In our pursuit of a fulfilling life, many of us dedicate our time to working jobs, saving for retirement, and enjoying the fruits of our labour. For most people, a job that pays $150K annually is a dream, and having a retirement fund of a million dollars is the ultimate goal.

Yet, in our quest for this "nirvana," we often find ourselves caught in a cycle of busyness, earning a salary, and maintaining a lifestyle that gives us the illusion of living our best lives.

The Illusion of a Great Life

We strive for the best experiences, indulging in the finest cars, gadgets, watches, and holidays.

This pursuit was my reality as well.

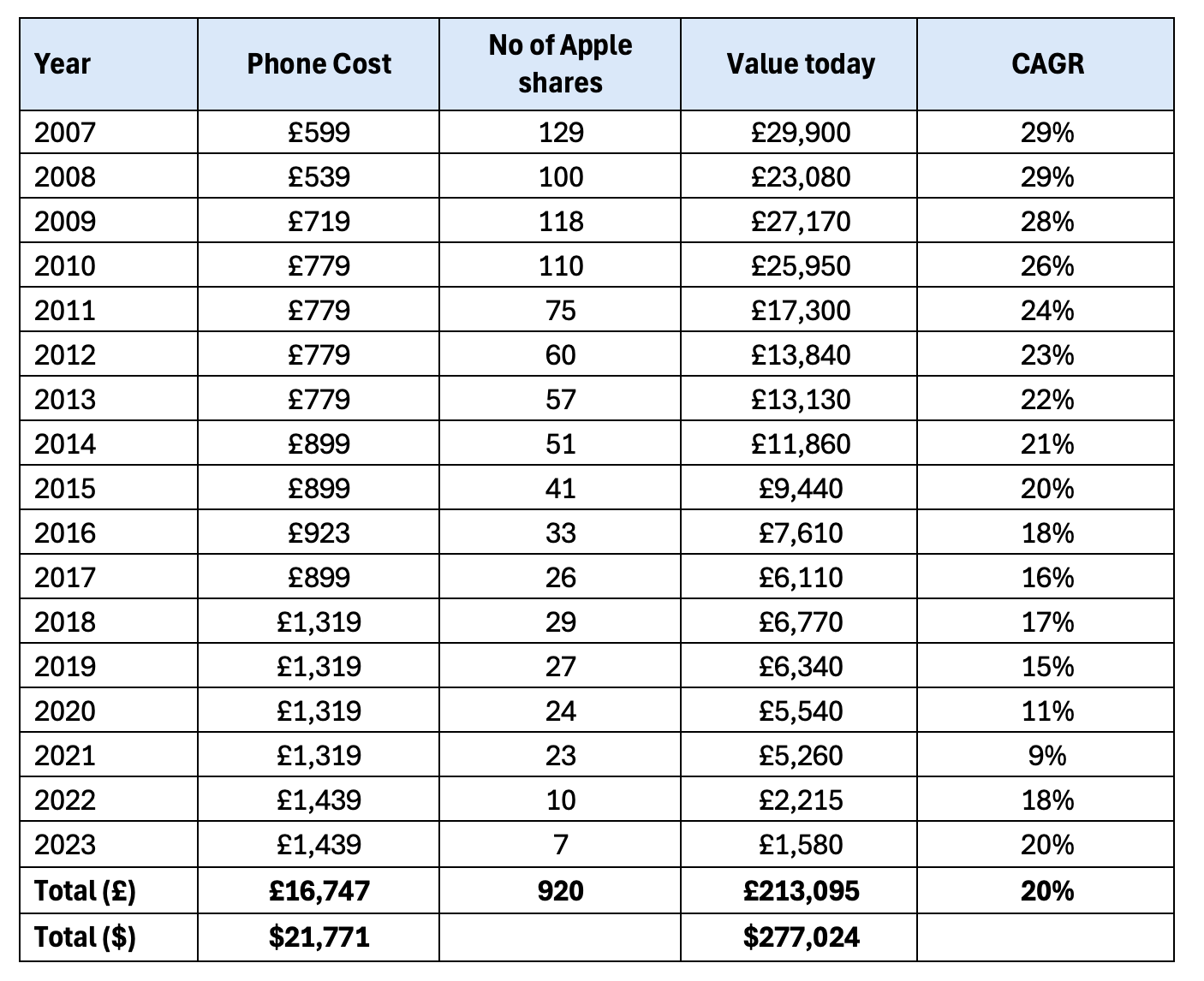

As an early adopter of technology, I've always been quick to embrace the latest trends. From buying my first iPhone in 2007 and upgrading every year to purchasing my first Tesla in 2017, buying NVIDIA's GeForce RTX 2060 chipset for my son's computer in 2019, to the Apple Vision Pro the week it launched, I've been at the forefront of consumer technology.

The Missed Investment Opportunity

While I've been adept at identifying trends as a consumer, I now realize that if I had applied this insight as an investor, my financial landscape would be drastically different.

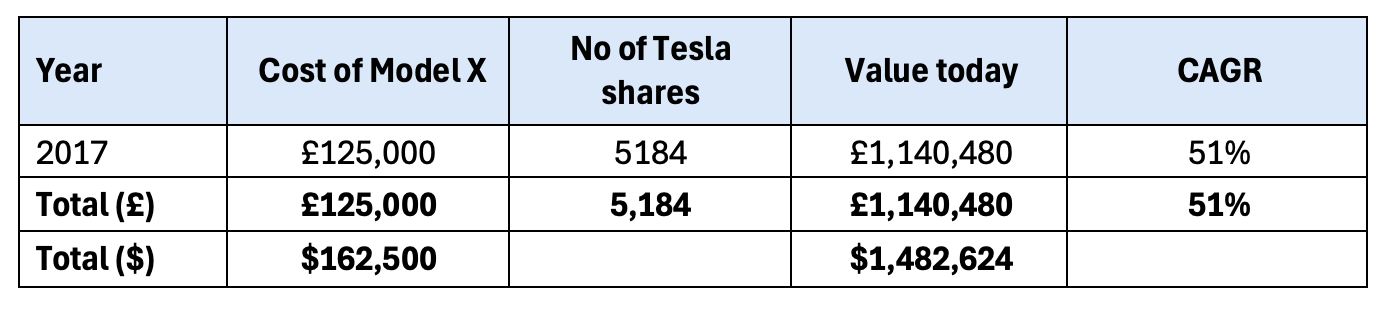

By investing in Tesla and Apple stocks instead of their products over the years, I could have been $1.25 million richer with Tesla. See this analysis of what could have been if I had bought Tesla shares instead of the car when I bought my first Tesla—a Model X in 2017

Now, if I had practised delayed gratification and bought the shares in 2017 and only allowed myself to buy my Tesla Model X in 2024 (after I had earned it), I would have had a new Tesla Model X AND $1.2 million instead of a seven-year-old car that has lost 70% of its value.

Similarly, my annual Apple fix has cost me a quarter of a million dollars.

I have made terrible investing decisions, but no other investing decision has ever cost me a million dollars.

Why do we focus so much on lousy investing rather than the long-term impact of bad spending combined with good investing and exponential growth?

The Power of Exponential Growth

This experience underscores a critical lesson from my Exponential Growth Framework: when you identify a product or company executing strongly on a super growth trend and allowing it to compound over time, the financial outcomes can be miraculous.

The human mind struggles to grasp these exponential growth curves, so they often go unnoticed.

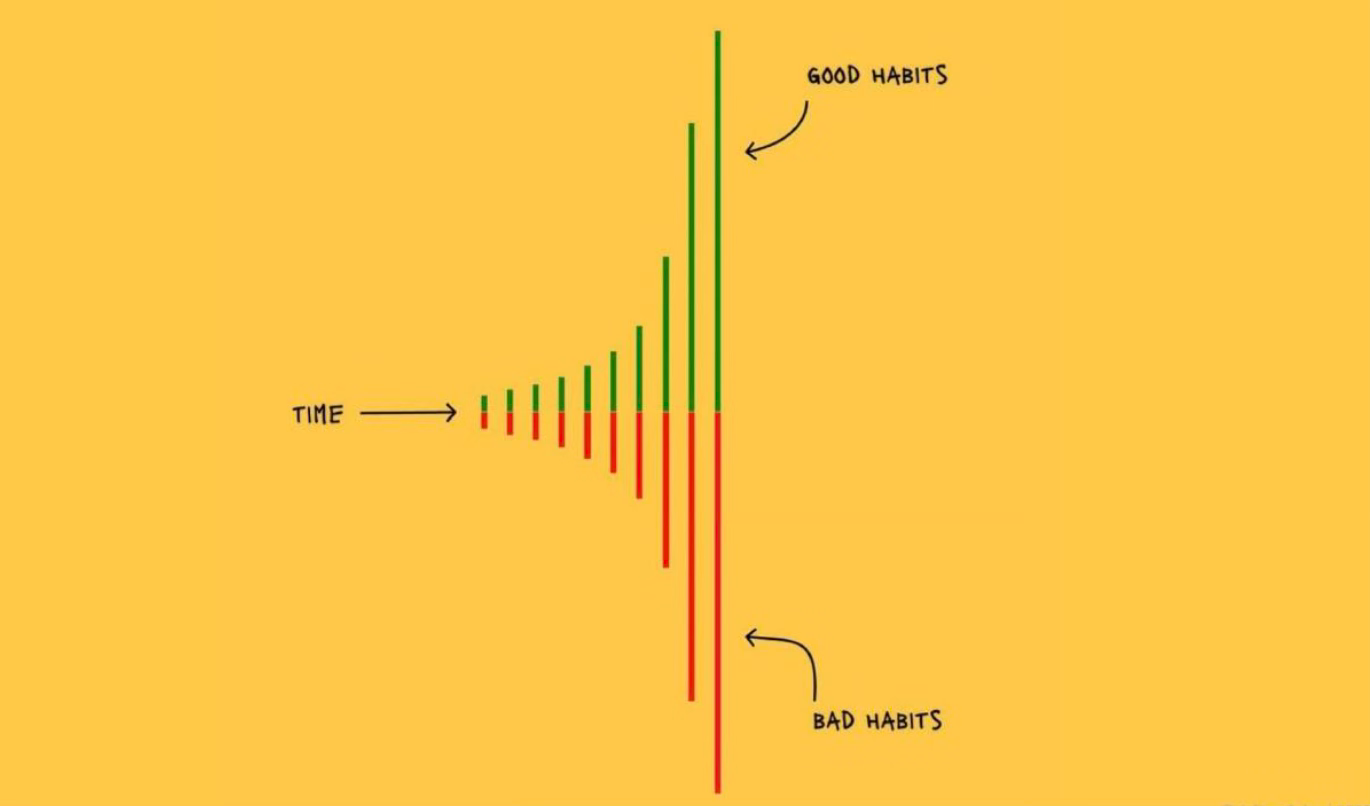

The truth is that both good habits (buying appreciating assets) and bad habits (buying conspicuous consumption) compound. One increases your wealth at an increasing pace, while the other erodes it at an increasing pace.

The Delayed Gratification Framework for Smart Investing

So, what's the framework to avoid these costly mistakes? Here's a simple yet powerful guide:

Identify the Right Trends: My Milestone 53 post lists emerging trends that have the potential to reshape industries.

·Spot Tempting Products: You'll find companies whose products are irresistible in these areas. Recognize these as indicators of potential growth.

Invest in Shares, Not Products: Instead of purchasing the latest gadgets or cars, channel your funds into buying shares of these promising companies.

Hold for the Long Term: Let your investments compound over the years, capitalizing on the exponential growth potential.

Indulge your craving when you have earned it: Buy that shiny object, but after the profit from the shares you bought, make it 'free' to buy.

By shifting focus from consumerism to strategic investing, we can transform our financial futures.

This framework not only helps avoid the pitfalls of accumulating depreciating goods but also leverages the power of trends and compounding to build substantial wealth over time.

Unsurprisingly, the famous Stanford Marshmallow experiment, conducted by Professor Walter Mischel in the 1960s, found that children who can practise delayed gratification are the most likely to succeed in later life.

As the framework shows, delayed gratification in adults is also a powerful predictor of financial success.

For more on this study, read here.

This framework does not constitute specific investing advice. It is a way to frame options to help readers make better decisions.

Thanks for reading/listening, and I look forward to your insights.

If you found this post valuable, please share it with others

Check out some of my other Frameworks on the Fast Frameworks Substack:

The Fast Frameworks eBook+ Podcast: High-Impact Negotiation frameworks Part 2-5

The Fast Frameworks eBook+ Podcast: High-Impact Negotiation Frameworks Part 1

Fast Frameworks: A.I. Tools - NotebookLM

The triple filter speech framework

High-Impact Negotiation Frameworks: 5/5 - pressure and unethical tactics

High-impact negotiation frameworks 4/5 - end-stage tactics

High-impact negotiation frameworks 3/5 - middle-stage tactics

High-impact negotiation frameworks 2/5 - early-stage tactics

High-impact negotiation frameworks 1/5 - Negotiating principles

Milestone 53 - reflections on completing 66% of the journey

The exponential growth framework

Fast Frameworks: A.I. Tools - Chatbots

Video: A.I. Frameworks by Aditya Sehgal

The job satisfaction framework

Fast Frameworks - A.I. Tools - Suno.AI

The Set Point Framework for Habit Change

The Plants Vs Buildings Framework

Spatial computing - a game changer with the Vision Pro

The 'magic' Framework for unfair advantage

Share this post