The Framework:

“All things are poison, and nothing is without poison; the dosage alone makes it, so a thing is not a poison”. - Paracelsus

Which is the most dangerous animal in the world? Of course, the one that kills the most people each year.

The humble mosquito takes the crown with 725,000 people killed every year, compared to 500,000 killed by humans in homicides and war, followed by 50,000 killed by snakes. The Lion comes in at No 13 with 100 kills a year and the shark at No 15!

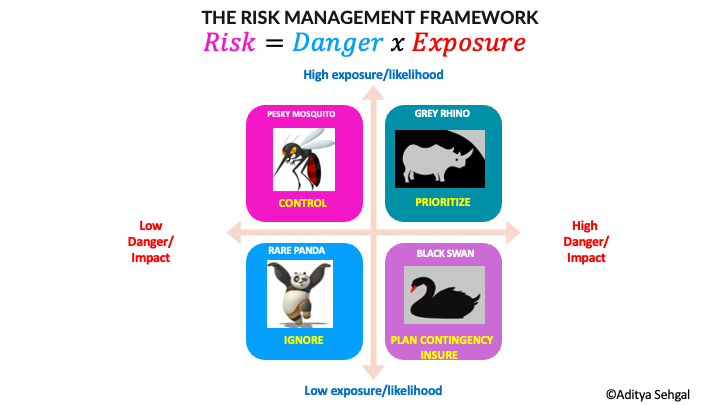

We create risk by multiplying danger with the likelihood of facing that danger.

Things that are ‘not very dangerous’ (e.g. a mosquito bite) become dangerous when multiplied a billion times. Billions of mosquito bites cause over 200 Million cases of Malaria annually and over 600,000 deaths.

Water is not particularly poisonous. But when drunk in excess, it is as much a poison as cyanide.

Too much of anything is not a good thing.

To understand risk and manage it, we must consider both the danger and the exposure. There are four archetypes of risk, with different prioritisation and strategies to manage risk:

The grey rhino

Michelle Wucker explains the concept of the Grey Rhino in her bestselling book.

Imagine you are in the African savannah. In the distance, you see a colossal rhino peacefully grazing. It is grey because all rhinos are grey. You have been watching it for a while - it doesn’t appear immediately threatening, and it is far away that you know you can outrun it. You lose track of the rhino and get busy looking at your phone. Suddenly you look up. The rhino is now significantly closer and MUCH larger. It looks up and sees you. You know, the moment it decides it doesn’t like you. It charges - you turn to run, but now you learn that a rhino’s top speed is 55 kmph. It is too late.

There was ample opportunity to escape a tangible and visible threat IF you had acted earlier.

A grey rhino is a highly probable, high impact yet neglected threat.

An example is the climate crisis. We know that we are reaching the point where we will trigger irreversible climate change. Once started, the impact of worsening climate will cause unimaginable losses in lives, livelihoods and living standards for our children and their children. This example is a classic grey rhino - humanity is quibbling over trivial politics when the need of the hour is to invest the most significant investment in human history NOW to avert this grey rhino.

The way to tackle a grey rhino is to PRIORITISE and act NOW. You can not wait till the rhino is close enough for it to block your escape route.

Grey rhinos lurk everywhere - from global calamities to business and personal rhinos. Humans are experts at somehow ignoring these rhinos!

The black swan

Nassim Nicholas Taleb explained black swans in his bestselling book.

A black swan describes a rare and unpredictable outlier event, which can be rationalised and seems ‘obvious’ in hindsight. An example of a black swan event is the Sep 11 2001 terrorist attack on the world trade centre or the rise of the internet.

By definition, a black swan is not likely in the short term but can have a catastrophic impact if it does happen.

To manage a black swan, along with your plan A and plan B, you want to develop a plan Z - a contingency plan for the ‘craziest case’ scenario. In addition, you can also buy insurance for the contingency and think of it as a ‘regular business expense’.

The pesky mosquito

The pesky mosquito as an individual is irritating rather than dangerous. But when the danger cumulates with significant exposure, the risk becomes very high.

To manage the pesky mosquito, you can eradicate and control the pest as much as you can.

To do this, you can

control the number of mosquitoes to minimise chances of infection (fewer places for mosquitoes to breed, pesticides to kill mosquitoes, your own genetically engineered insects to kill the harmful insects)

reduce the severity of infection (improve human immunity)

and treat infections when they do happen.

Many large companies think small startups are like pesky mosquitoes. In the beginning, the tiny startups don’t have much effect, but over some time, multiple pesky startups can ‘unbundle’ a large company’s business model.

The rare panda

The panda is that rare creature that is (mostly) benign and very rare. We can safely ignore it.

Applications:

This framework has applications in business, personal life, finance, epidemiology, toxicology and anywhere there is a risk.

Pandemics - Covid-19:

There is an ongoing discussion about the Omicron variant of Covid-19 and the risks relative to the Delta variant. Should we conclude that a less severe Omicron presents lower risks than Delta?

Let’s assume that the Omicron variant of Covid-19 is less severe than the Delta variant, with only 50% of the hospitalisation/fatality rate. Early data in the UK published by the Imperial college indicates that the risk of reinfection with Omicron is about 5X that of Delta. In this scenario, the overall risk of Omicron hospitalisation/fatality is 2.5X that of Delta, given similar vaccination rates in the population. Even if it is ‘milder’, it can still be more ‘risky’. In this scenario, the framework would ask to treat Omicron like the Pesky mosquito and still attempt to ‘control it’ unless it is clear that the severity level is so low that the real risk is acceptable even with the higher exposure (e.g. similar to the common cold).

Finance and investing:

The risk framework provides traders multiple strategies to think about risk and return.

Investors manage risk by spreading the risk with a more diversified portfolio to hold multiple uncorrelated assets. So if there is a severe ‘danger’ of loss in one asset class, the ‘exposure’ is limited to only part of the portfolio.

The climate grey rhino tells us that humanity is likely to make a massive investment in addressing the climate change challenge. We can foresee a Y2K type situation for every economic sector. We will need to upgrade most human infrastructure in the coming decades. We will invest dozens of trillions of dollars - and create significant growth opportunities.

Nassem Taleb’s Empirica capital invests in options trades looking for black swans. The odds against a black swan means that he gets very low prices on many bets with fantastic odds. When he correctly bets on a black swan event, his profits are enough to cover more than the continuous slight losing bleed of the price of his options.

Day traders and swing traders work on the Pesky Mosquito strategy - they aim to ride the volatility of markets - making small gains each time but maximising the number of times they ‘rotate’ their money. They strive for control by minimising the uncontrolled time their bets are in the market and not in the form of cash.

Risk vs return:

Return is the inverse of risk. The reverse of the framework defines the framework of return (to be published in a future post).

Increasing risk can increase the standard deviations of returns - i.e. chances of higher gains or higher losses. The best fund managers manage risk over the long term to provide a reliable low volatility return for a given level of risk.

Being mindful about and choosing the level of risk you are comfortable with vs the returns you expect is very important. You do not want to take significant risks for small returns!

Creating your risk map:

Every human being and business carries risks.

All companies and individuals should create a risk map using the risk management framework.

You can brainstorm a list of risks with your team or family and place them on two axes - likelihood and impact. Group the risks in each of the four quadrants to understand each type of risk and cluster your strategies do deal with them.

Give each risk a score between 1-5 based on how comfortable you are managing the risk.

Create a clear strategy to manage all the critical risks in the ‘Grey rhino’ and ‘Pesky mosquito’ quadrants. Focus on the risks where you are ‘uncomfortable’ (3-5 on the comfort scale) and ensure you have clear plans and ownership for those.

Evaluate if you can ‘buy insurance’ or ‘hedge’ against the black swans - what is the cost, and is it something you can carry as a legitimate expense? Think through how you will manage the black swan risk if it comes true.

For example, consider the personal risk of developing a chronic disease like cancer. While you may not expect to face this risk in the short term, it could happen. Make sure you have insurance for medical expenses and a clear strategy of how you will manage yourself if it happens. You may not need to do it right away, but make sure you do it in the next month or two!

If some of your risks fall in the rare panda category, ignore them.

Every year update your risk framework and see the direction of travel of your risks.

Have they gotten bigger or smaller?

Have you completed the actions you had planned to increase your comfort levels?

Further reading:

Lethal doses of water, caffeine and alcohol

The Grey Rhino - Michelle Wucker

Interactive climate change website: guardian

Wiki: The black swan - Nassim Nicholas Taleb

Omicron reinfection rate 5X vs Delta

Nassem Taleb - black swan investment strategy

CB Insights: Unbundling P&G and CPG

Sources for images:

Just watched your youtube video with Shantanu and ended up here where I have a higher chance of you actually reading my comment, I'm working on creating a new category in a very niche Industry, I would do anything to get mentored by you, how do I reach you?

good one. Aditya

also I need one help _ how do you attach files( pdf/excel/,,) on post . ?