP.

Like any company, RB wasn't perfect.

The company made its share of mistakes and developed what became known as a "Marmite culture". Some people thrived in its aggressive, incentive-driven environment, while others were repelled by it.

Critics viewed the company culture as mercenary, harsh, and too narrowly focused on financial growth rather than broader impact.

In hindsight, the company could have balanced these cultural aspects better.

Nevertheless, RB built an extraordinary engine for consistent performance and true meritocracy, celebrating individual and collective achievements. Its leadership exemplified remarkable diversity, with over forty nationalities in the top 400 and over twenty-five in the top 40.

Most significantly, it cultivated a generation of leaders who carried these principles to other companies, extending RB's influence well beyond its boundaries.

Here are a few ideas to take away:

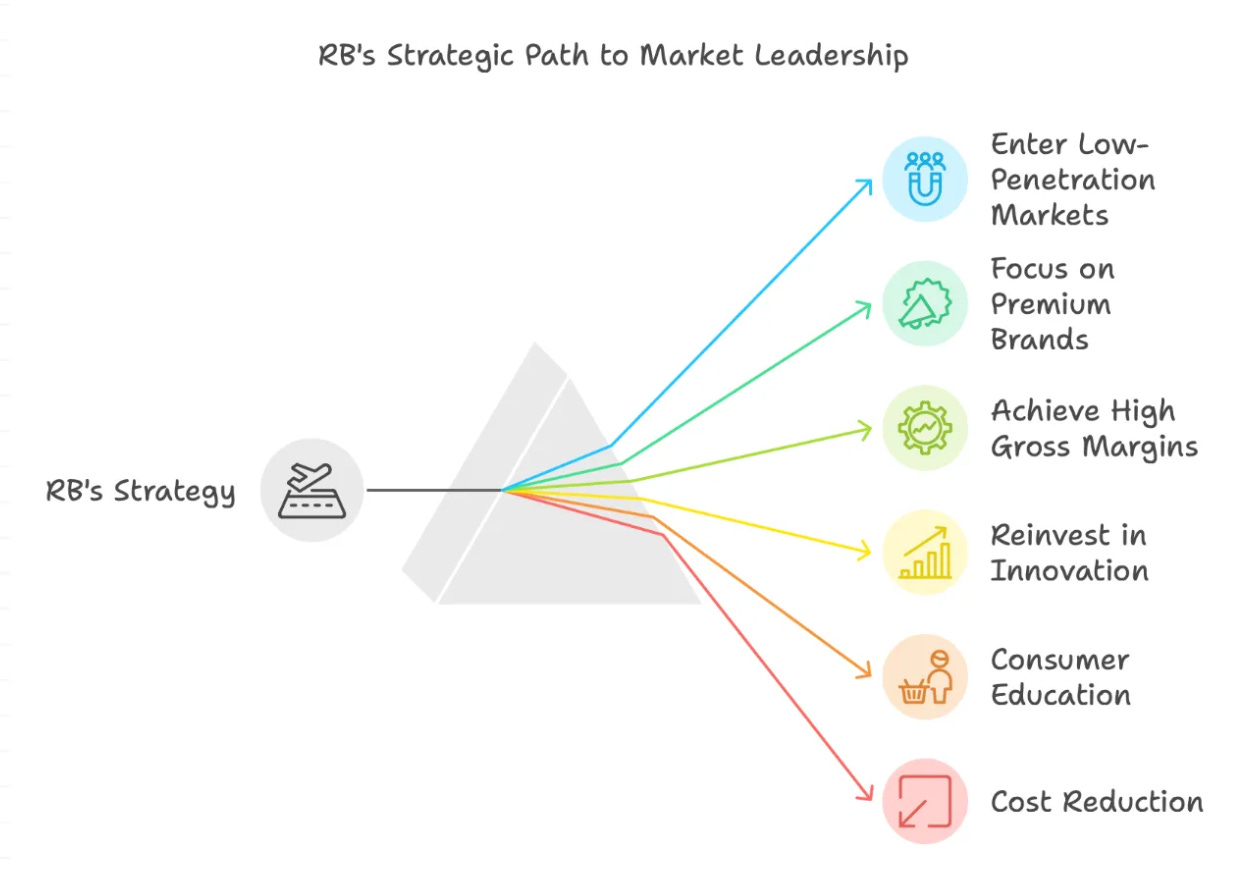

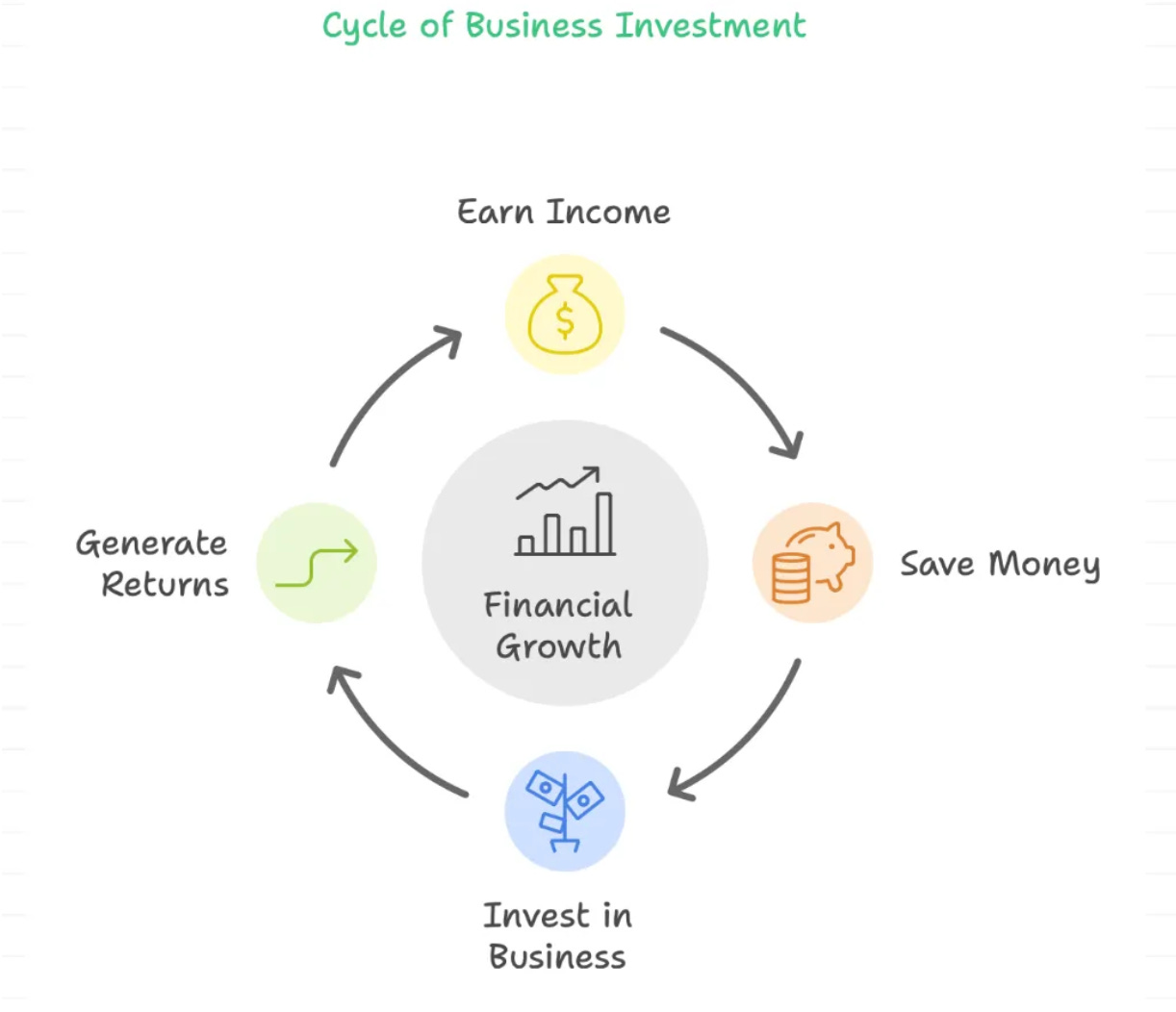

At its heart, RB had a simple strategy: enter low-penetration markets with premium brands and high gross margins, reinvest these margins in continuous innovation, and educate consumers about the category. This approach leads to long-term category leadership. Then, reduce costs annually and reinvest those savings into business growth. In the long term, this model has driven long-term leadership in strategic categories along with a disproportionately high share of the profit pools in these categories.

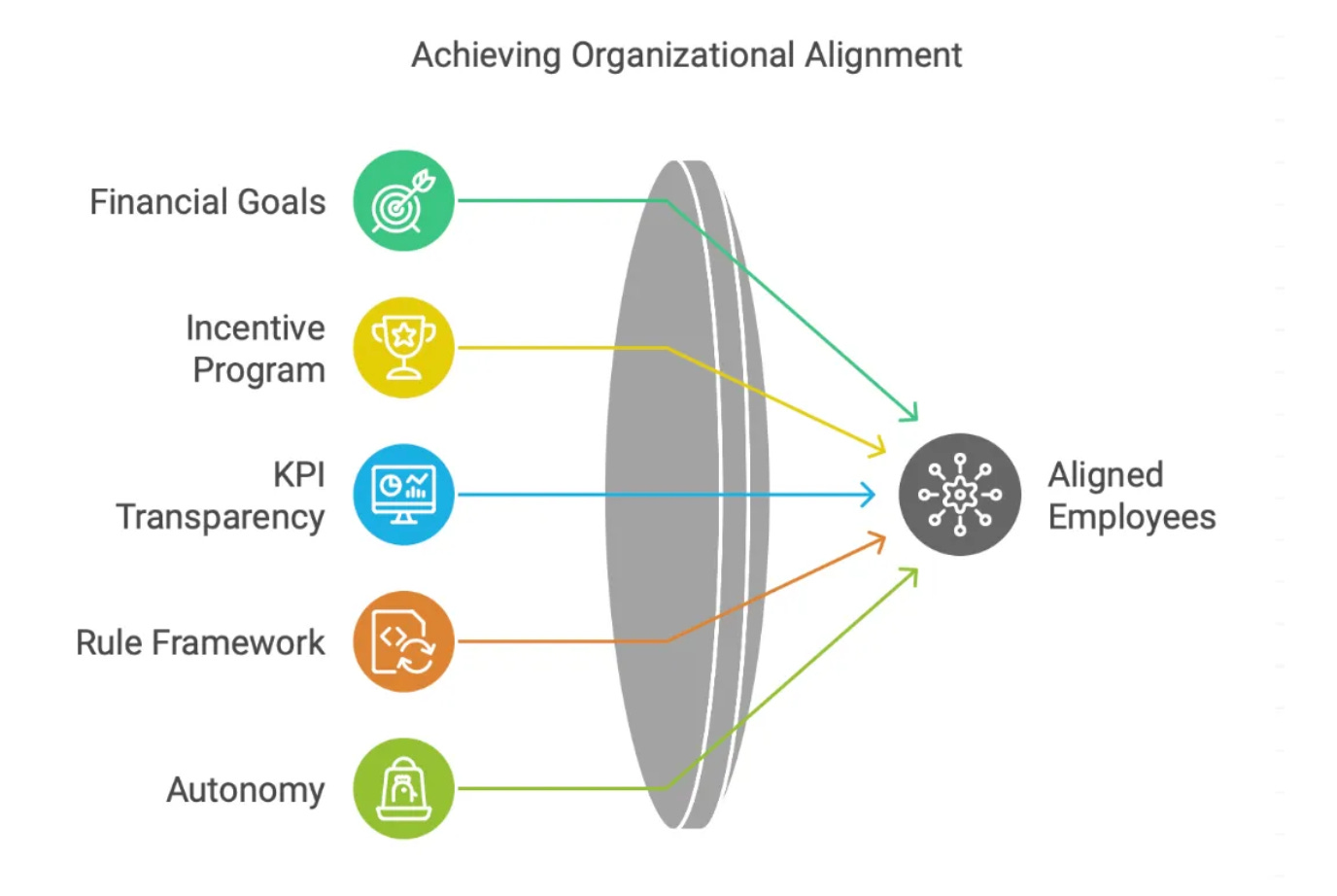

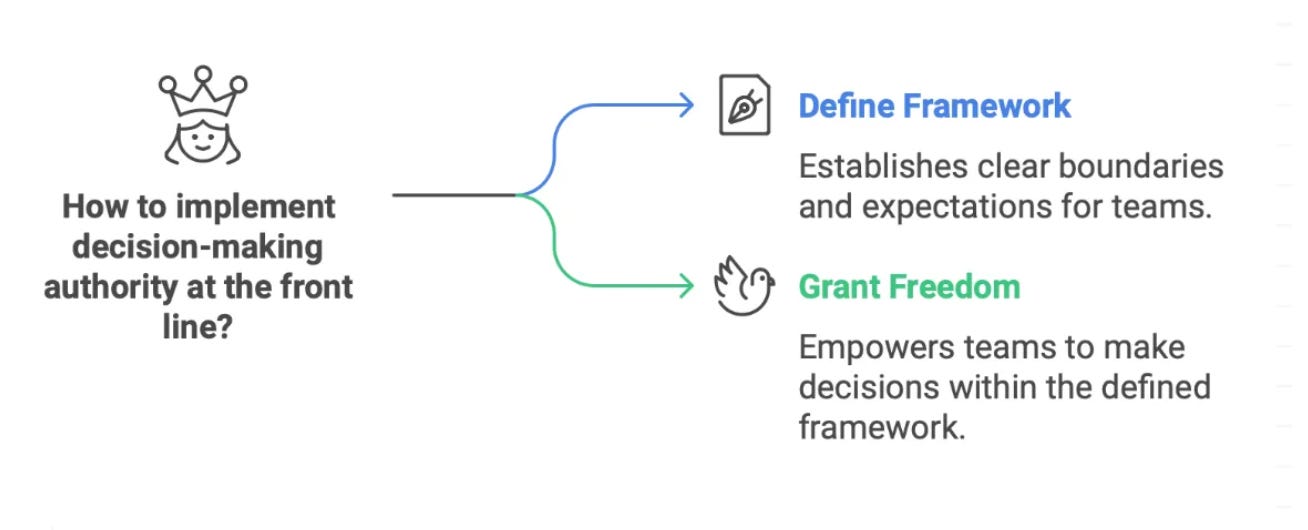

RB's operating model was equally straightforward: align employees with financial goals through a robust incentive program. Show them exactly how their work impacts the company's key performance indicators and makes their bonus calculations transparent. Provide a clear framework of rules while allowing significant autonomy within it.

.

Strategy is about choosing what to do. Make clear choices—if everyone agrees with your decisions, you probably haven't made real choices.

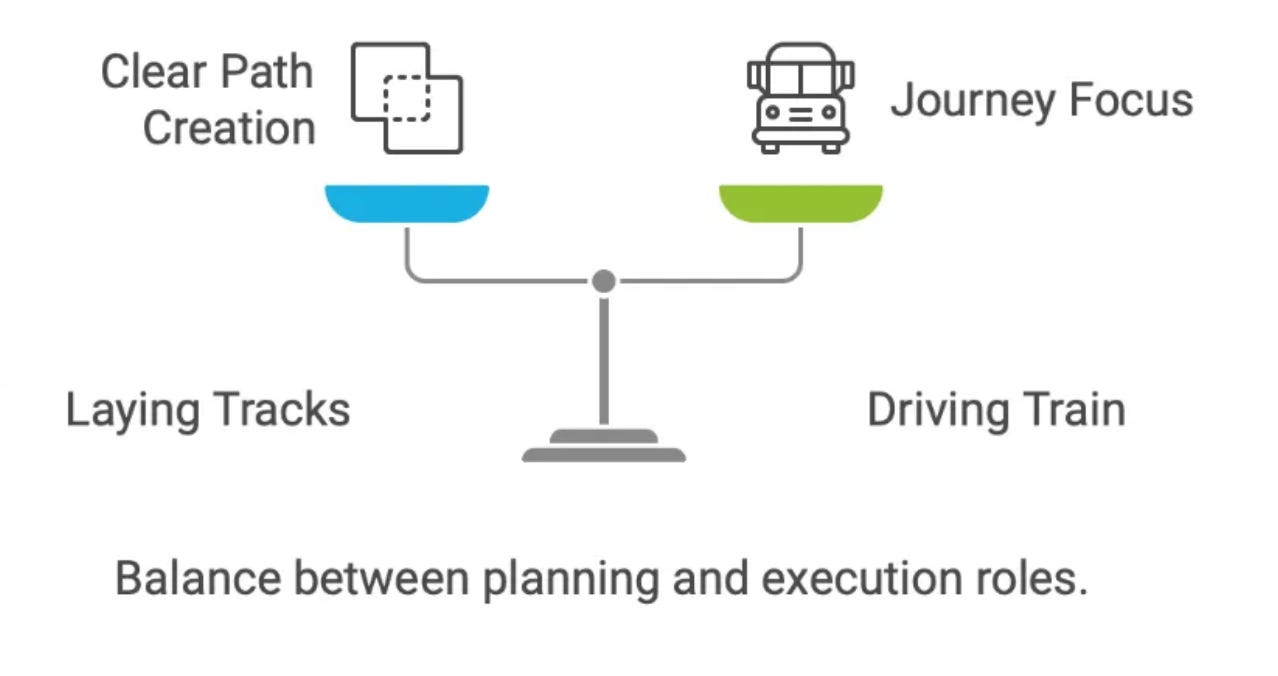

There is a difference between those who lay the tracks and those who drive the train. If you're building the operating model, create clear paths others can follow without complications. If you're driving the train, focus on the journey ahead rather than fixing the tracks.

.

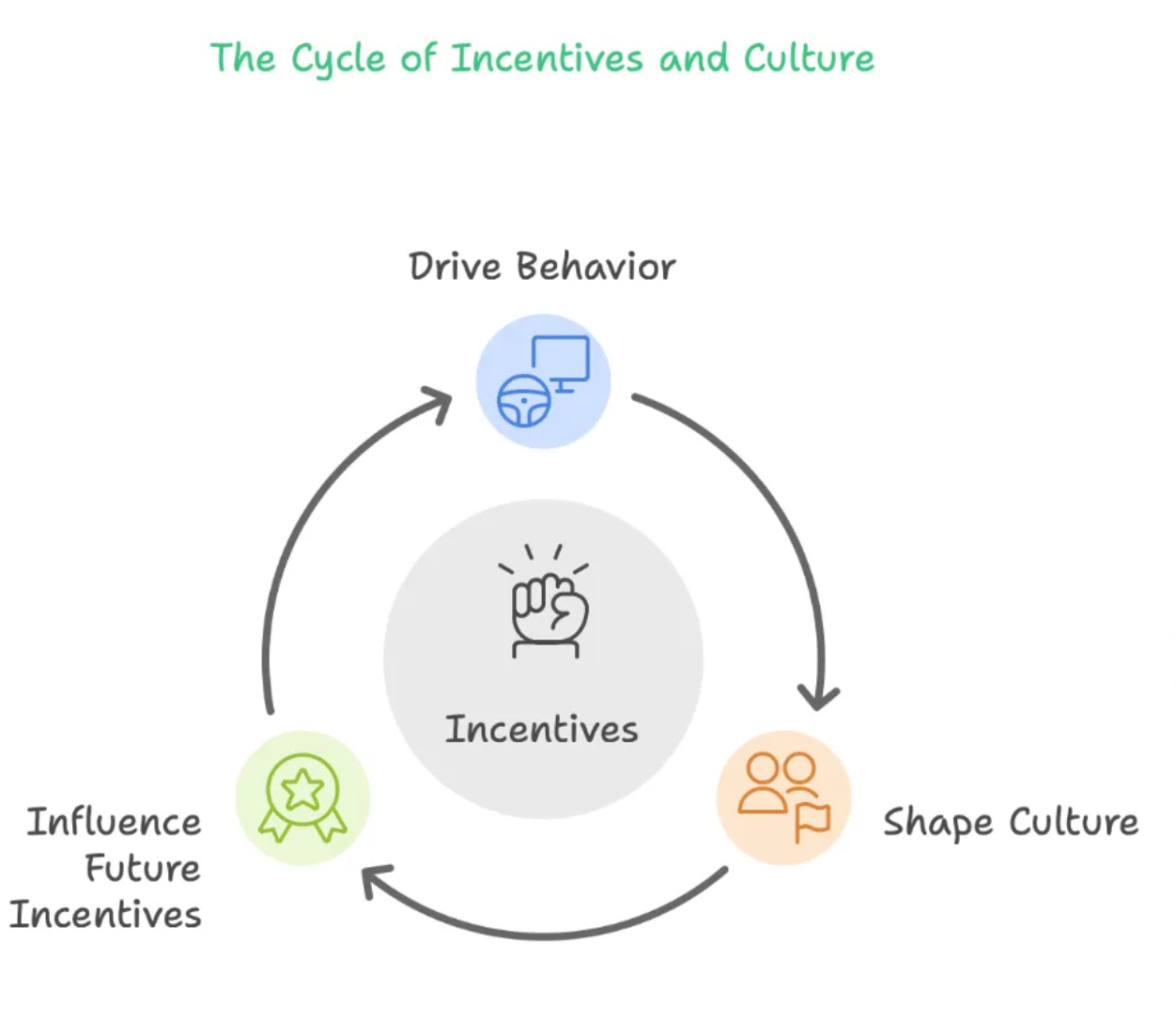

Incentives drive behaviour, and behaviour drives culture. Therefore, incentives shape your culture—be intentional about what you incentivize

Earn before you can pay. Before investing in a business, you need to create the savings that make the investment possible

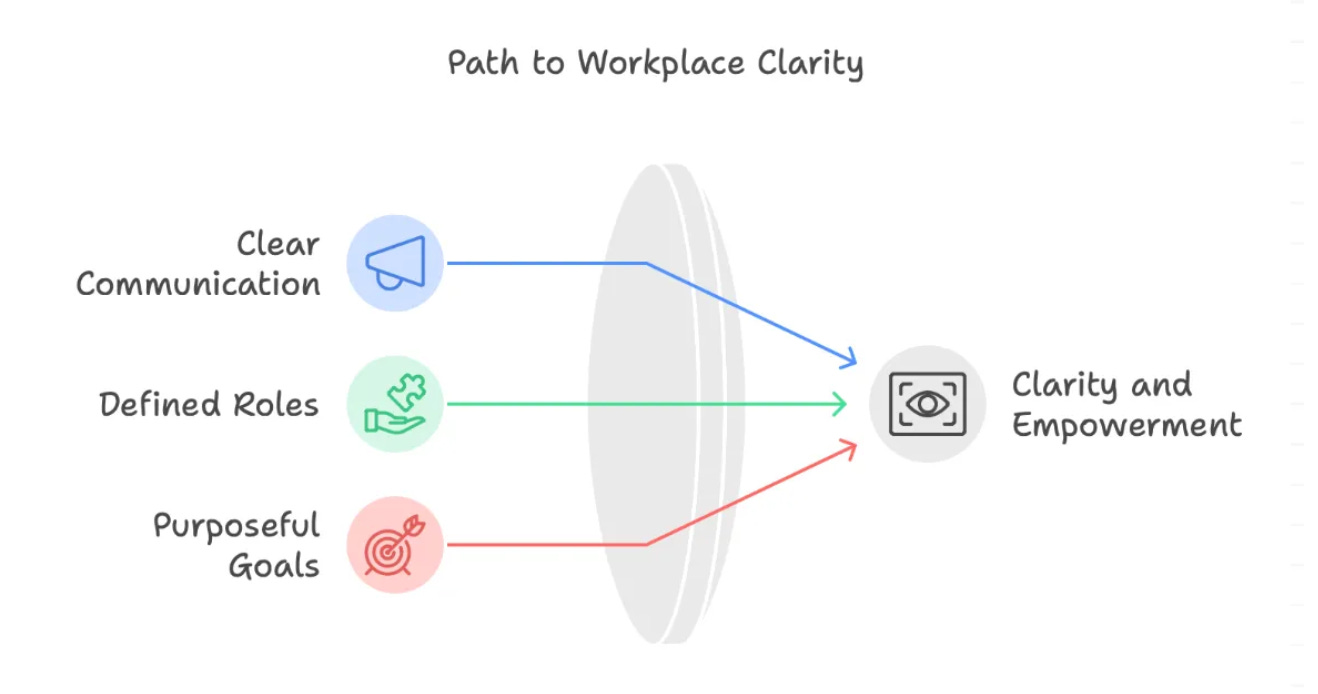

People come to work every day aiming to do their best. Don't confuse or disempower them. Please don't make them struggle to understand their purpose or impact. Give them the gift of clarity.

Constructive conflict is essential for uncovering and solving issues that might remain hidden and create bottlenecks. Design your organization to encourage productive disagreement.

.

Decision-making authority needs to be delegated to the front line. To achieve this, give your teams a clear framework and grant them complete freedom within the framework.

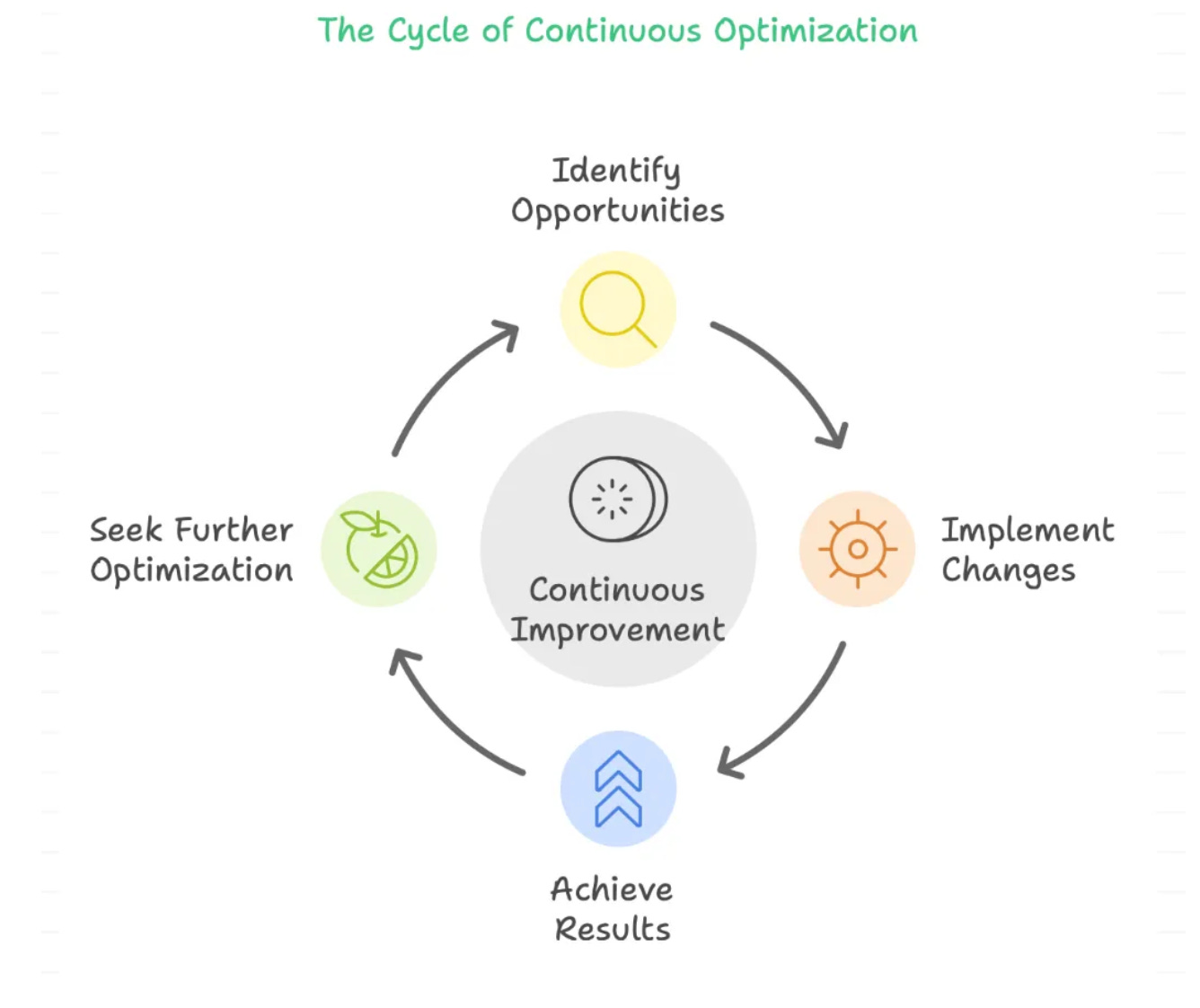

There is always juice in the lemon—you can always do more. Even after a decade of cost-cutting, there's always room for optimization. Just look at how chip manufacturers continue to advance through Moore's Law

.

These Frameworks are from a golden period in RB's history. They are based on my recollections of my time there and do not include proprietary or confidential Reckitt information.

The company now operates as Reckitt, and I’m sure some of these principles are still at the heart of its operations. Still, this document does not claim to accurately reflect today’s Reckitt simply because, like all businesses, it has evolved and changed over the last five years.

Please share if you enjoyed this post or think it could help someone else. I would love to hear if you have worked at RB or a similar company and if you have additional insights. Please share your thoughts in the comments.

Check out some of my other Frameworks on the Fast Frameworks Substack:

The delayed gratification framework for intelligent investing

The Fast Frameworks eBook+ Podcast: High-Impact Negotiation Frameworks Part 2-5

The Fast Frameworks eBook+ Podcast: High-Impact Negotiation Frameworks Part 1

Fast Frameworks: A.I. Tools - NotebookLM

The triple filter speech framework

High-Impact Negotiation Frameworks: 5/5 - pressure and unethical tactics

High-impact negotiation frameworks 4/5 - end-stage tactics

High-impact negotiation frameworks 3/5 - middle-stage tactics

High-impact negotiation frameworks 2/5 - early-stage tactics

High-impact negotiation frameworks 1/5 - Negotiating principles

Milestone 53 - reflections on completing 66% of the journey

The exponential growth framework

Fast Frameworks: A.I. Tools - Chatbots

Video: A.I. Frameworks by Aditya Sehgal

The job satisfaction framework

Fast Frameworks - A.I. Tools - Suno.AI

The Set Point Framework for Habit Change

The Plants Vs Buildings Framework

Spatial computing - a game changer with the Vision Pro

The 'magic' Framework for unfair advantage

Really interesting article.

My background is public and charitable sector, so the commercial sector is like a foreign island to me. But there are elements of familiarity!

As always, great insights. Thanks for sharing this Addy!!!