The China struggle

Has the China dream turned into a struggle? Part 2 of my 2 part series on India and China

Note: this is a long post. You can also download a PDF eBook version here:

1. Introduction

In my previous article, I explored the Indian dream. Today, I'm diving deep into the Chinese dream, sharing fresh insights from my recent visit to China.

China’s Contrasting Narratives

‘Call it “Sinophrenia”: the simultaneous belief that China is about to collapse and about to take over the world.’ -Thomas Orlik.

Having lived in China for seven years and visiting annually since 2015, I've been exposed to the internal Chinese narrative. This narrative portrays China as a benevolent power that never seeks to conquer other lands, aims to help developing countries, and has endured centuries of Western oppression—a continuing story of victimization.

Living now in the UK and India, I encounter a contrasting Western and Indian perspective: one that sees China as a calculating power seeking world domination and Western subjugation. This view portrays China as using technology as a Trojan horse to spy on Western countries while relying on stolen ideas rather than innovation. Despite their political differences, the USA, UK, and India share this view of China as a major threat.

So, which narrative reflects reality?

The truth, as often happens, lies between these extremes. From my vantage point, I see China as a future world co-leader. It will compete with the USA and eventually become the largest economy. It will likely surpass the US in innovation leadership. China and the USA remain interdependent; despite efforts at decoupling, neither country can currently function without the other. This points toward an era of co-opetition—competition in some areas and cooperation in others. The alternative—a complete break leading to a cold war or worse—would be catastrophic, though unlikely. A better understanding of China could help prevent this outcome.

I've gained insight into future global trends by observing China's developments. China often leads these trends, with its current developments appearing elsewhere years later. I'll share this perspective by explaining China's behaviour patterns, likely future developments, and how it navigates the new world under a Trump presidency.

China's influence will touch your life regardless of where you live. Understanding this complex country is crucial, mainly since its government acts pragmatically and predictably in seeking the best path forward for its 1.4 billion citizens in an increasingly challenging world.

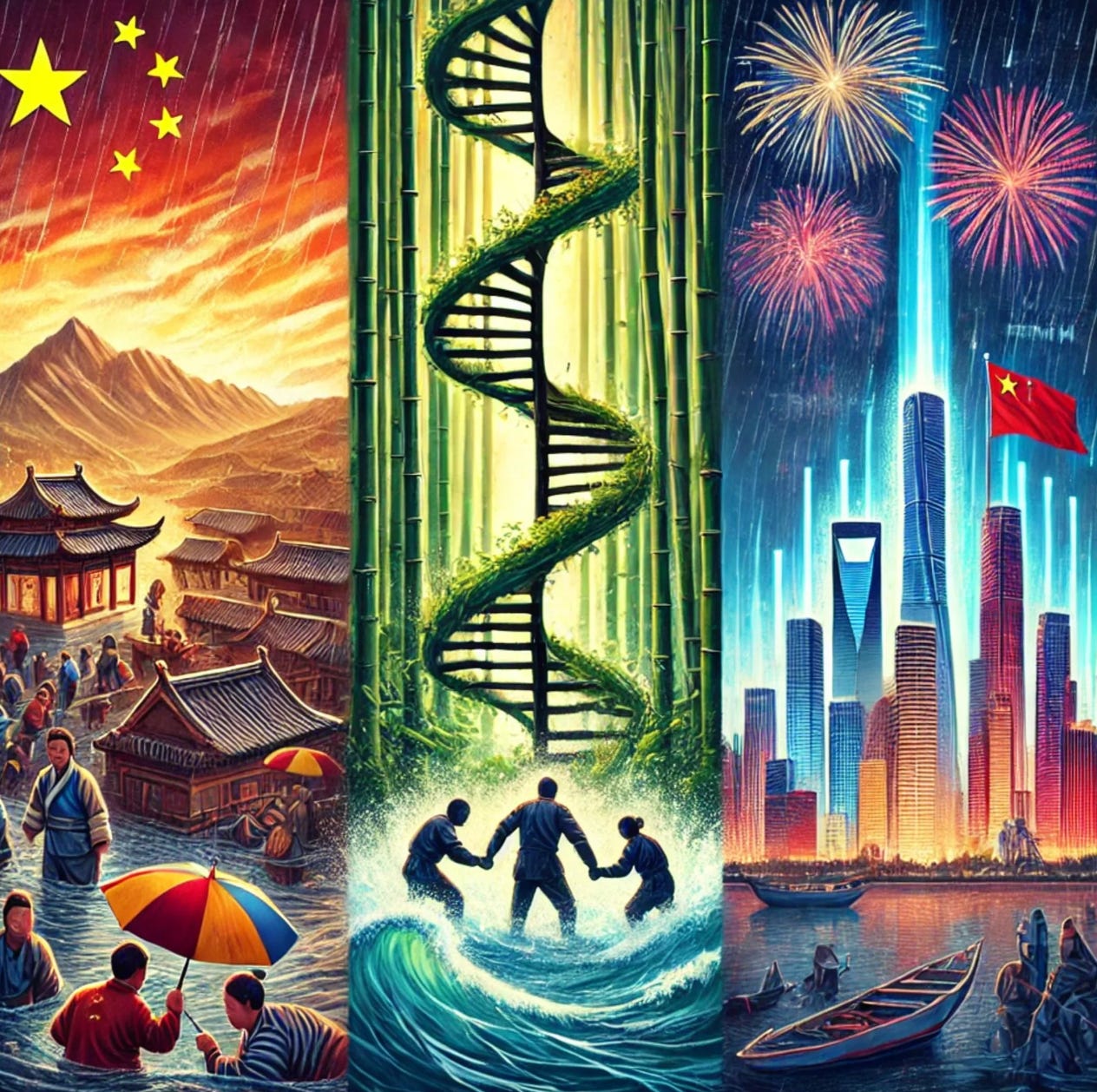

Understanding a nation shaped by struggle

To understand China, one must grasp how its people's history and culture shape their worldviews and behaviour.

This understanding is vital as China's influence touches everyone's lives—whether they realize it or not.

Given this complexity, I must make this article longer than my usual frameworks.

Cultural anthropologist Dr. Clotaire Rapaille, who studies the "Culture Code" of civilizations, countries, brands, and people, identifies three core elements in China's cultural DNA: struggle against adversity, resilience, and ultimate triumph.

Throughout its history, China has faced numerous existential threats—from foreign invasions to devastating natural disasters like famines and floods. In each instance, the Chinese people have demonstrated remarkable resilience, working relentlessly to overcome these challenges.

2. Historical and cultural foundations

The roots of resilience: From Middle Kingdom to Modern Power

China's civilization has endured for over 2,000 years under largely centralized rule. For 1,700 of those years, China was the world's dominant economic power, facing decline only in the 19th and 20th centuries when Western powers and Japan subjugated the nation.

Confucian Philosophy and the Collective Vision

Confucianism profoundly shapes Chinese society, emphasizing the harmonious relationship between the individual, family, and state. This philosophy envisions a strong family and state led by a virtuous leader—like a family patriarch making difficult decisions for collective benefit. Through millennia, Chinese people have viewed the state as the ultimate patriarch, safeguarding their civilization through hard work and perseverance. The Communist Party, recognized by its citizens, continues this tradition of moral authority as the patriarch at the head of the Chinese family, making the tough decisions for the family to survive and thrive.

The Chinese language reflects this worldview—its contextual nature, without specific verb tenses for past, present, and future, embodies an extraordinarily long view of time and continuity. Wisdom emerges from experience and reflection. Duty and natural order are ingrained in the system. The vast majority of people in China are Han Chinese, and the immigrant dream here centres on Han Chinese migrating within China to find opportunities rather than welcoming outside influences. The concept of flow, exemplified by yin and yang or water-wearing away rock, permeates Chinese thinking. This perspective of patient persistence inspired events like the Long March when Chairman Mao's army retreated 9,000 kilometres to ensure their survival and eventual revival.

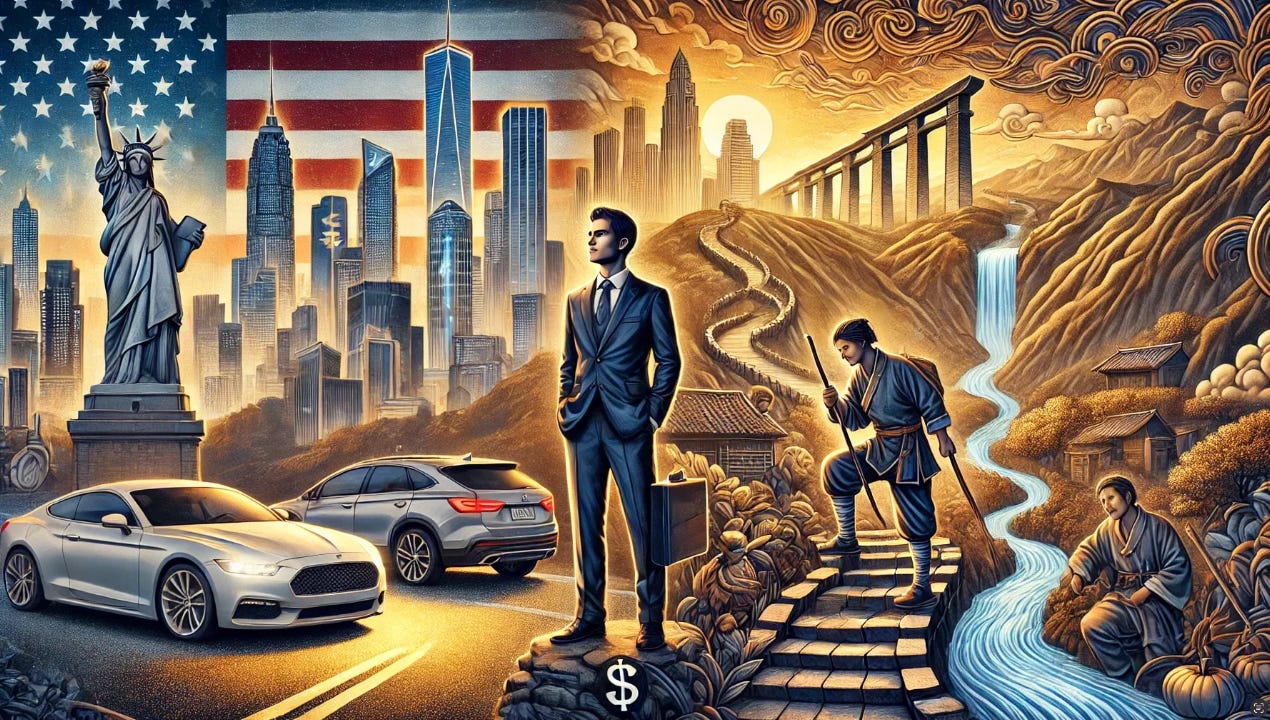

3. Contrasting dreams: The Chinese struggle and the American Dream

Resilience vs. Opportunity: A Clash of Archetypes

In sharp contrast, Dr Rapaille has this to say about America:

“The American Culture Code for America is DREAM. Dreams have driven this culture from its earliest days. The dream of explorers discovering the New World. The dream of pioneers opening the West. The dream of the Founding Fathers imagining a new form of union. The dream of entrepreneurs forging the Industrial Revolution. The dream of immigrants coming to a land of hope. The dream of a new group of explorers landing safely on the moon. Our Constitution is the expression of a dream for a better society. We created Hollywood and Disneyland and the Internet to project our dreams out into the world. We are the product of dreams and we are the makers of dreams.

the American culture exhibits many of the traits consistent with adolescence: intense focus on the “now,” dramatic mood swings, a constant need for exploration and challenge to authority, a fascination with extremes, openness to change and reinvention, and a strong belief that mistakes warrant second chances. As Americans, we feel we know more than our elders do (for instance, we rarely consult France, Germany, Russia, or England on our foreign policy), that their answers are out of date (we pay little heed to the opinions of these cultures when it comes to global matters), and that we must reject their lessons and remake the world (few of us—even our leaders—are students of world history, choosing to make our own mistakes rather than learn from the mistakes other cultures have already made).”

As the world's dominant superpowers, this fundamental difference between how America and China view themselves and the world inevitably leads to misunderstandings.

While the American dream emphasizes individual opportunity, the Chinese dream focuses on collective resilience and overcoming adversity—"winning the struggle." This manifests in two ways:

For individuals and families, as with Americans, personal struggle and diligence are pathways to prosperity.

For the nation, there exists a collective mission to help China regain its "rightful place" among world powers.

Current American efforts to limit China's ambitions strengthen the internal Chinese narrative of Western historical oppression continuing today. The Chinese see history repeating itself—Western powers constraining China—leading them to prepare for a prolonged struggle.

This reinforces China's determination to persevere, uniting the nation's collective will to endure any hardships needed for ultimate success. China pursues technological self-reliance and leadership as a matter of survival, believing time is on its side.

As America restricts China's access to crucial semiconductors and oil resources, China's resolve grows stronger to overcome what it sees as oppression and achieve eventual triumph—no matter how long the journey takes.

The Long Game: Patience and Persistence in Strategy

A Chinese saying goes, "It doesn't matter if you go fast, as long as you keep going in the same direction." With a clear goal, they see success as inevitable—whether it takes two years or two thousand. The Chinese view the past few centuries merely as a brief pause in their historical dominance.

4. Economic Growth and Transformation

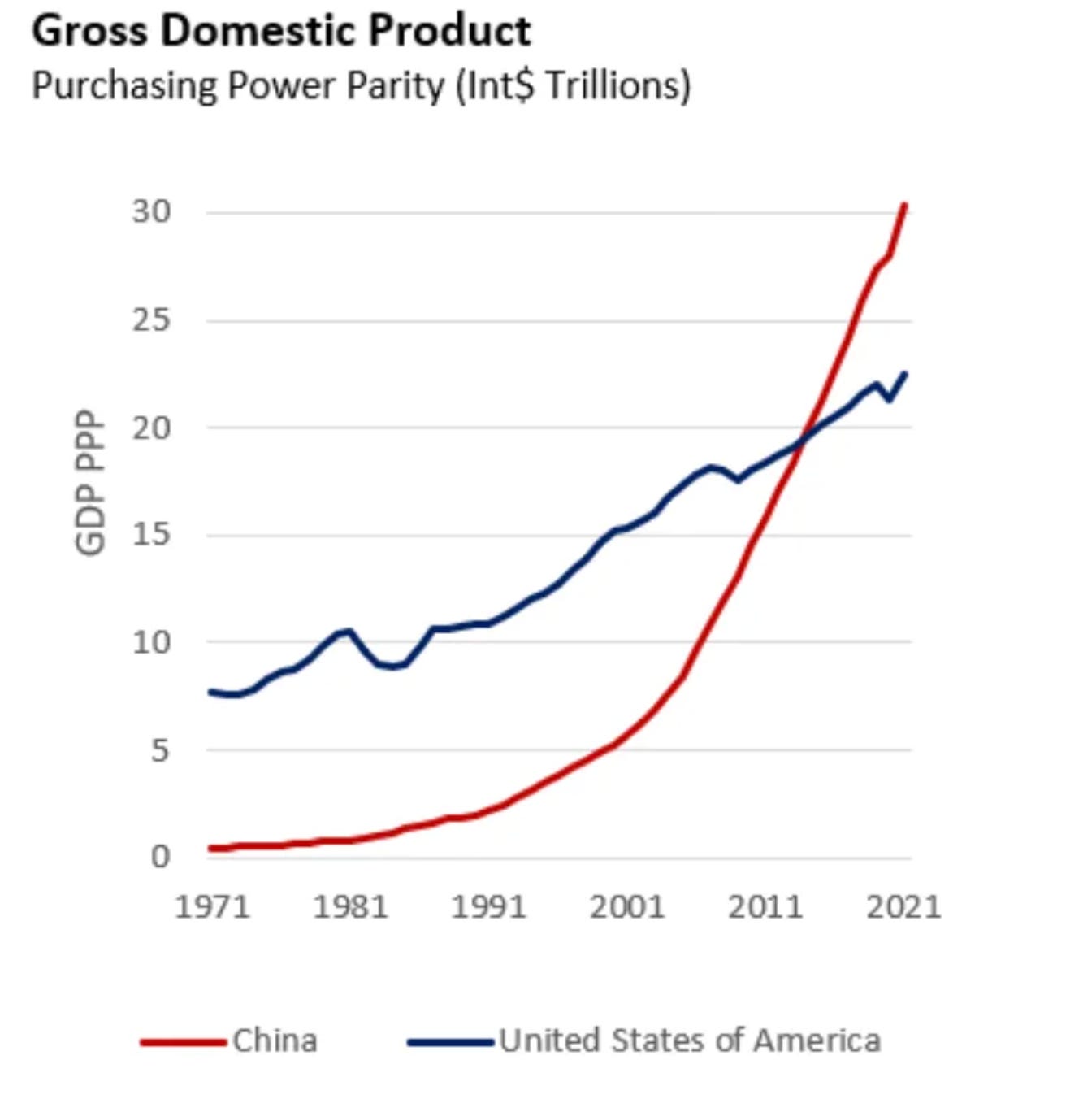

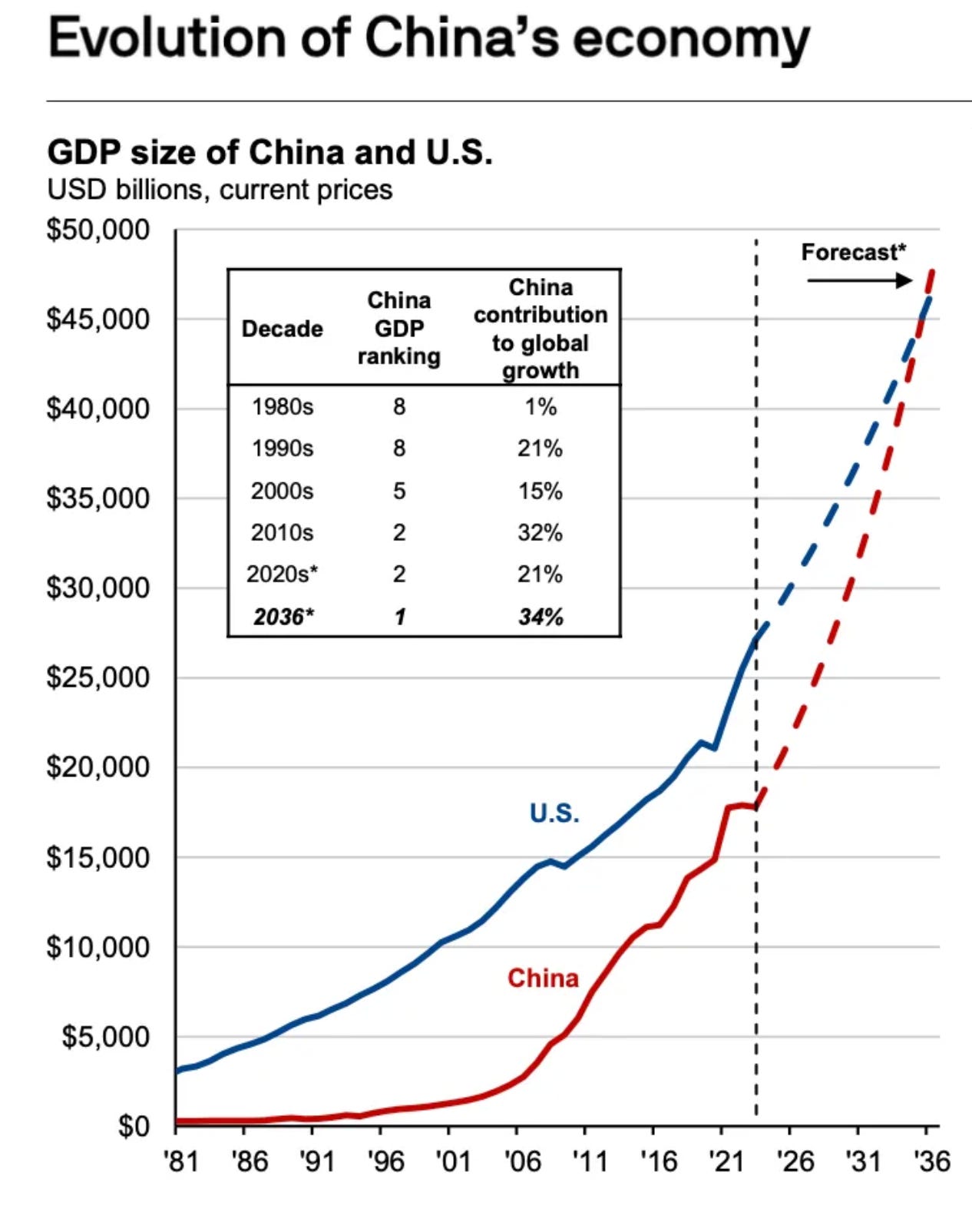

Their confidence in reclaiming the position as the world's leading economy isn't unfounded—China surpassed the USA as the world's largest economy in 2018 (when measured by purchasing power parity).

In terms of absolute GDP, China remains behind the USA. The projected date for China's catch-up has been pushed back from 2030 to 2036, as the US economy has outperformed expectations while China's growth has slowed.

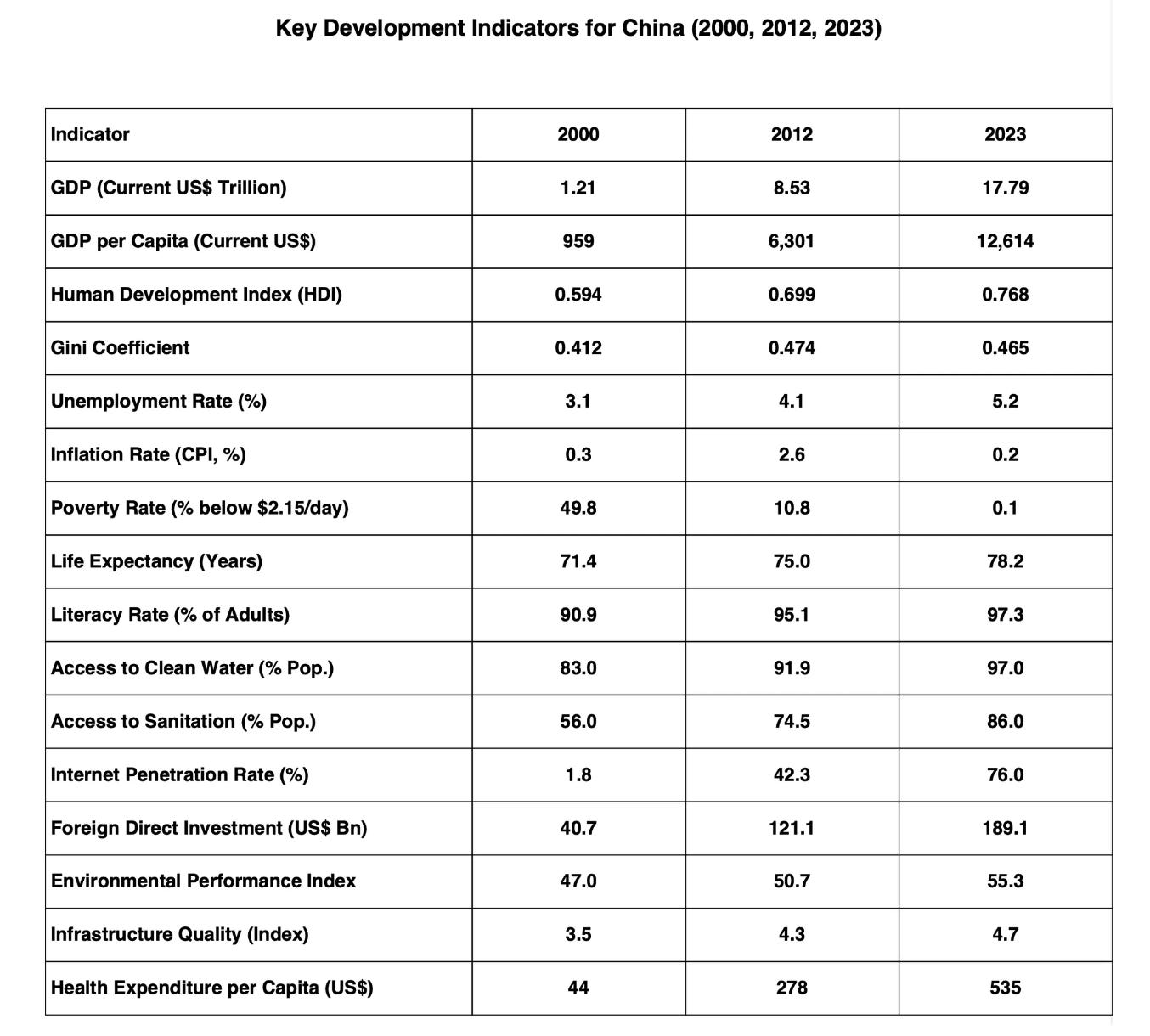

This GDP growth has transformed China dramatically. The lifting of a billion Chinese people out of poverty and the dramatic improvement of their standard of living stands as one of humanity's most outstanding achievements in recent decades.

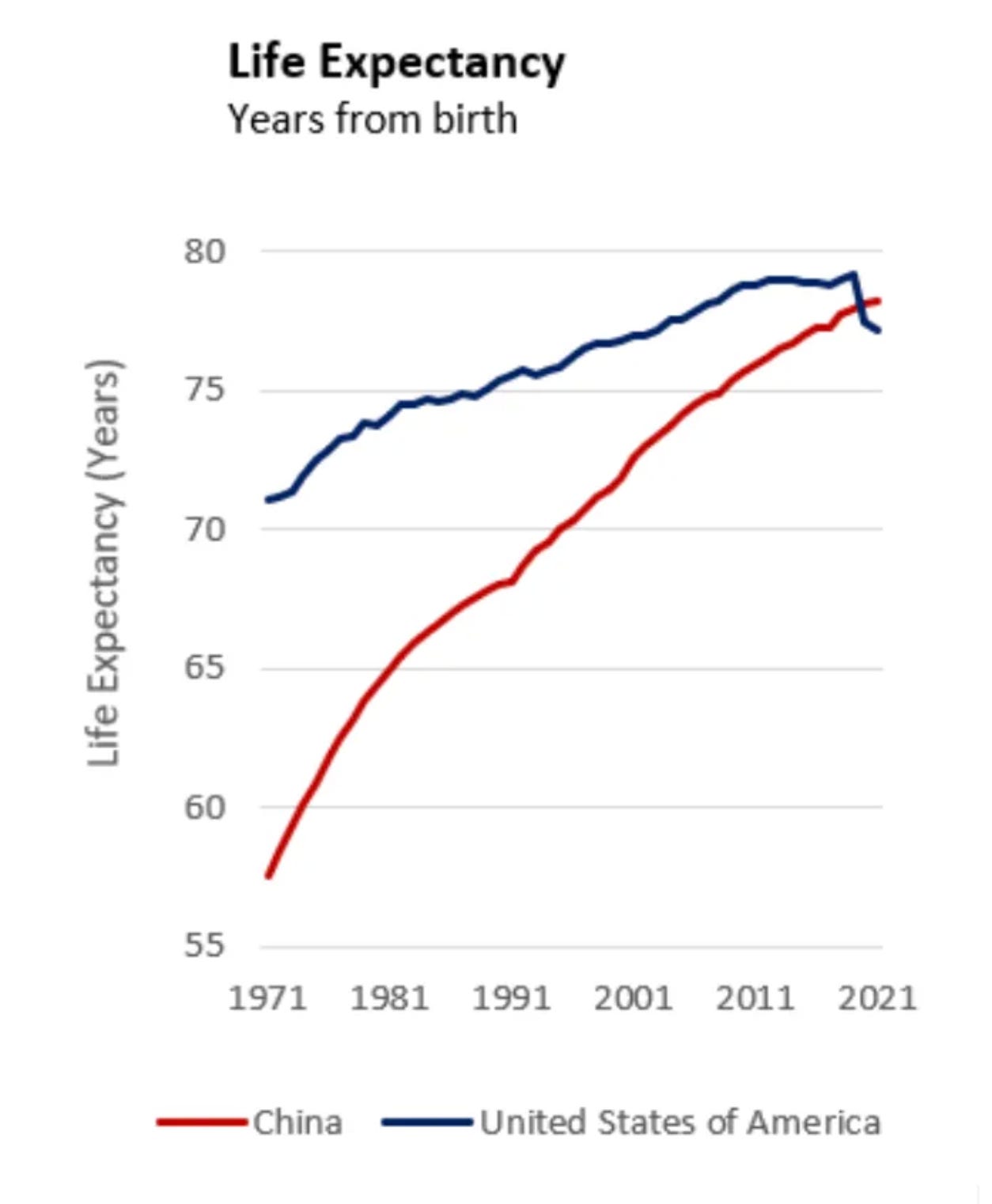

Today, the average Chinese person's life expectancy matches that of an American.

China has made remarkable progress, but lately, the narrative has shifted. Public discourse now centres on the perception that the "China Dream" has faltered, suggesting the country faces serious difficulties.

5. Challenges to China’s Growth

The Chinese economy is weaker than expected, not weaker than other countries.

So, how weak is the Chinese economy currently? And how badly is it doing?

We've all heard about China's supposed collapse and economic struggles. It's true that China is growing more slowly than in the past and faces economic challenges and a confidence issue.

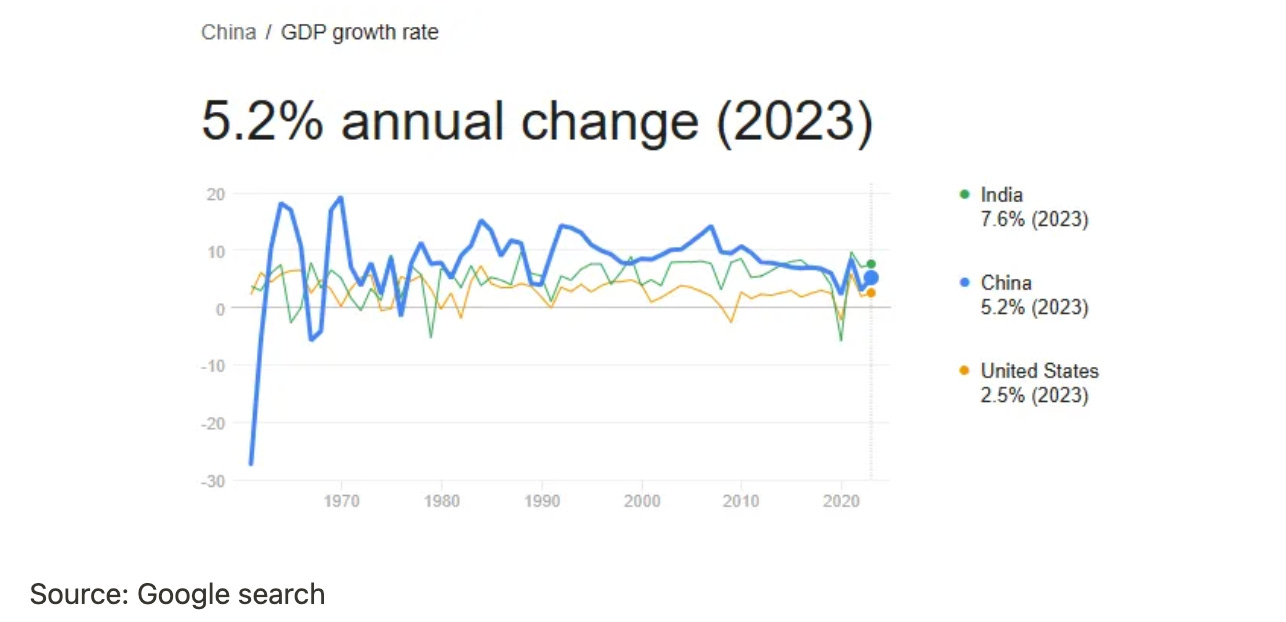

However, a slowdown doesn't mean China is doing worse relative to others - it is doing worse relative to expectations.

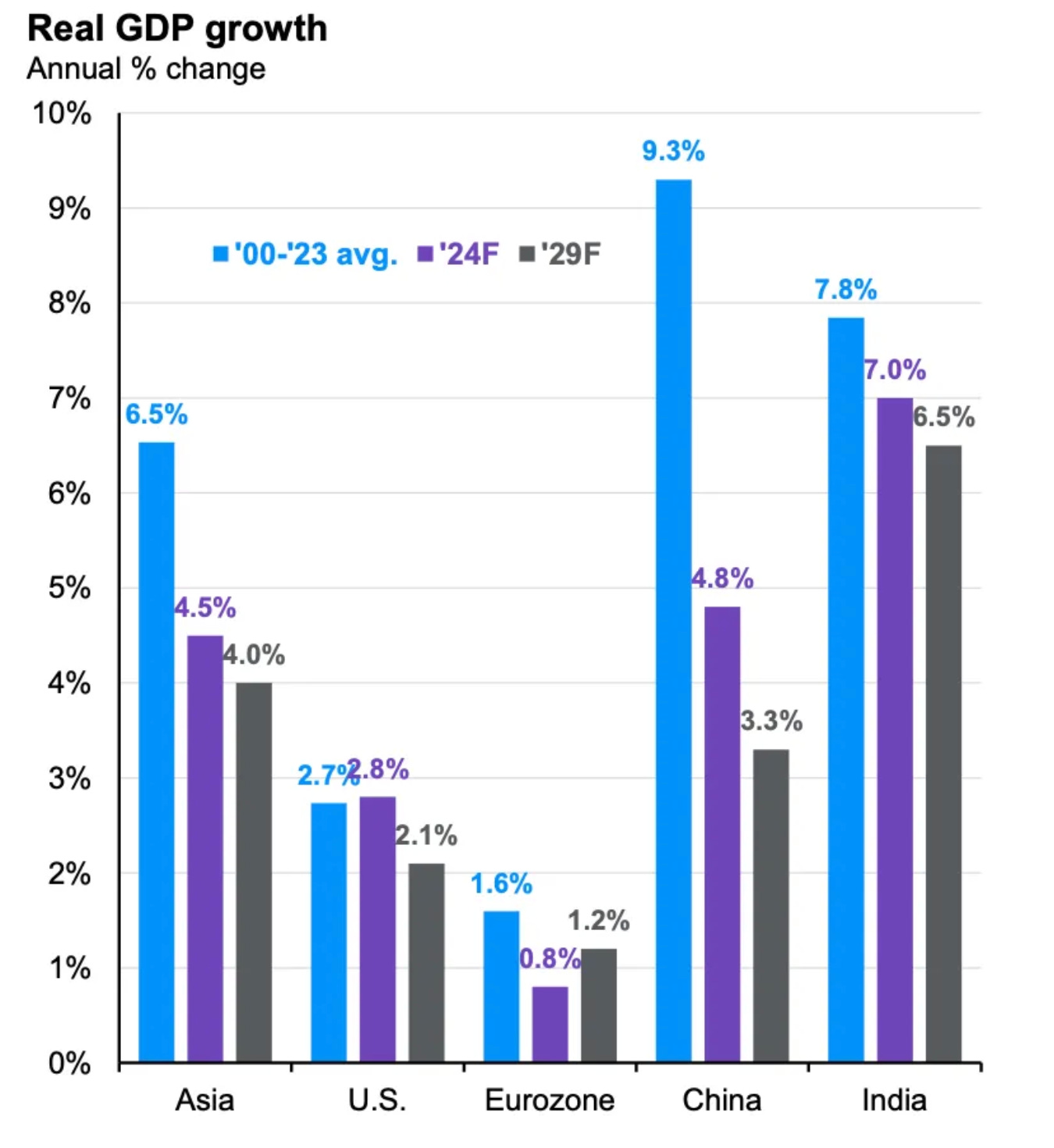

It remains a global growth powerhouse, outpacing both the USA and India.

In 2023, China's GDP grew by 5.2%, double the US growth rate of 2.5% and not far below India's 7.5%. Despite slower growth, China's economy expanded by nearly $0.9 trillion, the same as adding a quarter of the Indian economy.

So, is this ‘slower’ rate of growth a problem?

The challenge isn't just today's slower growth rate but also the projected slower growth over the next five years. The world must adjust its expectations from China's previous 10% growth to a more mature economy growing at 3-5%.

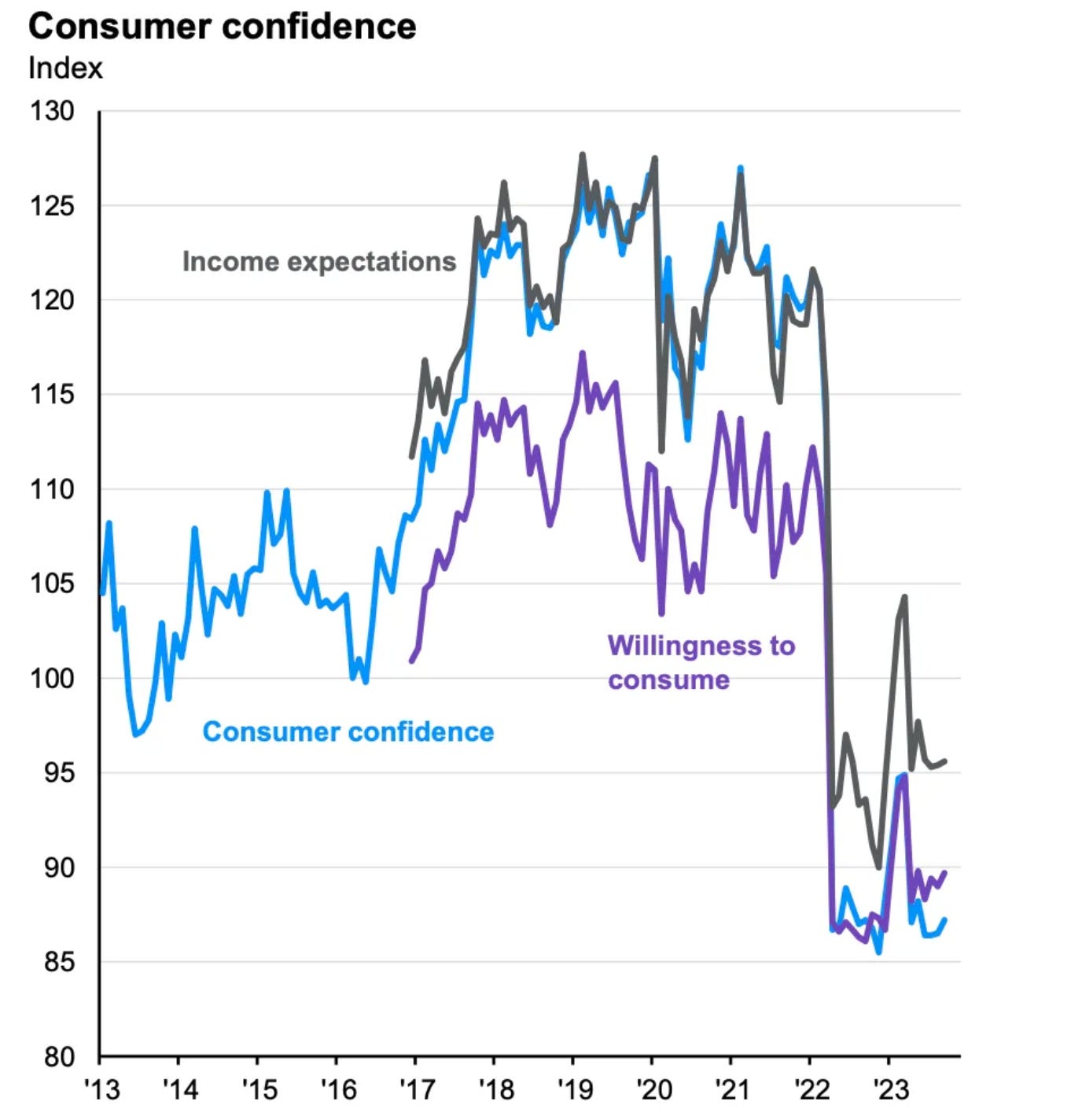

The slowing of China’s economy has led to a loss of both external and internal confidence.

What has eroded global confidence in China's trajectory, and why is current sentiment particularly negative?

The answer lies in a dual crisis of confidence: external faith has diminished while domestic consumer and business confidence has also declined.

External factors constraining China:

American shift to competition mode, Negative perception and news, Covid, Decoupling:

Externally, the loss of confidence in China started during the first Trump presidency.

For many years, America outsourced manufacturing to China, contributing to China's rise. This arrangement benefited both countries: America gained access to affordable, high-quality products, while China developed its people, economy, and infrastructure.

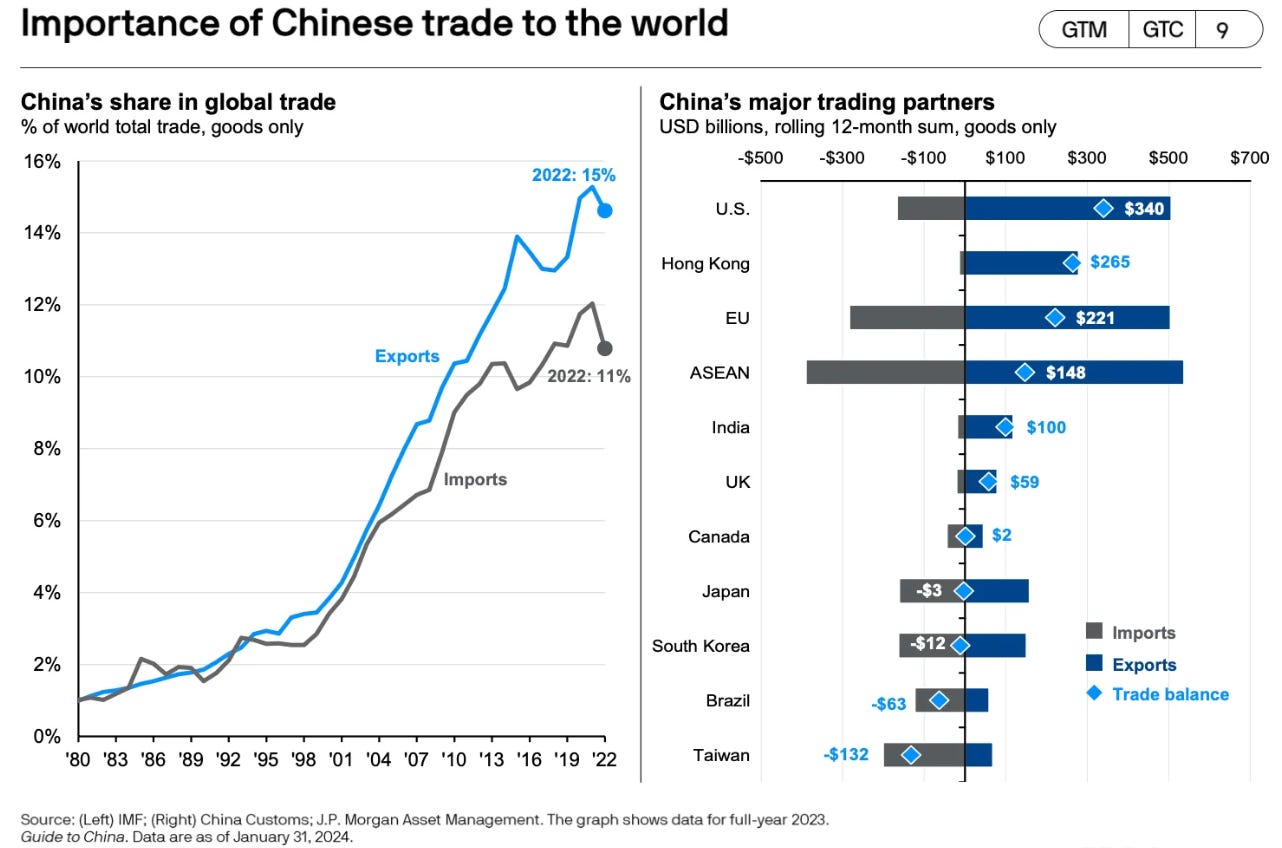

China became the world's largest factory and crude oil consumer. A pivotal moment came in 2014 when China's annual semiconductor import costs surpassed its crude oil bill—a clear sign of its technological advancement.

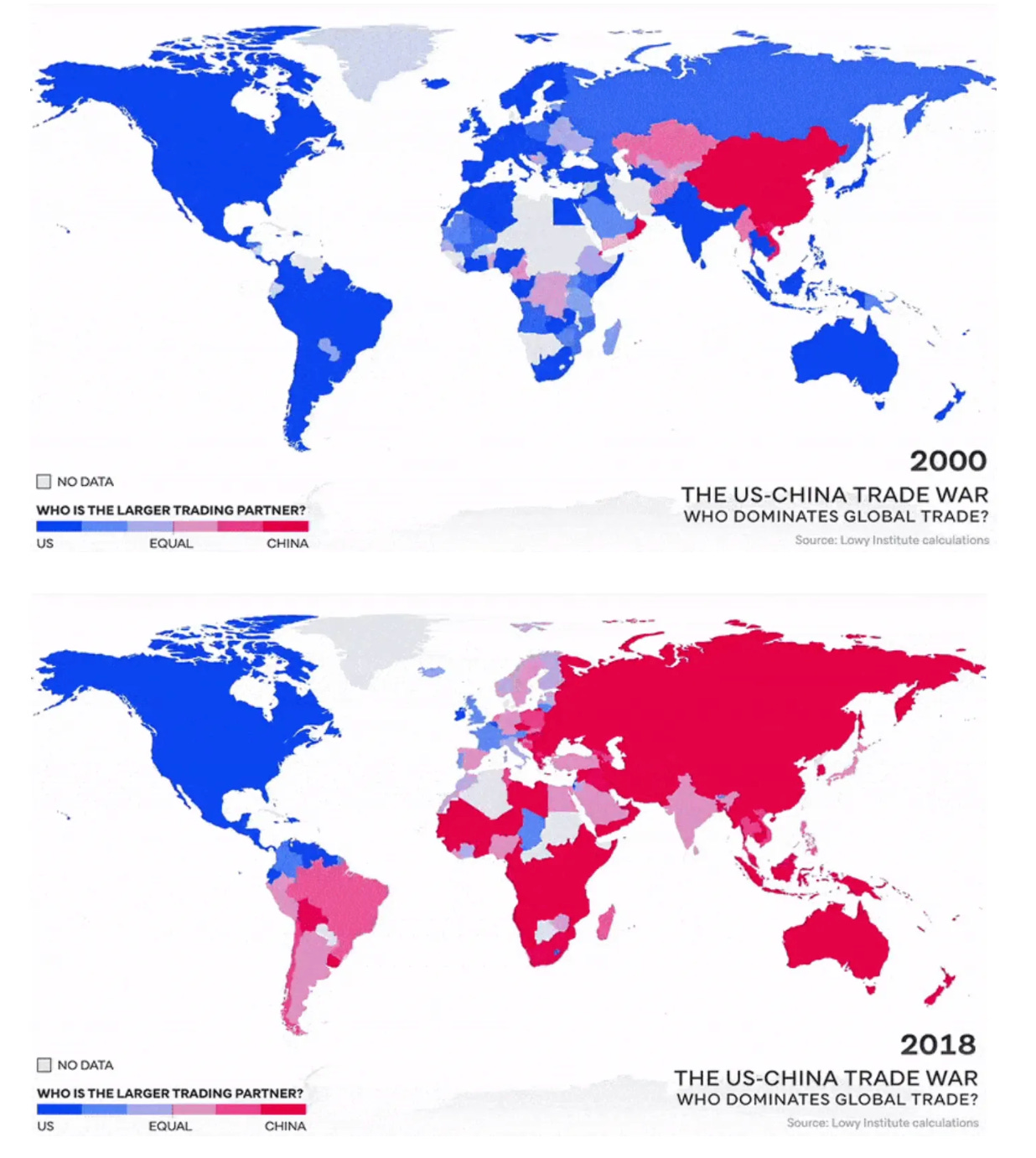

As China grew, it began competing with the USA beyond GDP. It created equally dynamic tech companies, built superior infrastructure, and became the primary trading partner for most countries worldwide. China's eventual dominance seemed inevitable.

However, America responds poorly to being overtaken—as Japan discovered when it last challenged American dominance. An America unaware of competition differs drastically from one fighting to maintain its top position. The latter responds by innovating faster while simultaneously working to undermine its rival.

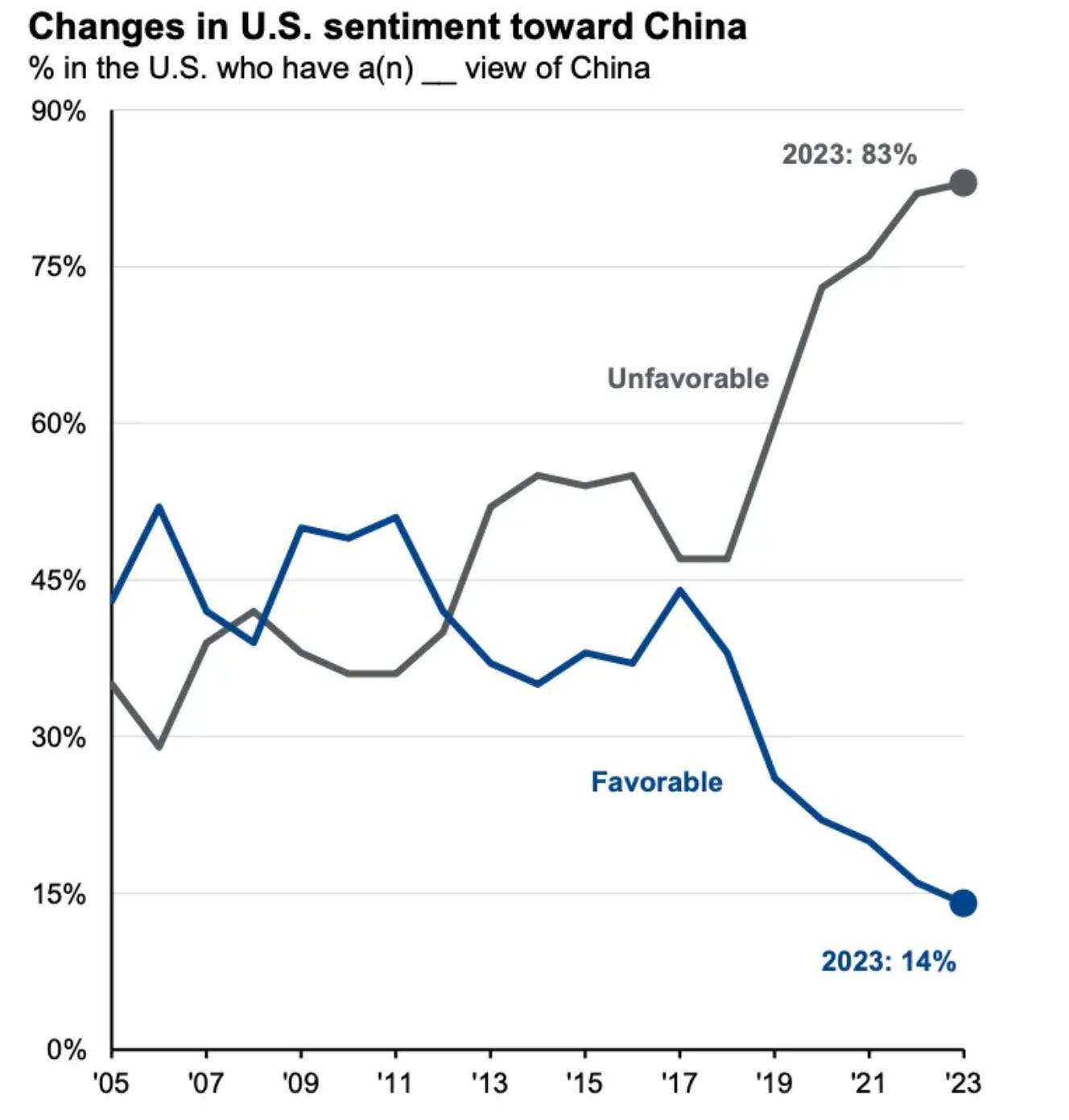

Trump was the one who elevated China's rise as a critical national concern—a message that coincided with the Covid pandemic, which he associated with China.

In a divided country, finding a common external adversary can unite opposing voters—precisely what Trump achieved by framing China's development as a fundamental threat to American interests. This stance evolved into a rare point of bipartisan consensus, with Democrats and Republicans viewing China as an antagonist. As is often the case, once American opinion solidified, other Western nations aligned with this perspective.

From 2017 onward, Western media increasingly adopted a critical stance toward China, with widespread negative coverage and propaganda shifting public sentiment in the US and Western countries from neutral to unfavourable.

This rift deepened during the Covid-19 pandemic when debates over the virus's origins and China's distinctive approach to crisis management further strained relations between China and the West.

Is China really in competition with the USA?

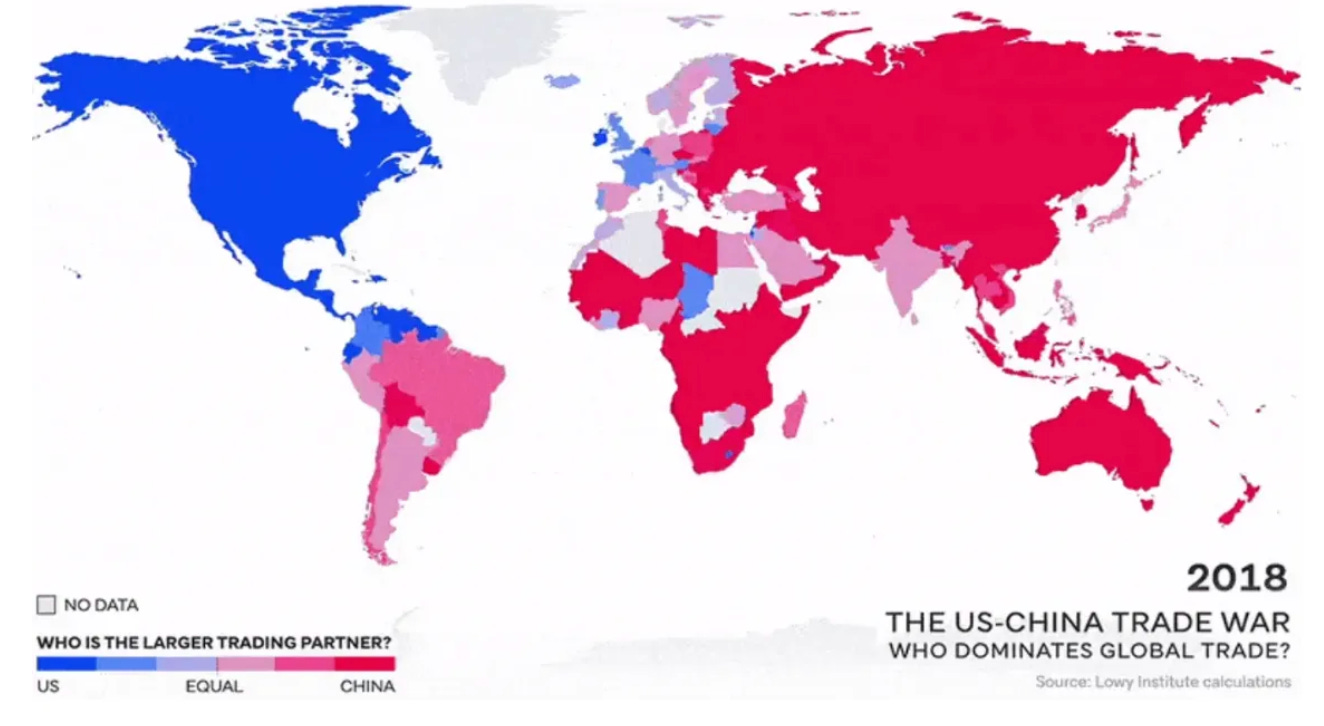

Judge for yourself by comparing the list of countries where the USA was the No. 1 trading partner (blue) vs. China (red) between 2000 and 2018.

By 2023, U.S. dominance has eroded even further. Even staunch U.S. allies like the UK now import more from China than from the USA ($99 Bn vs $92 Bn). Countries like Brazil, which had similar import levels from both nations in 2018, now buy 40% more from China than from the USA. Despite its tensions with China, India's imports from China are triple those from the USA in 2023. American trade leadership has shrunk to its immediate front and backyard—Canada and Mexico—and the gap is closing even here.

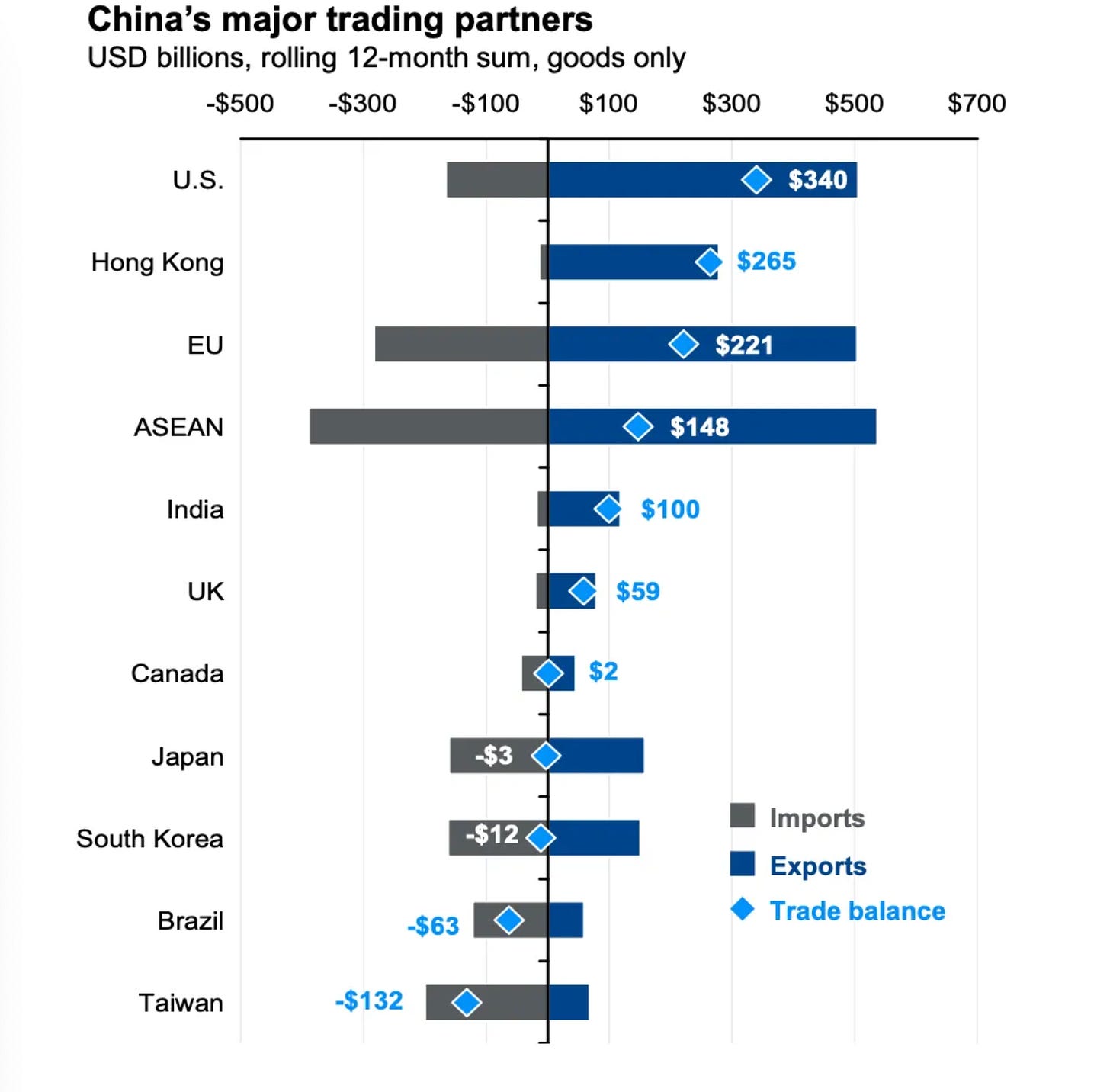

China has emerged as the dominant global powerhouse for trade. It maintains positive trade surpluses with most markets, with only three types of exceptions: countries that supply Semiconductor Chips which China cannot yet produce (Taiwan, Korea, Japan); countries where China is establishing alternative manufacturing bases (ASEAN); and countries that supply raw materials (Brazil, Africa, Russia). The strength of China's manufacturing engine is particularly evident in its trade balance with countries like India and the UK. For instance, India imports Over $100 Bn from China while exporting under $5 Bn back—highlighting the stark gap in industrial capacity between the two nations.

America recognized this new reality too late. By the time it responded, China had gained significant advantages.

Before Trump's presidency, the power dynamic between the USA and China was notably imbalanced.

While China restricted U.S. tech platforms, citing national security concerns, the USA kept its doors open to Chinese platforms.

China leveraged U.S. intellectual property and technology extensively, facing few restrictions. As the world's largest chip buyer, China built a formidable tech manufacturing ecosystem that surpassed U.S. capabilities.

China maintained higher tariffs on U.S. goods until Trump initiated a tariff war, eventually leading to more balanced rates—a policy that Biden's administration has maintained.

China's growth was fueled by American and Western companies pursuing profits through offshoring. Moving technology and manufacturing to China jumpstarted its industrial base, with far-reaching consequences:

China industrialized, and the USA deindustrialized:

China built an extraordinary ecosystem of skilled craftsmen and engineers. Supply chains flourished in close proximity, and numerous strong companies emerged. Meanwhile, America's industrial heartland suffered devastating job losses—destroying the American dream in cities like Detroit. This decline sparked social division and helped catalyze Trump's rise to power.

See this video from Apple CEO Tim Cook about why they manufacture in China:

China developed, and the USA decayed

The massive investment flow into China led to dramatic improvements in urban infrastructure, while U.S. cities and infrastructure lagged behind.

See these videos, which compare China's and USA infrastructure

While videos can be biased, I have visited over 100 cities in China and travelled extensively in the USA. I can attest firsthand that China is decades ahead in development and infrastructure.

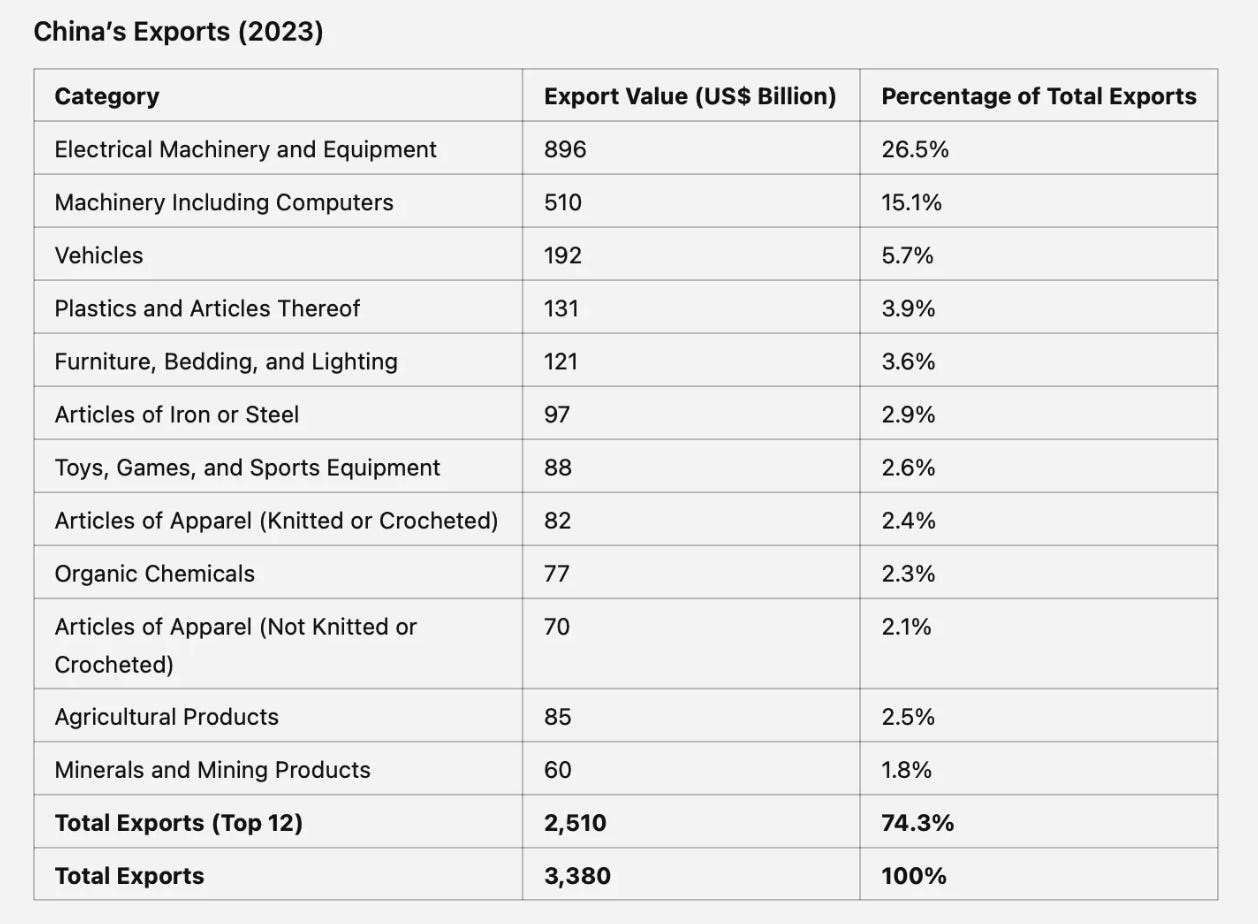

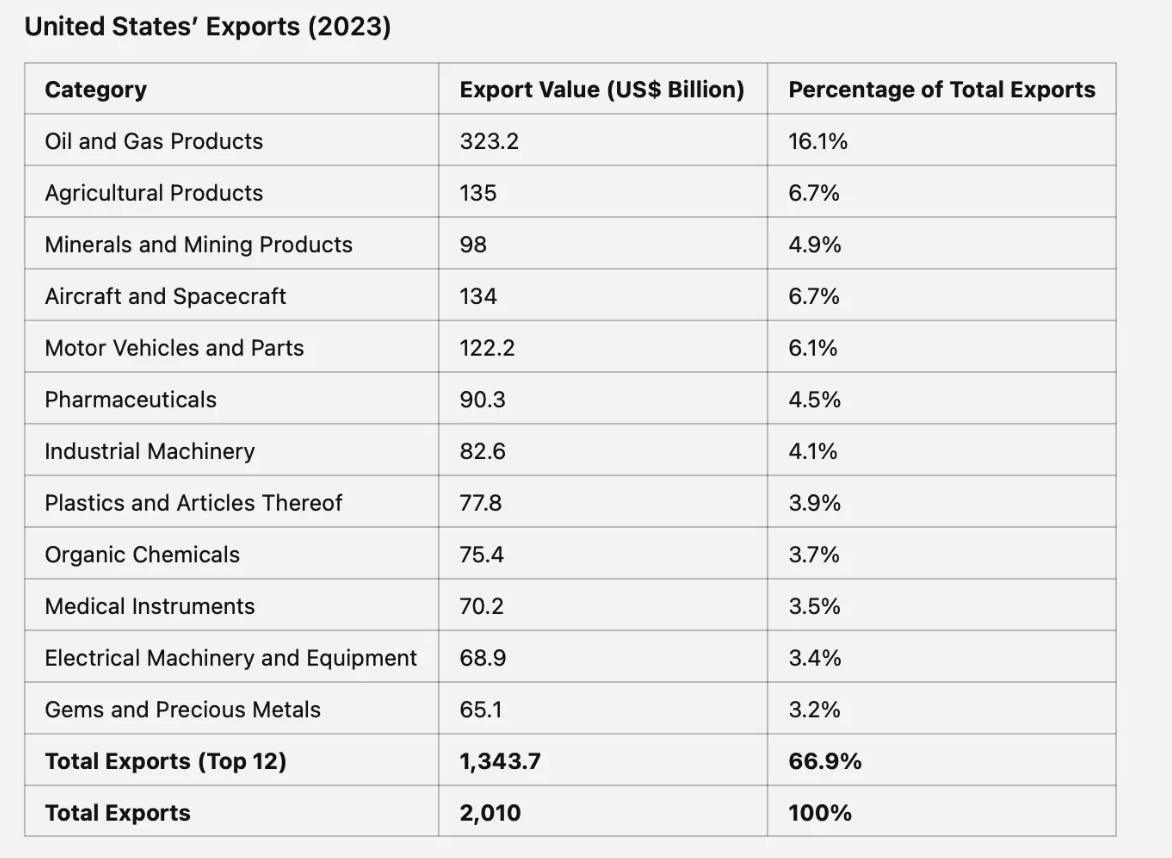

China became the high tech exporter, while the USA is in danger of becoming an exporter of commodities:

China’s top export categories are high-tech or industrial

While three of the top five export categories for the USA are now natural resources.

The USA also has high technology exports, but China’s output dwarfs them.

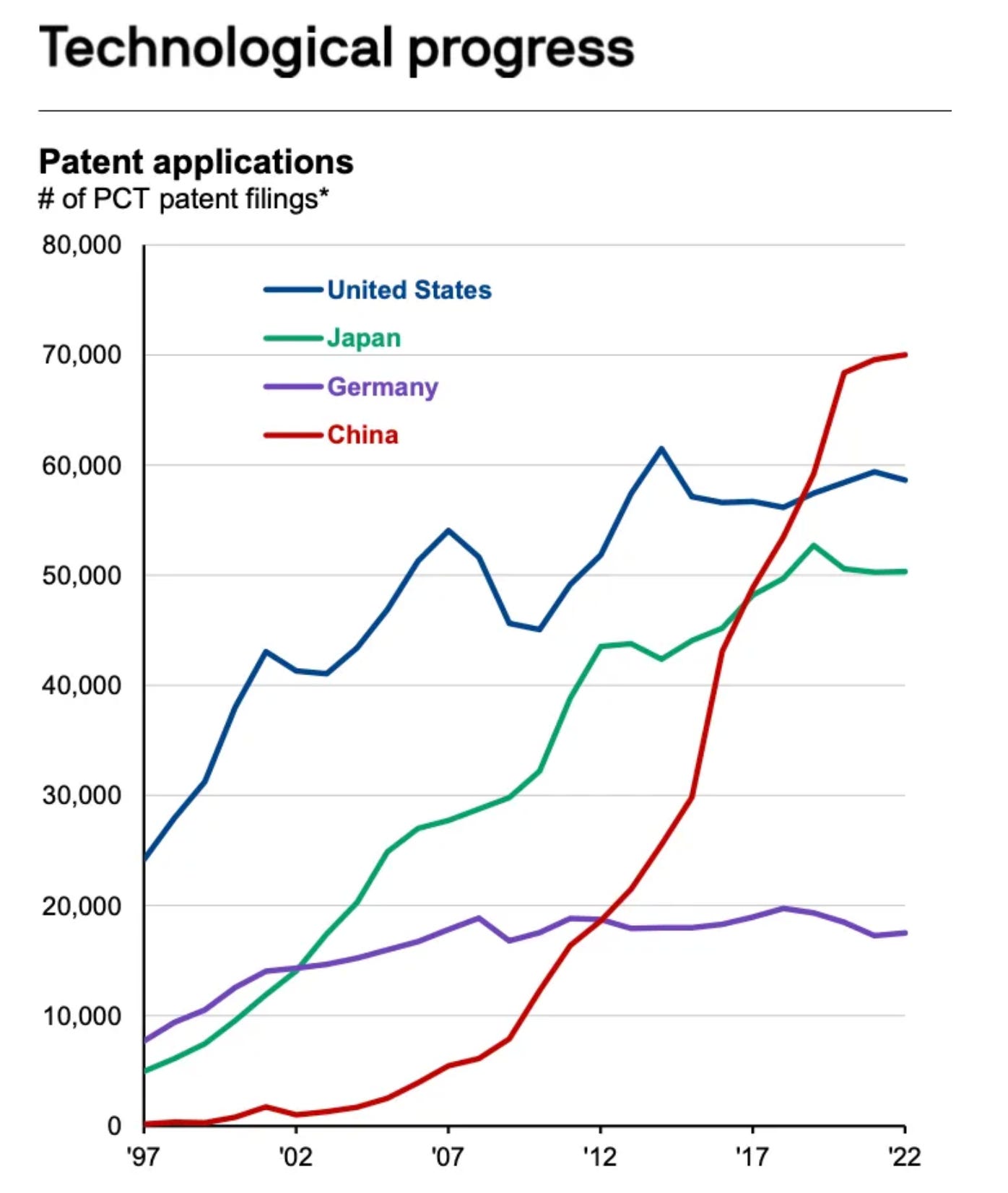

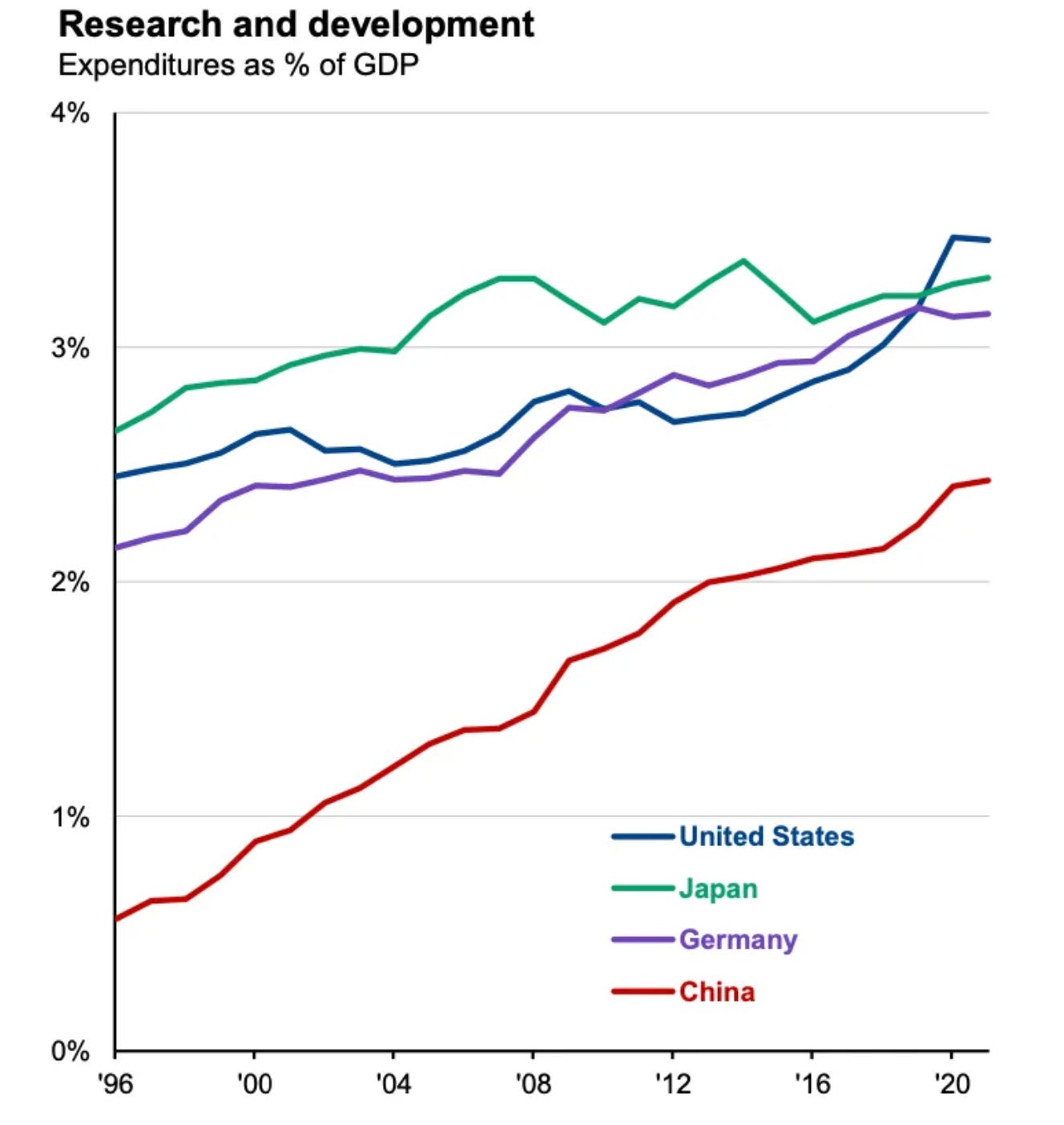

China became an innovation and technology leader

China has emerged as a formidable competitor in global innovation. It now files more patents annually than both the USA and Japan

and is spending more and more on R&D

After the USA and Western Alliance finally recognized they were losing this competition, they took decisive action:

Launching a propaganda campaign and political narrative to shift domestic public opinion against China

Constraining Chinese development by

Targeting leading Chinese tech companies like Huawei and TikTok

Limiting China's access to advanced semiconductor chips to slow innovation

Encouraging companies to relocate supply chains away from China

Implementing protective tariffs and anti-dumping duties

Restricting Chinese students and researchers from studying and working in America

Closely monitoring and preventing Chinese acquisition of sensitive IP

Challenging China's positions on Taiwan and Hong Kong

Maintaining selective cooperation where China's help was needed:

Encouraging Chinese investment in US Treasury Bills

Sourcing products that couldn't be manufactured domestically

Supporting US companies seeking access to Chinese markets (e.g., Boeing, Apple, Tesla)

Leveraging China's manufacturing to keep consumer costs low

Moving environmentally impactful production to China

Seeking commitments for increased Chinese imports of US commodities and agricultural products

This new "cold co-opetition" has become the new normal.

The stance is bipartisan in the USA—both parties adhere to the exact same blueprint.

This shift has directly caused an external loss of confidence.

Internal factors constraining China: A property crash, mishandling of ‘common prosperity’, and COVID-19 resulted in consumers feeling poor and stopping spending. This further dropped already low business confidence and tanked the stock markets.

Throughout history, China has viewed itself as the "Middle Kingdom" — the centre of the world. This worldview shapes Chinese culture, which traditionally sees itself as central while viewing outsiders as less significant.

This perspective has created an inward-focused culture, and even today, China's actions are driven more by domestic concerns than external ones.

And there are concrete reasons for this internal loss of confidence.

The first reason is related to changes in Government policy in China and a series of self-goals

These changes were signalled by how the Covid lockdown was handled - especially in Shanghai and the 14th five-year plan

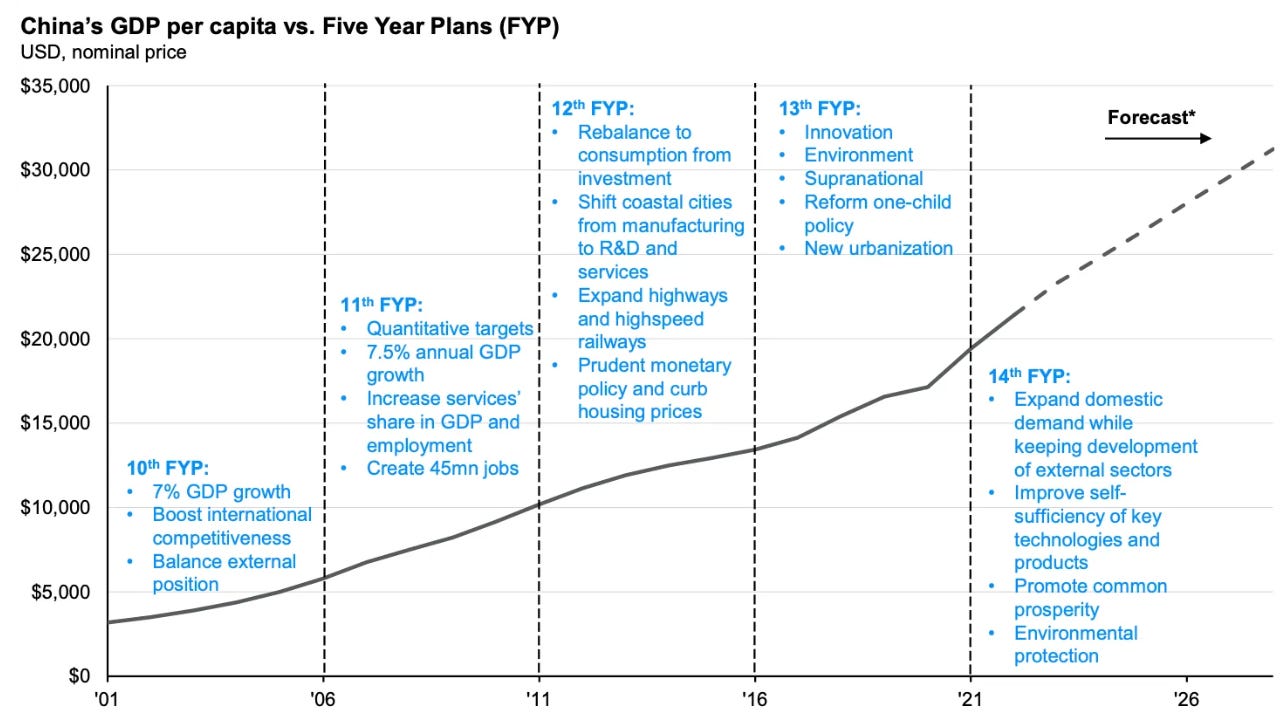

The five-year plans leading to 2021 were growth-focused and enabled Chinese people to work in a very ‘capitalist’ framework:

Since 1979, there has been an unspoken agreement between the Chinese government and its people: the people follow the party's leadership, and in return, the party helps them achieve a better future by improving their standard of living, quality of life, and health. The results are evident—China has an incredibly stable government with widespread popular support. While challenges exist, they remain relatively minor in the broader context.

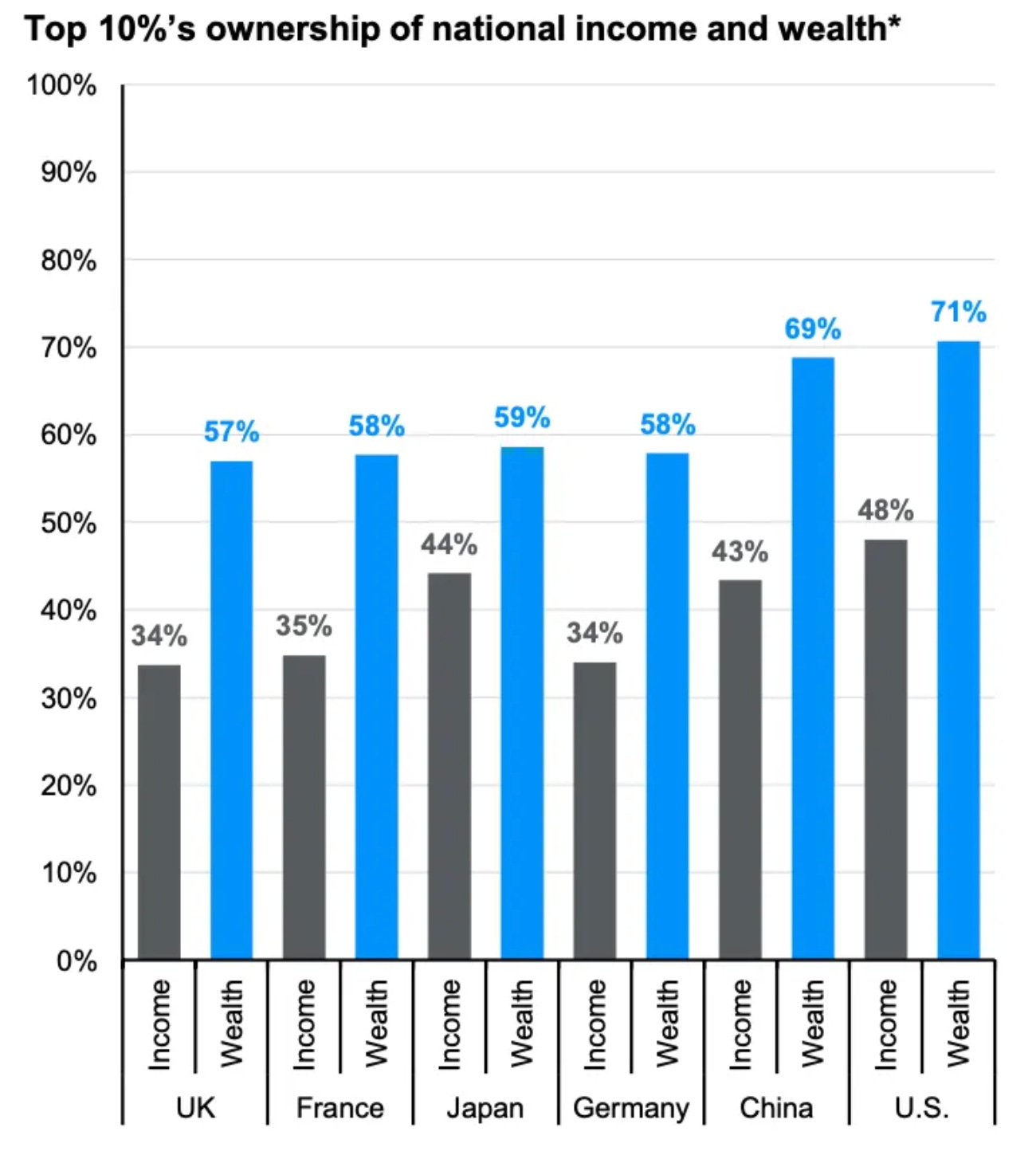

The party has implemented what it calls "communism with Chinese characteristics," a system that closely resembles capitalism. Wealth concentration at the top mirrors that of the USA, while social security and healthcare spending remain lower than in Western nations.

Like in America, the average Chinese citizen can aspire to accumulate wealth, and unlike in Europe, entrepreneurial success and wealth creation are viewed positively and aspirationally.

China's top 10% contribution to wealth and income parallels that of the United States, another highly capitalistic nation. China's wealth is even more concentrated than that of the welfare-oriented economies of Europe and Japan.

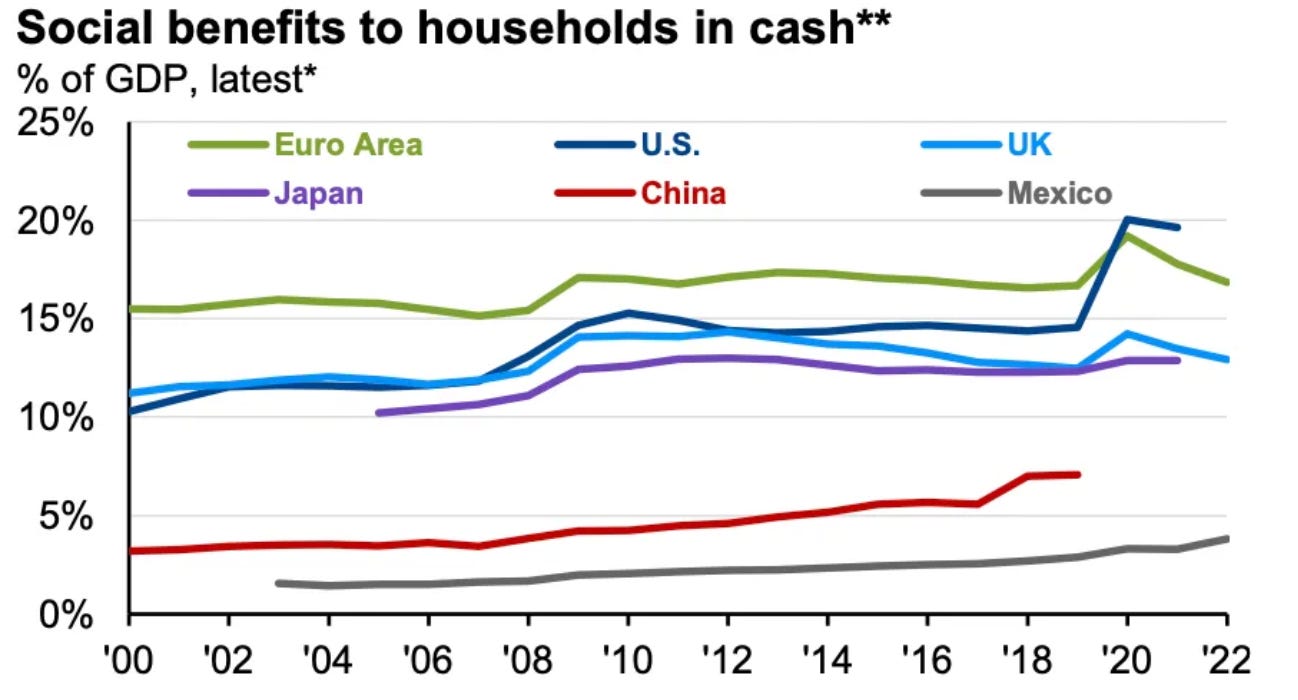

While China's median age of 39.8 is slightly higher than the USA's 38.7 but lower than the EU's 44, China allocates just 7% of its GDP to healthcare, compared to 17% in the USA and 11% in the EU.

China's public social protection expenditure is equally modest at 7% of GDP, while the USA spends 18% and the EU over 30%. Ironically, this "socialist" country invests far less in social welfare than its "capitalist" Western counterparts.

The 14th five-year plan signalled significant changes in priorities:

Growing local demand

Self-sufficiency in core technologies

Promote "common prosperity"

Environmental protection

The party leadership takes its role as "the head of the Chinese family" seriously, along with its responsibility for the well-being of the Chinese people—even when they believe harsh measures are necessary.

Their overzealous approach to COVID lockdowns angered many citizens. When they suddenly reversed course and reopened everything overnight, the population was shocked. After 25 years of relative freedom, people were starkly reminded of the government's power.

Meanwhile, growing pushback emerged against the widening gap between the ultra-rich and ordinary citizens. Pursuing a more equitable society under the banner of "common prosperity," the government cracked down on conspicuous consumption, corruption, and the ultra-wealthy. Many targets came from China's world-beating tech industry, and this crackdown significantly diminished their influence.

The central government shifted the financial burden to local governments to finance the costly COVID response. Simultaneous legal changes redirected more tax revenue to Beijing. Local governments, traditionally selling land to cover shortfalls, now struggled to find buyers. This created massive deficits they covered through loans and financing instruments, leading to a debt crisis. Local governments accumulated an estimated 100 trillion RMB ($14.5 trillion), with annual debt payments exceeding $290 billion.

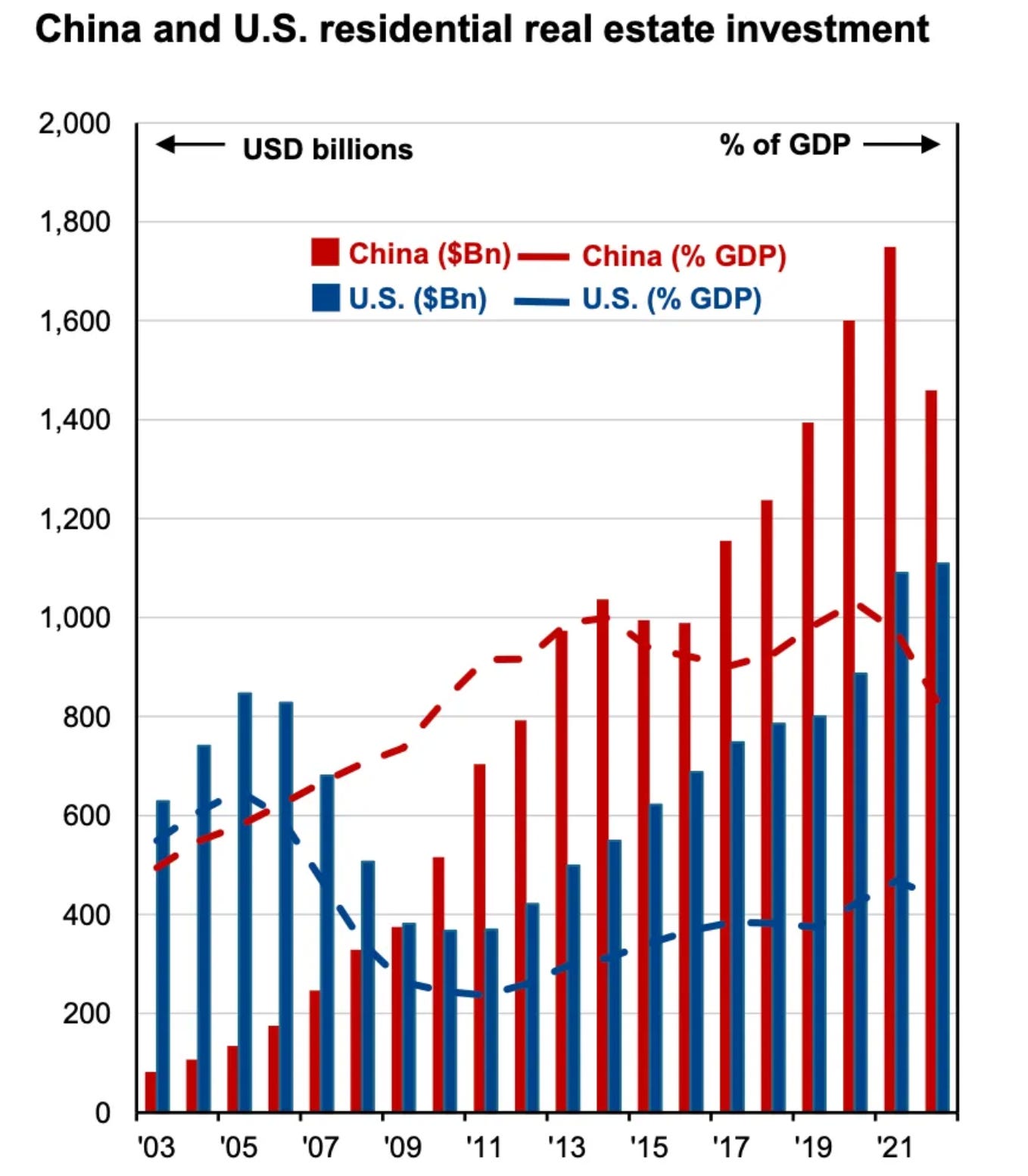

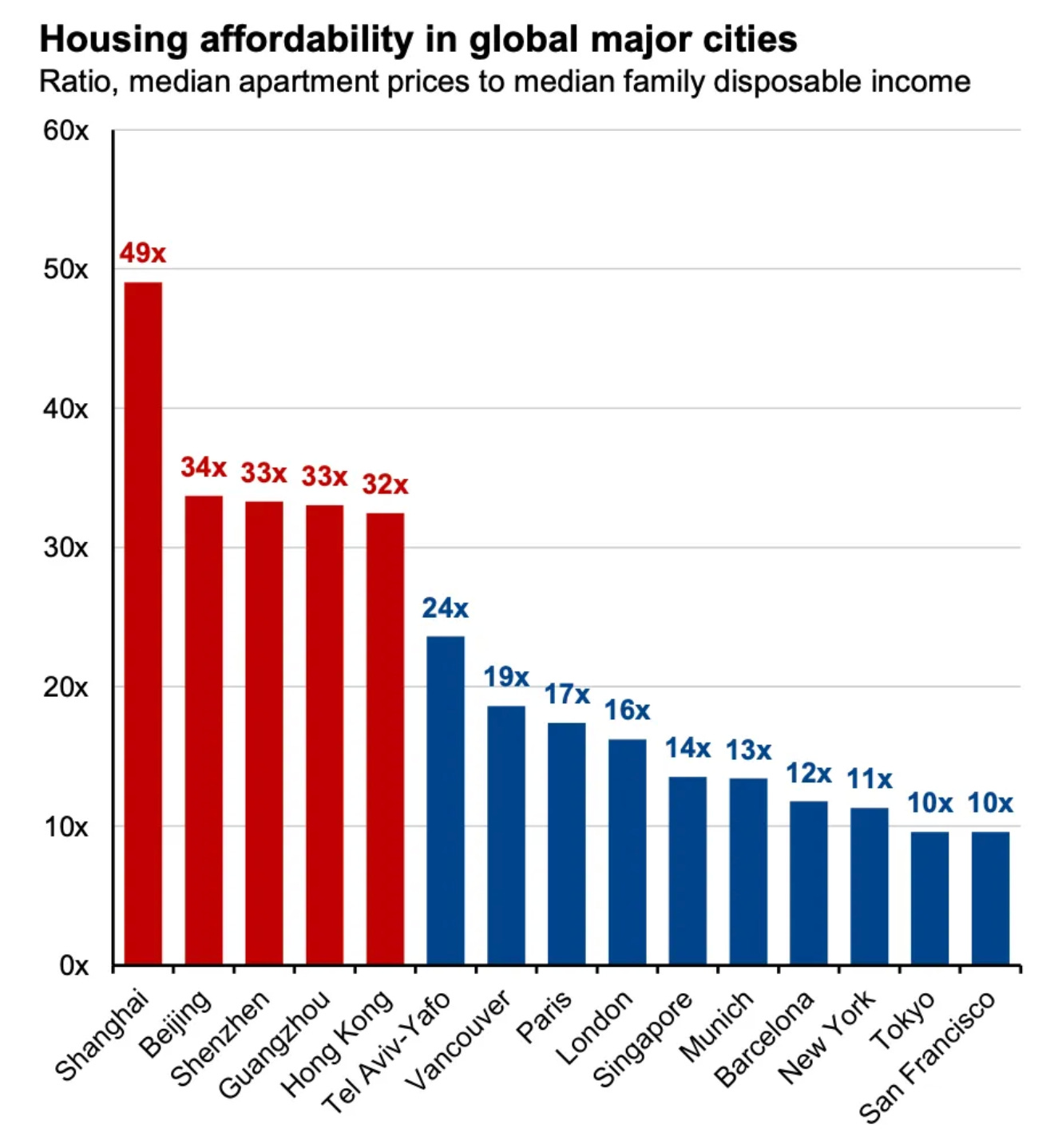

Before COVID, China's property market was booming. People invested their life savings and took loans to buy primary residences and often second homes as investments. The total value of Chinese residential property surpassed that of the U.S. and continued growing until 2020.

Leading to a massive price bubble which made house prices unaffordable.

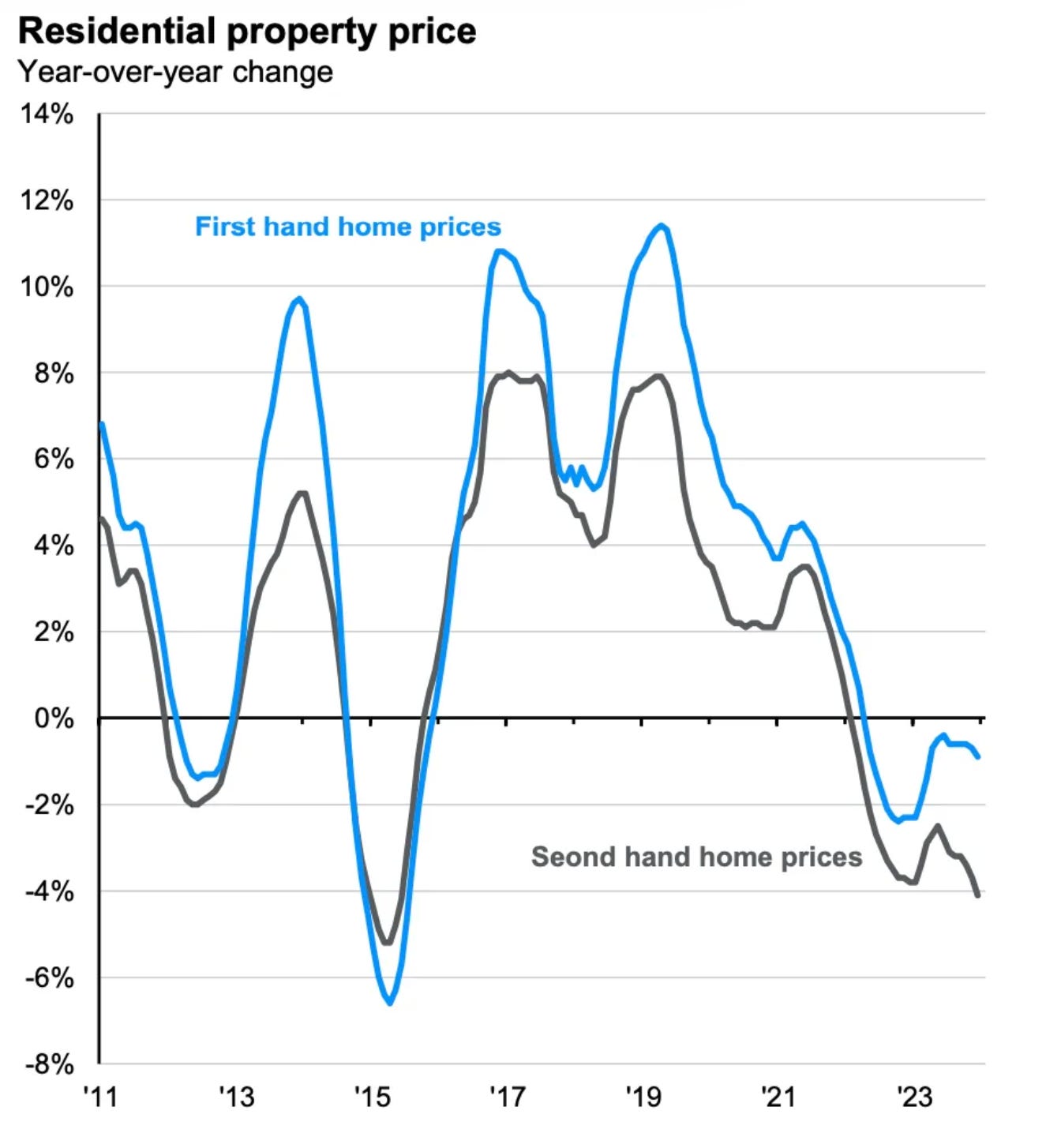

Developers had overbuilt properties extensively, financing their projects with loans based on projected rising home prices. When Covid hit, housing demand and prices plummeted, exposing these builders financially. Many went bankrupt, further eroding local confidence.

This triggered the start of a massive internal crisis of confidence amongst Chinese consumers:

The combination of low demand and property oversupply caused home prices to plunge

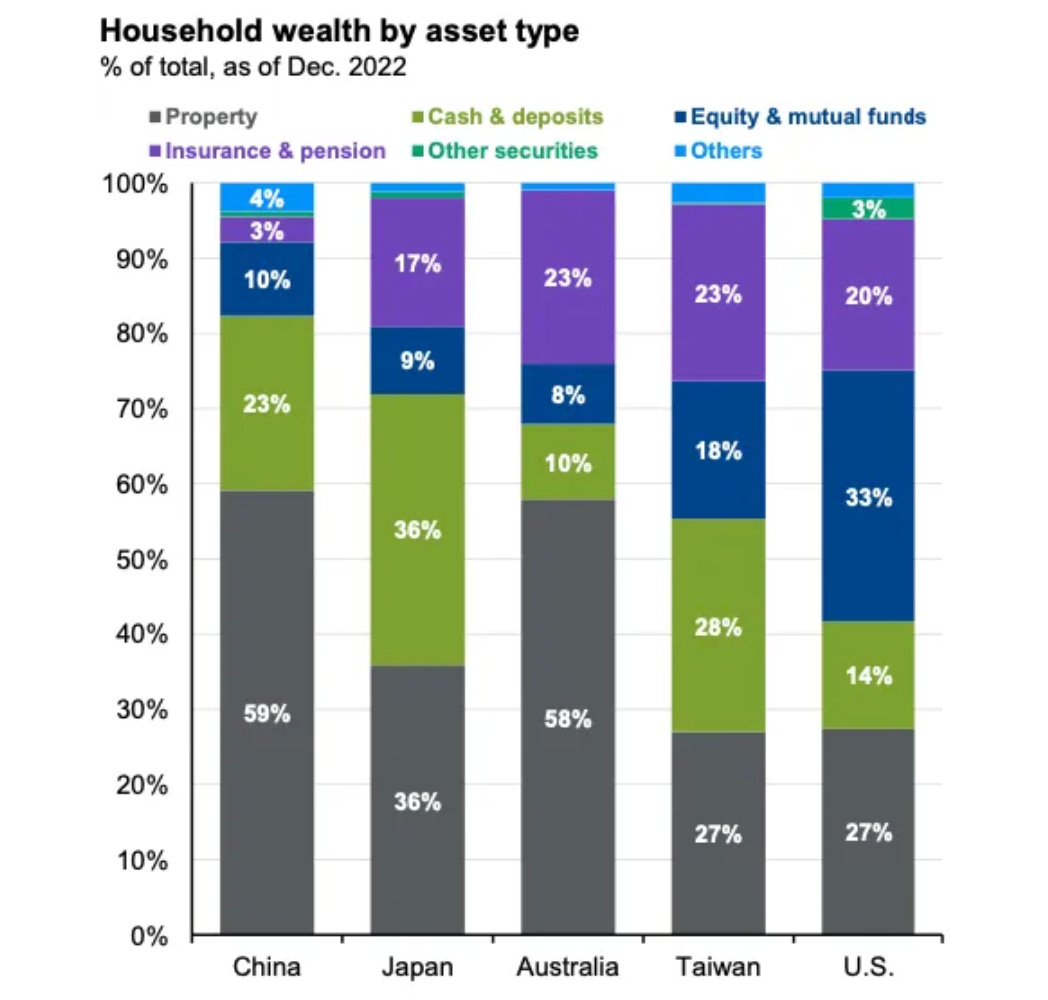

There's a stark difference in how household wealth is distributed between China and the USA. While Americans have over 50% of their wealth in stocks and pensions, Chinese families have just 13%. Instead, 59% of Chinese household wealth is tied up in real estate.

Picture a hardworking Shanghai family. You buy your first apartment with a loan. After ten years of diligent work, you've paid off half the mortgage and feel confident enough to take out a second mortgage for an investment property. Life seems secure as your property values rise while your mortgage balance shrinks.

Then Covid hits, revealing limitations on personal freedom you hadn't expected. Property developers begin declaring bankruptcy, and housing prices plummet—possibly below what you paid for your second property. As interest rates climb, you watch a significant portion of your wealth vanish overnight, leaving you feeling vulnerable and trapped.

The broader economy slows, too. Your only child graduates college but faces a brutal job market, struggling to find work matching their education level. You wonder if they'll ever achieve the quality of life you've known.

Adding to your worries, your company's performance suffers, and management cancels this year's bonus.

Your confidence as a consumer has hit rock bottom.

So, what do you do in this situation?

The answer is simple—when in doubt, save for a rainy day.

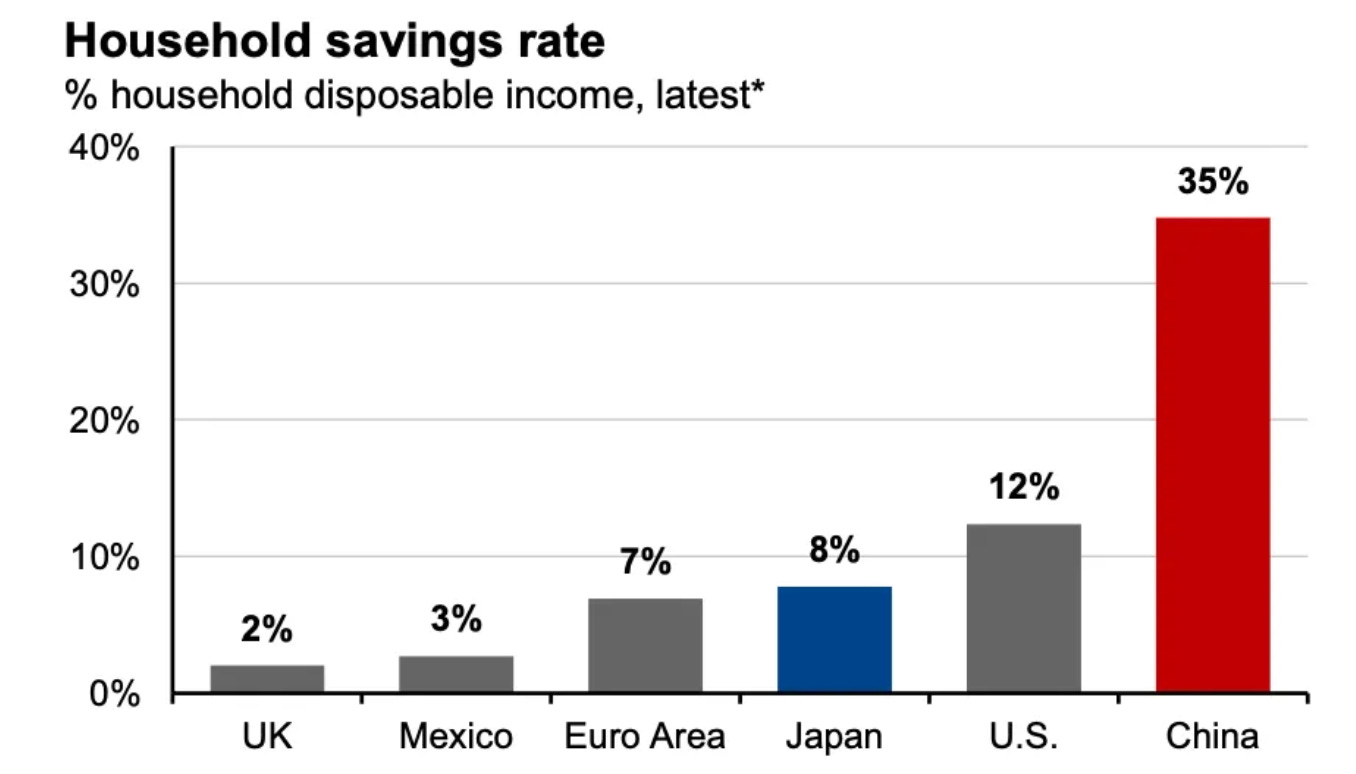

The Chinese are champion savers.

Even in regular times, their household savings rate is more than double that of the US and four times that of the EU.

And these are not regular times.

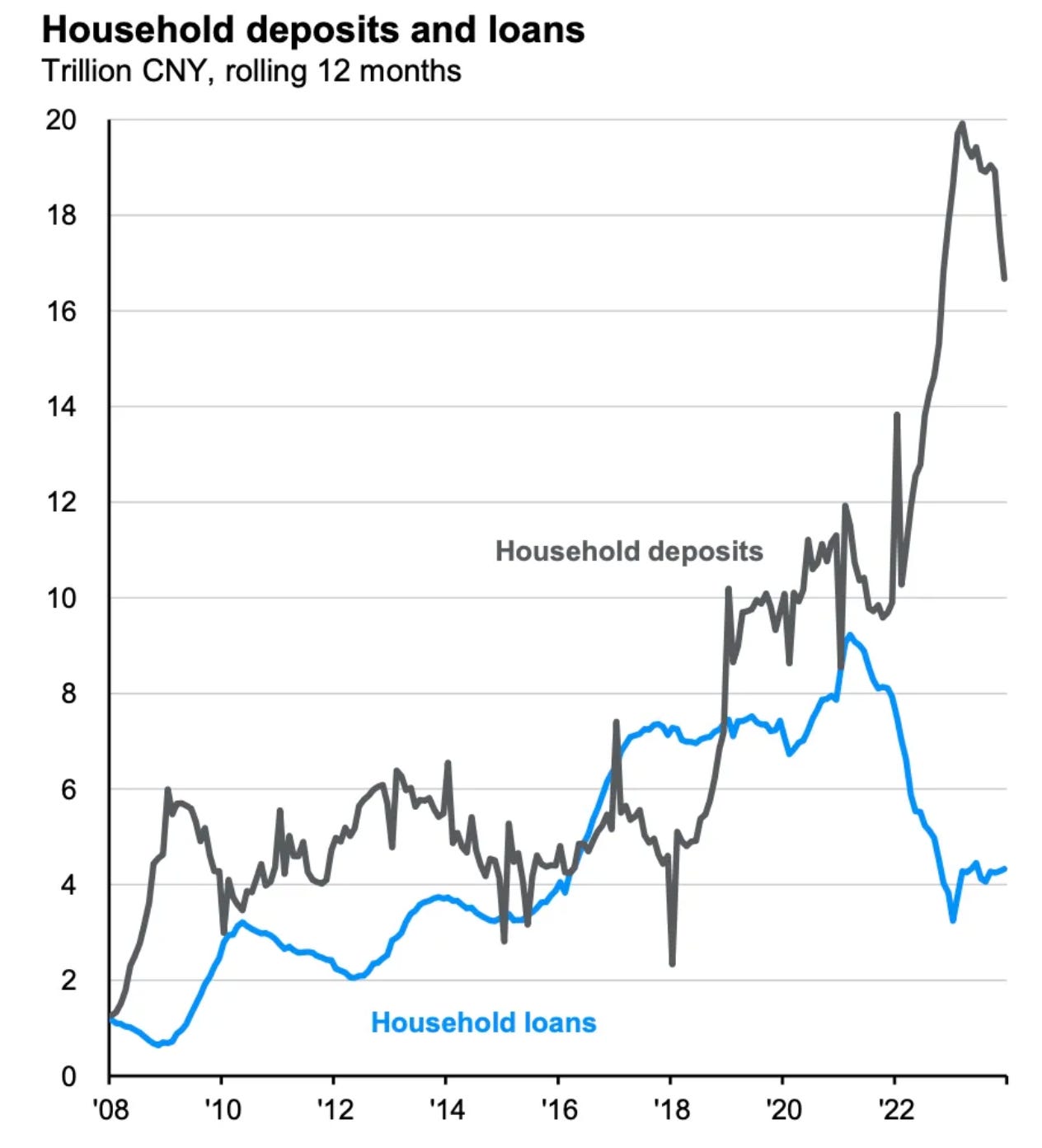

Given these challenges, you tighten your spending, pay off expensive loans, and save money for emergencies. After all, uncertainty looms—your child's employment prospects are unclear, and your job security isn't guaranteed. You're also unsure when (or if) your property value will recover enough to restore your wealth, so you go into your saving shell, HODL (hold on for dear life) and wait.

This led to RMB 13 trillion ($1.8 trillion) flowing into Chinese consumer bank accounts instead of circulating in the economy.

The result was a widespread drop in demand that affected businesses across all sectors in China.

But this money hasn't vanished—it's simply sitting in Chinese consumers' wallets, ready to flow back into the economy once consumer confidence improves.

The drop in consumer demand significantly eroded business confidence. This situation worsened due to local governments' desperate attempts to balance their budgets. They took four main actions:

Required employees to accept pay cuts due to budget shortfalls

Aggressively increased fines and enforcement to generate revenue, with penalties reaching 30% of some provinces' total revenue. They even began "fishing in the neighbour's pond"—sending teams to raid businesses in other provinces for alleged violations and imposing hefty fines. This practice severely dampened business confidence, causing many companies to maintain a low profile.

Attempted to revive land sales

Sought financial assistance from the Central Government

Poor consumer and business confidence tanked the stock markets, compounding the misery further:

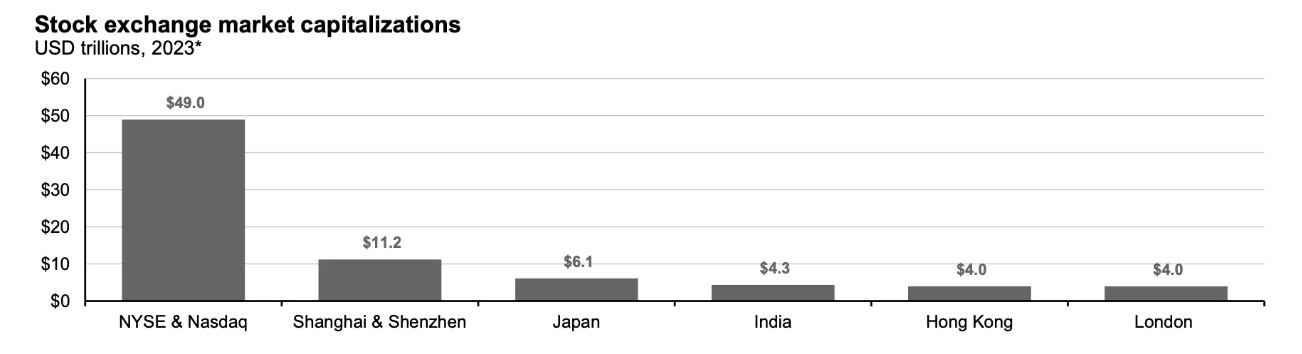

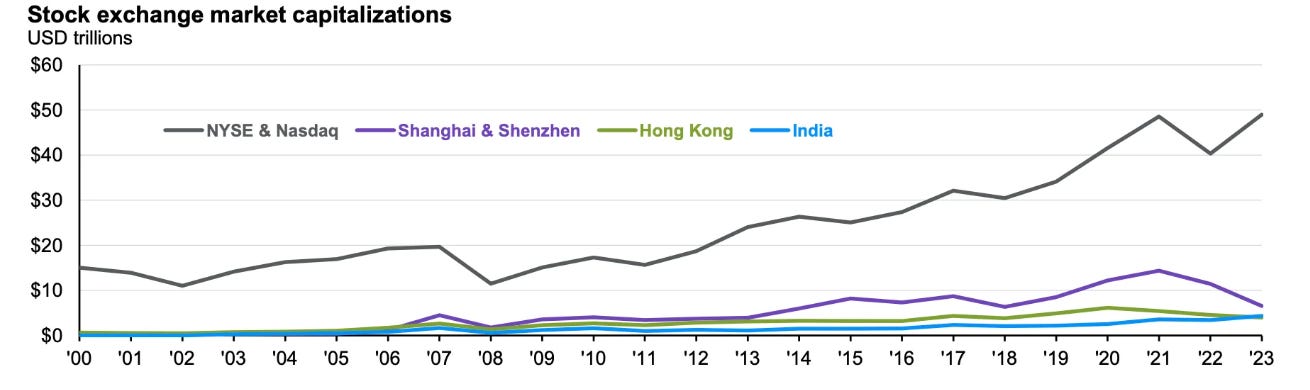

Given the relatively small proportion of GDP in stocks and relatively immature markets, the Chinese indices have a market capitalisation of about $15 Trillion, and the US markets at nearly $50 Trillion.

This lack of confidence resulted in markets moving in the opposite direction from the USA, further compounding the problem.

A combination of the loss in consumer and business confidence in China and the loss of international confidence resulted in local funds sitting in banks and international investments exiting the markets. This also tanked the stock markets, and now everyone was feeling poor and miserable.

The Government failed to grasp the severity of these converging issues early enough. When it finally acted, its response was insufficient and lacked the decisiveness needed to address the crisis.

The way forward: Rebuilding internal confidence in China

To rebuild confidence, the Chinese government must play a key role.

The first step is to address the internal lack of confidence:

The Chinese leadership now recognizes the key issues causing internal loss of confidence and has begun signalling solutions.

If property prices rise and the industrial and job outlook improves, consumer confidence could recover. This might encourage consumers to spend their hoarded $1.8 trillion, putting China back in business.

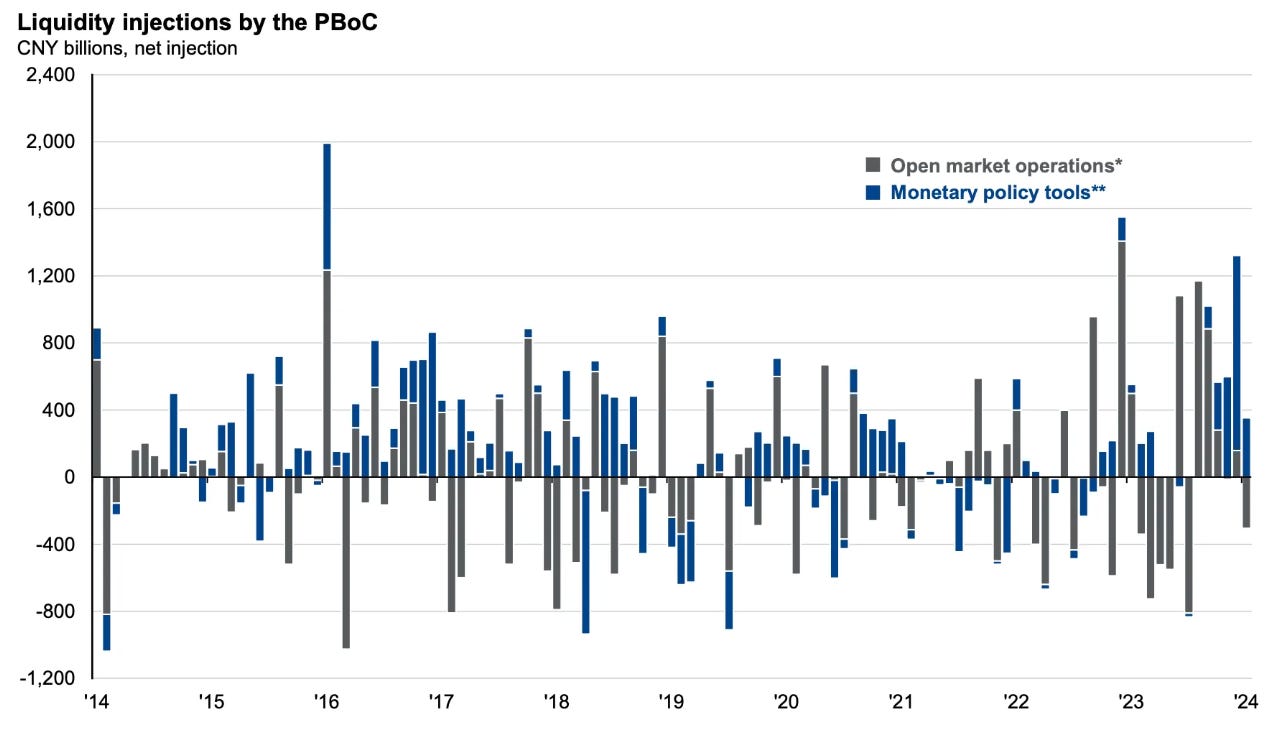

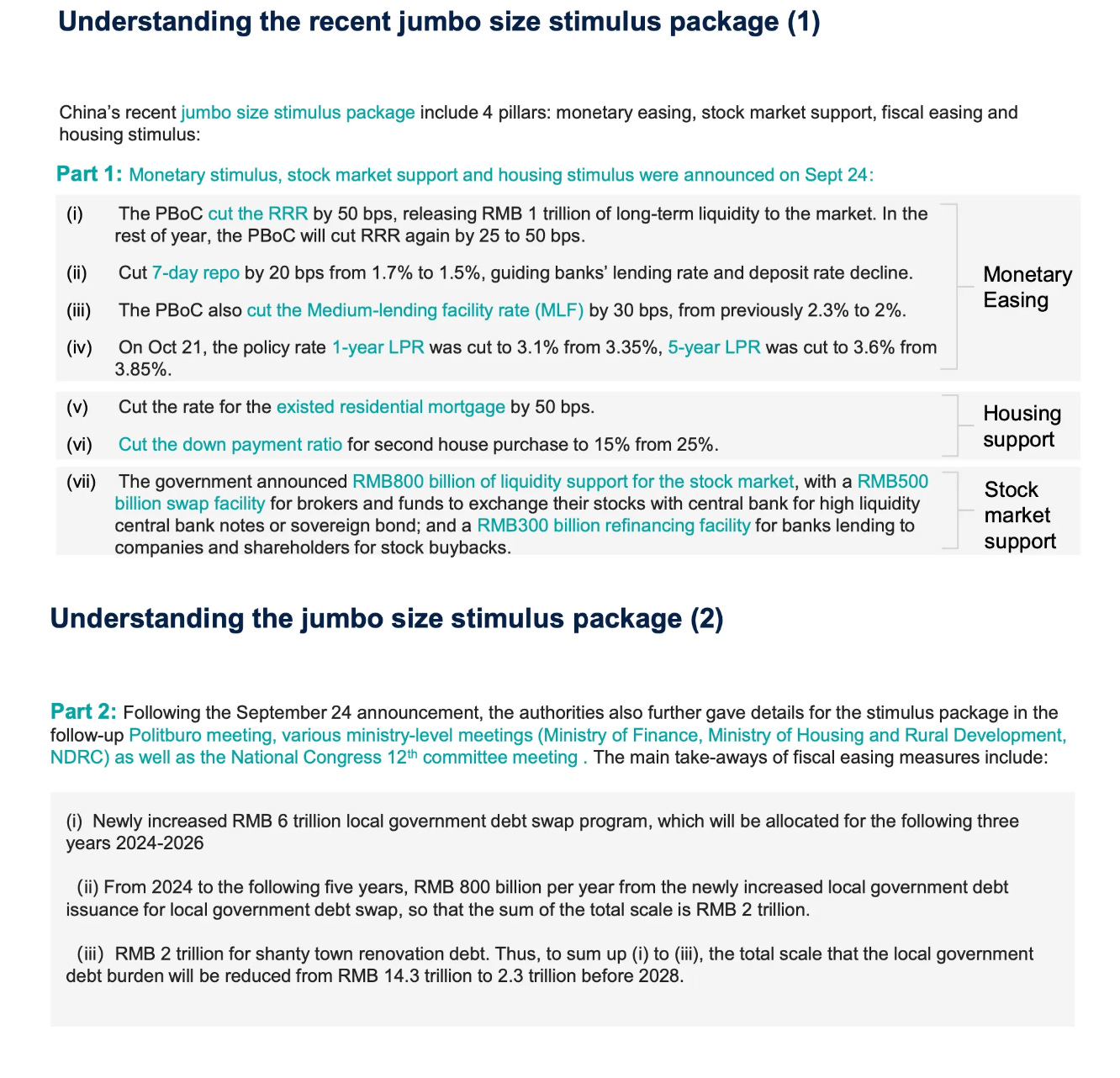

China has been leveraging available tools to boost liquidity in the economy. The central bank has initiated a series of liquidity injections to achieve this.

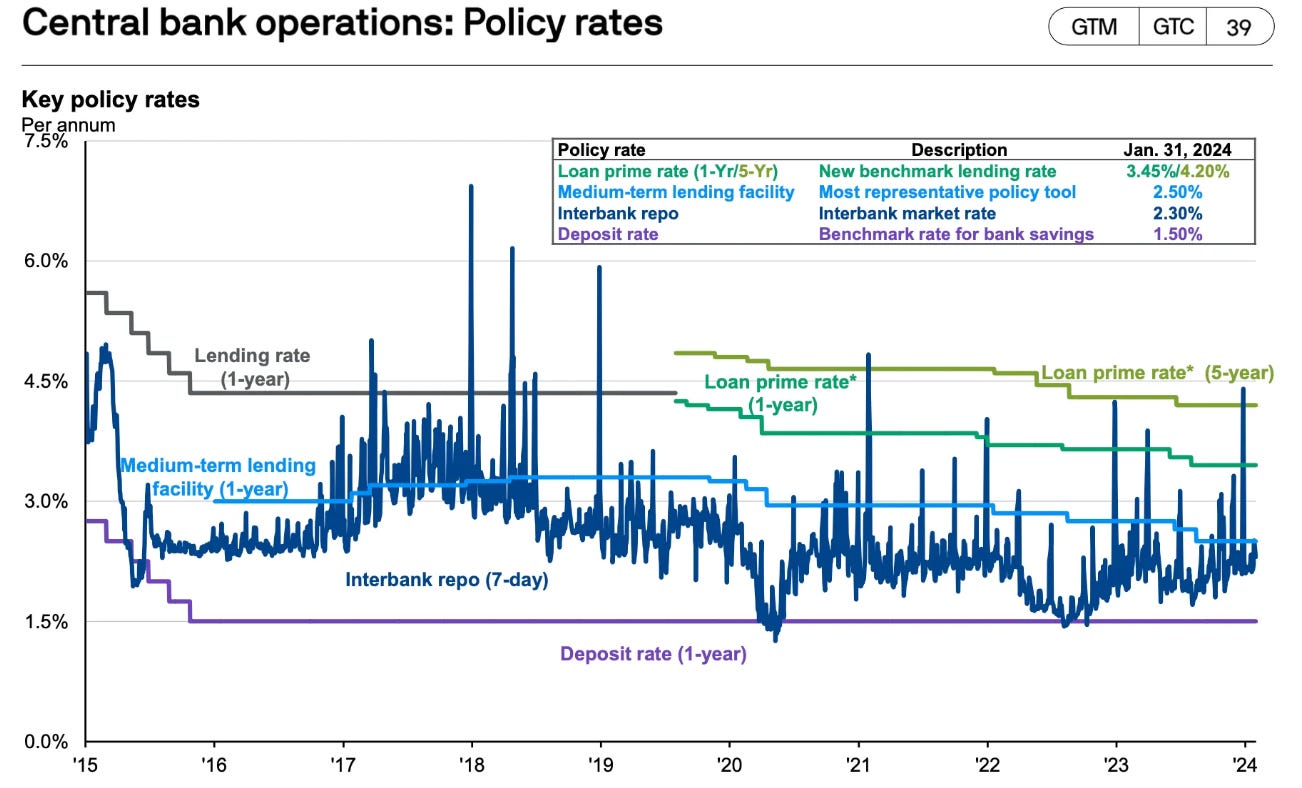

While interest rates worldwide have been rising, China has maintained steady or declining rates.

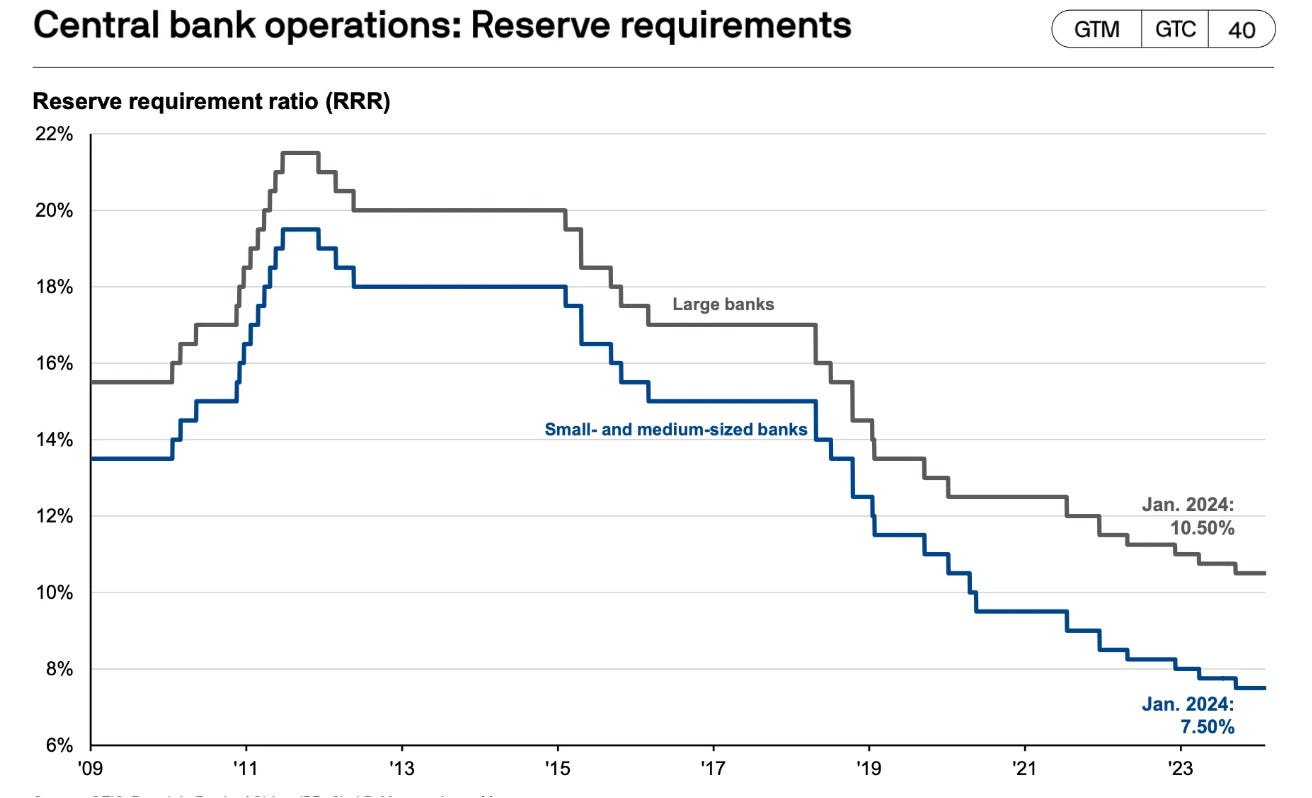

Additionally, it has increased market liquidity by reducing the reserve ratio requirement for banks by nearly half between 2018 and 2023

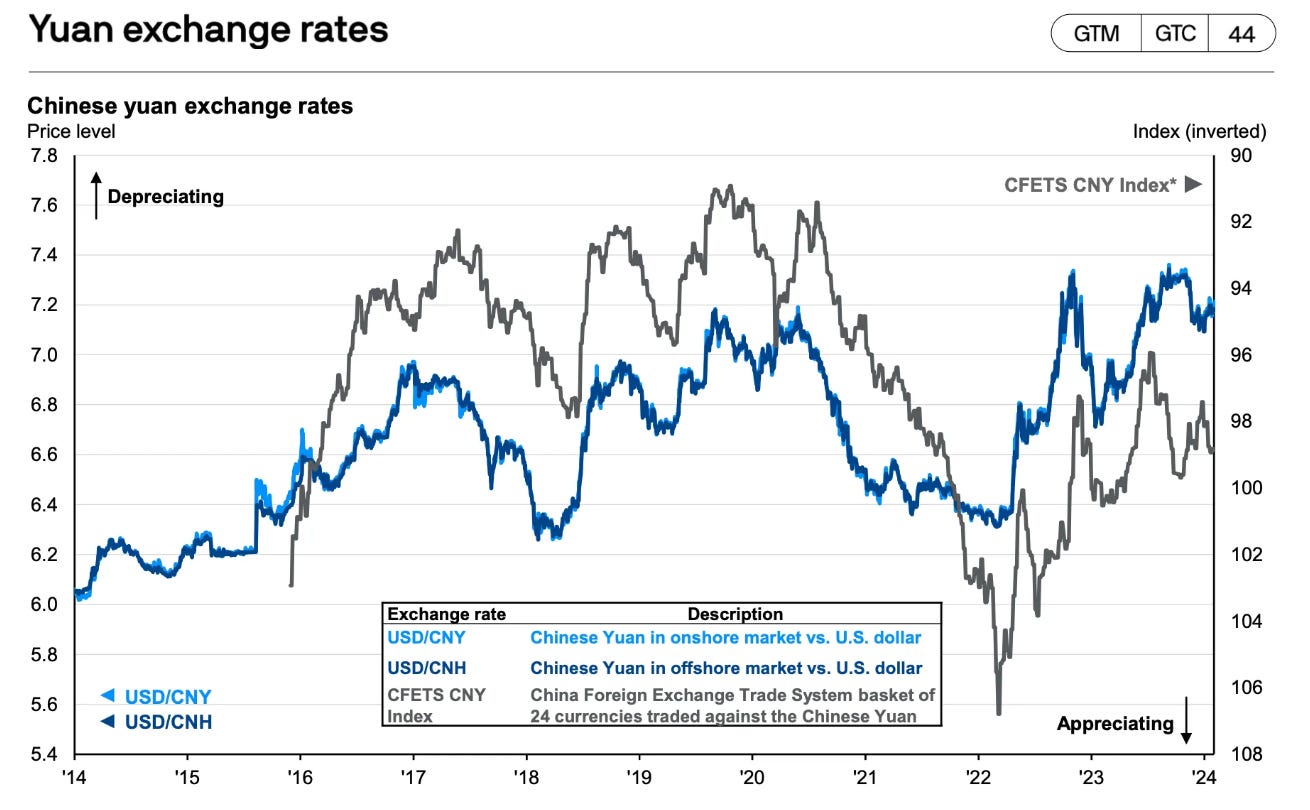

Over the past year, the RMB has fallen 8% against the dollar, enhancing China's competitive position.

Several significant developments were announced in November 2024:

The Central Government has committed to addressing local government debt

A new plan will convert excess housing inventory into state housing by purchasing units from developers

Local governments have received strict orders to stop undermining business confidence through excessive fines

To support these initiatives, the government announced a massive stimulus package of 10 trillion RMB ($1.4 trillion) to boost the housing market, stock market, local governments, and consumer confidence.

While this is a massive stimulus package, questions remain about whether it will need to be increased—given it represents 6% of GDP, with some commentators suggesting it should be closer to 10%. For reference, here are previous stimulus levels in China and the USA:

China's 2024 stimulus - $1.4 trillion; 6% of GDP

USA 2020 stimulus (Cares ACT) - $2.2 Trillion; 10% of GDP

USA 2008 stimulus: $700 Bn; 4.8% of GDP

China 2008: $596 Bn; 12.5% of GDP

The Chinese government will likely use every tool to boost consumer sentiment, aiming to unlock the accumulated savings and combine them with the stimulus to jumpstart China's economy.

China will need to organize its internal affairs before facing the next major challenge—the imminent arrival of President Trump, Part 2.

Managing competition with America and navigating external challenges

How will China navigate the impending Trump storm?

This question was at the top of my mind and dominated conversations during my two-week visit in November, especially since I was in China the day he won the presidency.

The issue breaks down into two key questions:

Tactical: How can China protect itself from Trump's potential tariffs?

Strategic: How can China position itself to progress further to achieve its dream of becoming the world's largest economy and technology leader?

I asked most people I met whether they thought a Trump or Biden presidency would be better for China.

The surprisingly consistent answer across my conversations was that China preferred Trump to Biden. Here's their reasoning:

Both Democrats and Republicans are anti-China, so there's little difference. They argued that Biden has been even more challenging on China than Trump—maintaining the tariffs and making semiconductor restrictions more severe.

Trump, being a businessperson, might be more open to making deals.

Business leaders with significant Chinese interests—like Elon Musk (whose company Tesla derives about 40% of revenue from China), Peter Thiel, Tim Cook of Apple, and Jensen Huang of NVIDIA—might influence Trump's decisions, as they have much to lose if relations deteriorate.

Even regarding Trump's proposed 60% tariff, my contacts were relaxed, noting they had already derisked their businesses.

Derisking China vs Trump Tariffs

Chinese businesses anticipated these challenges back in 2020. They've spent the past four years reducing their risks, putting them in a position where tariffs pose less of a threat:

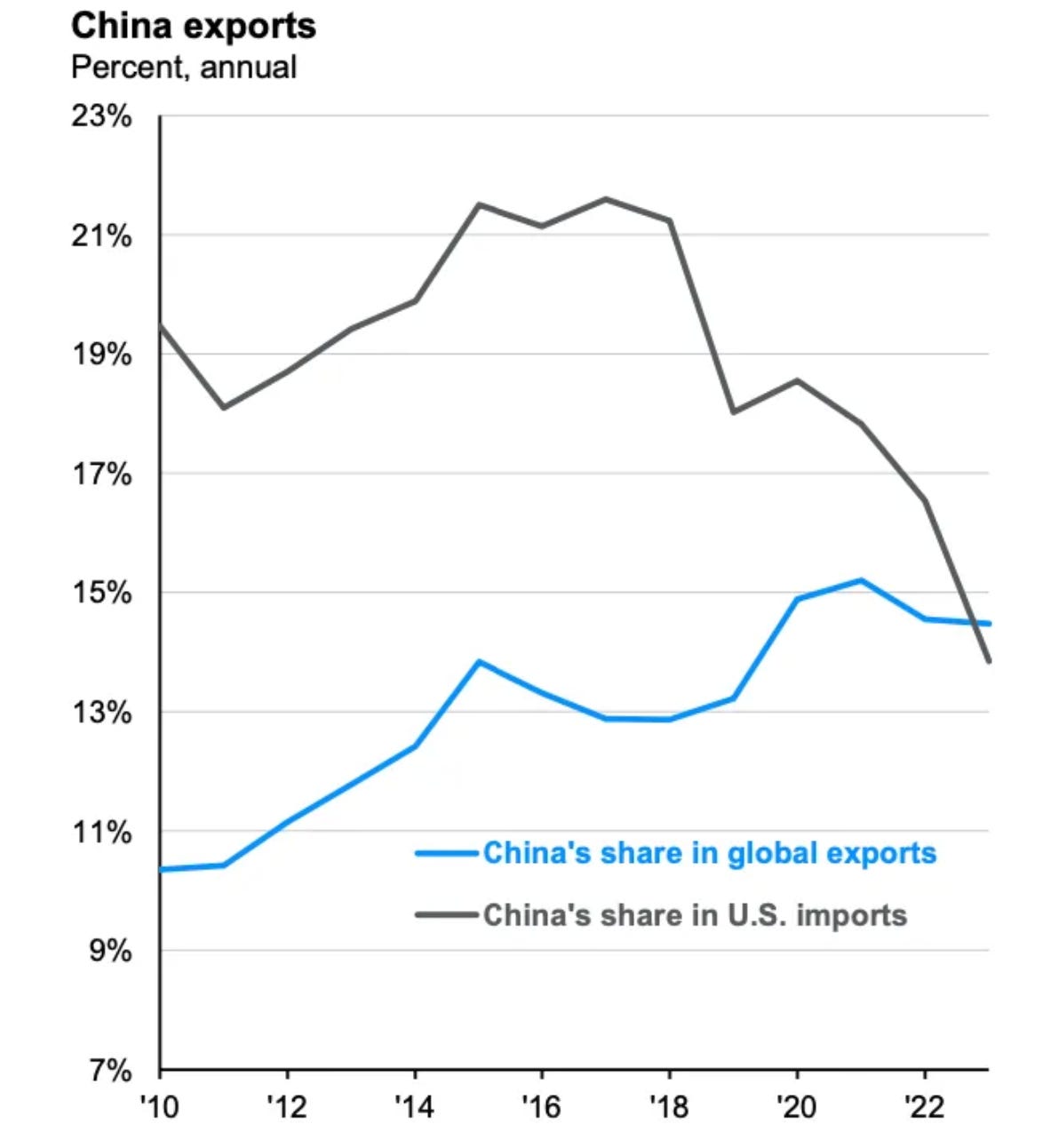

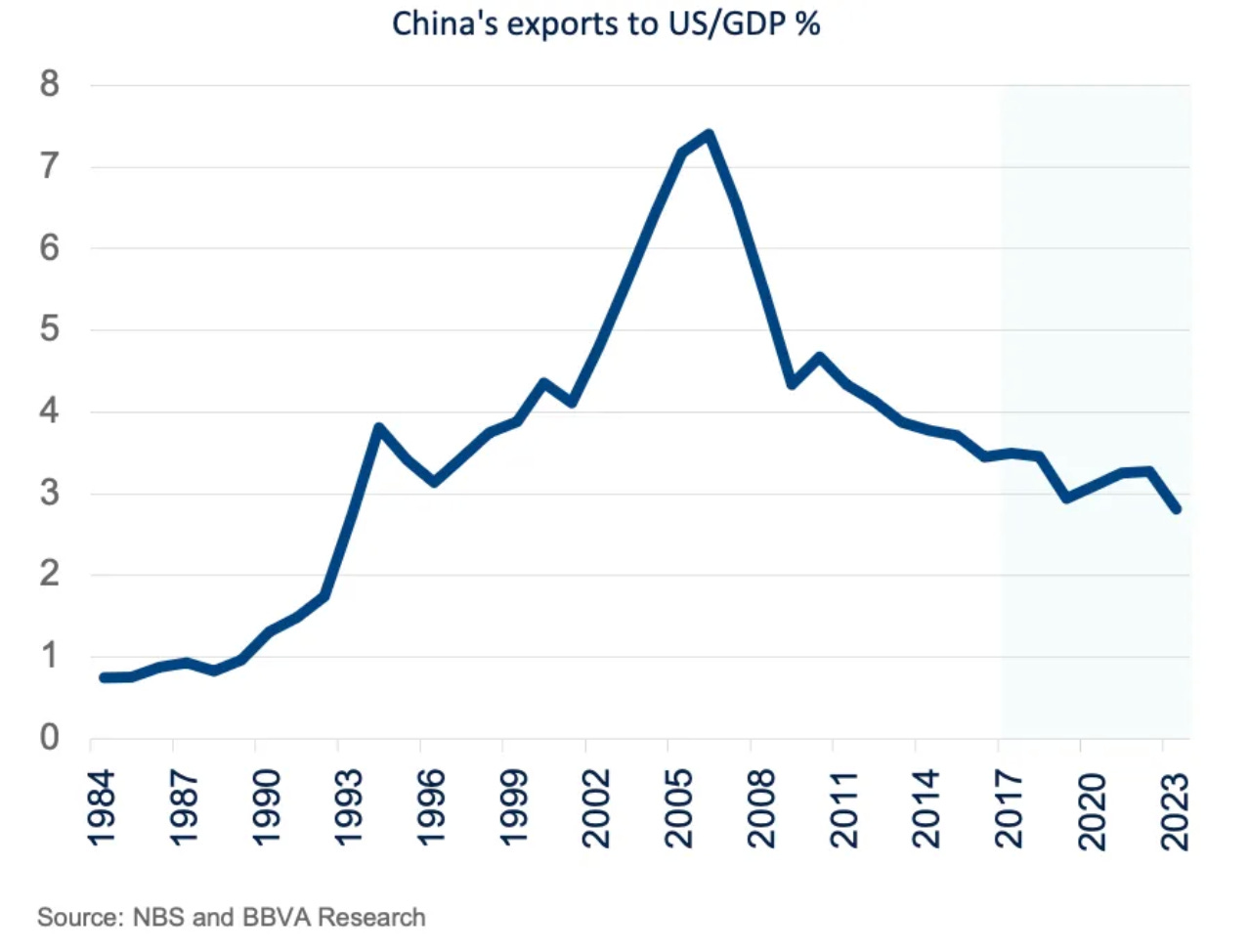

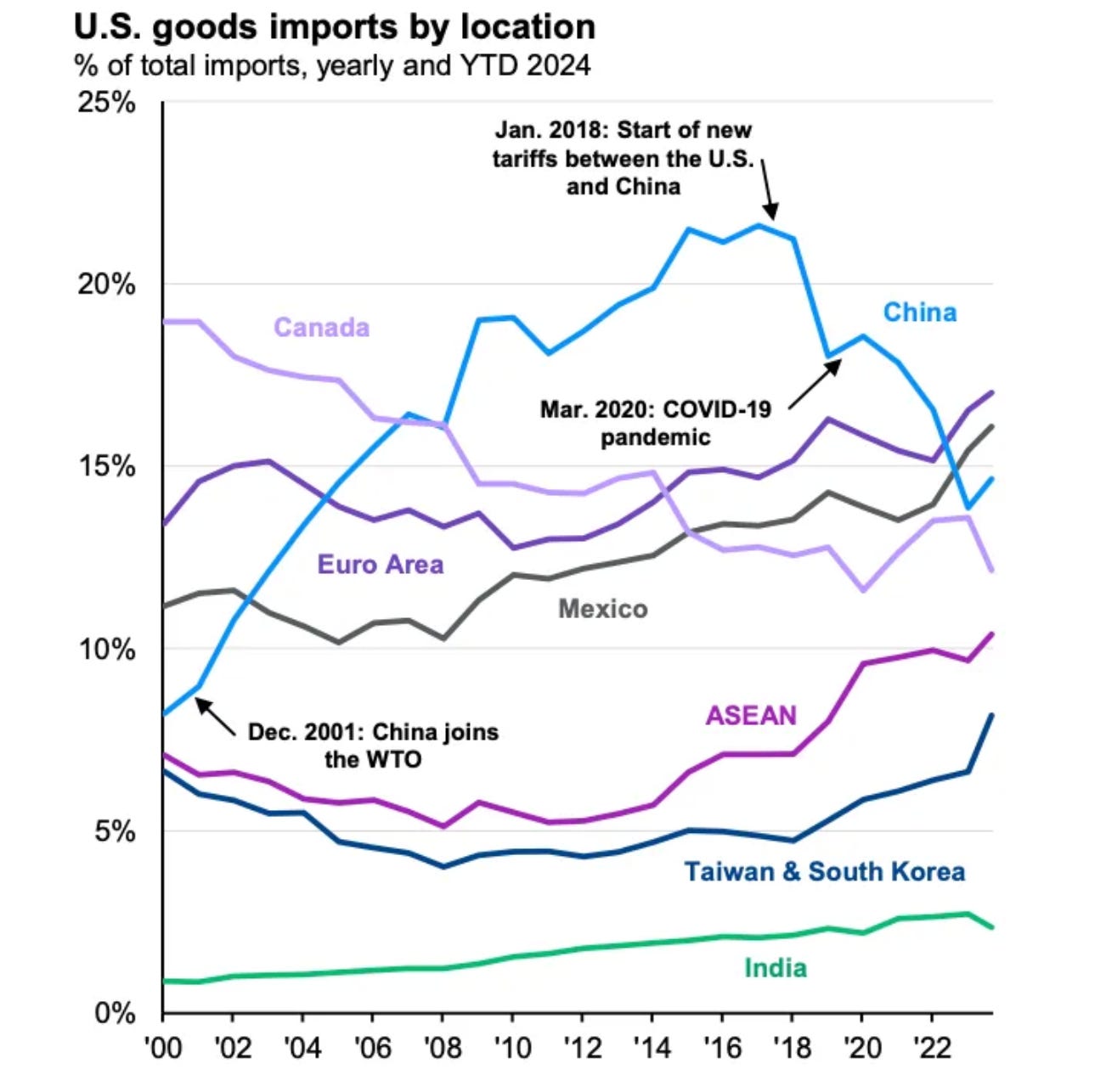

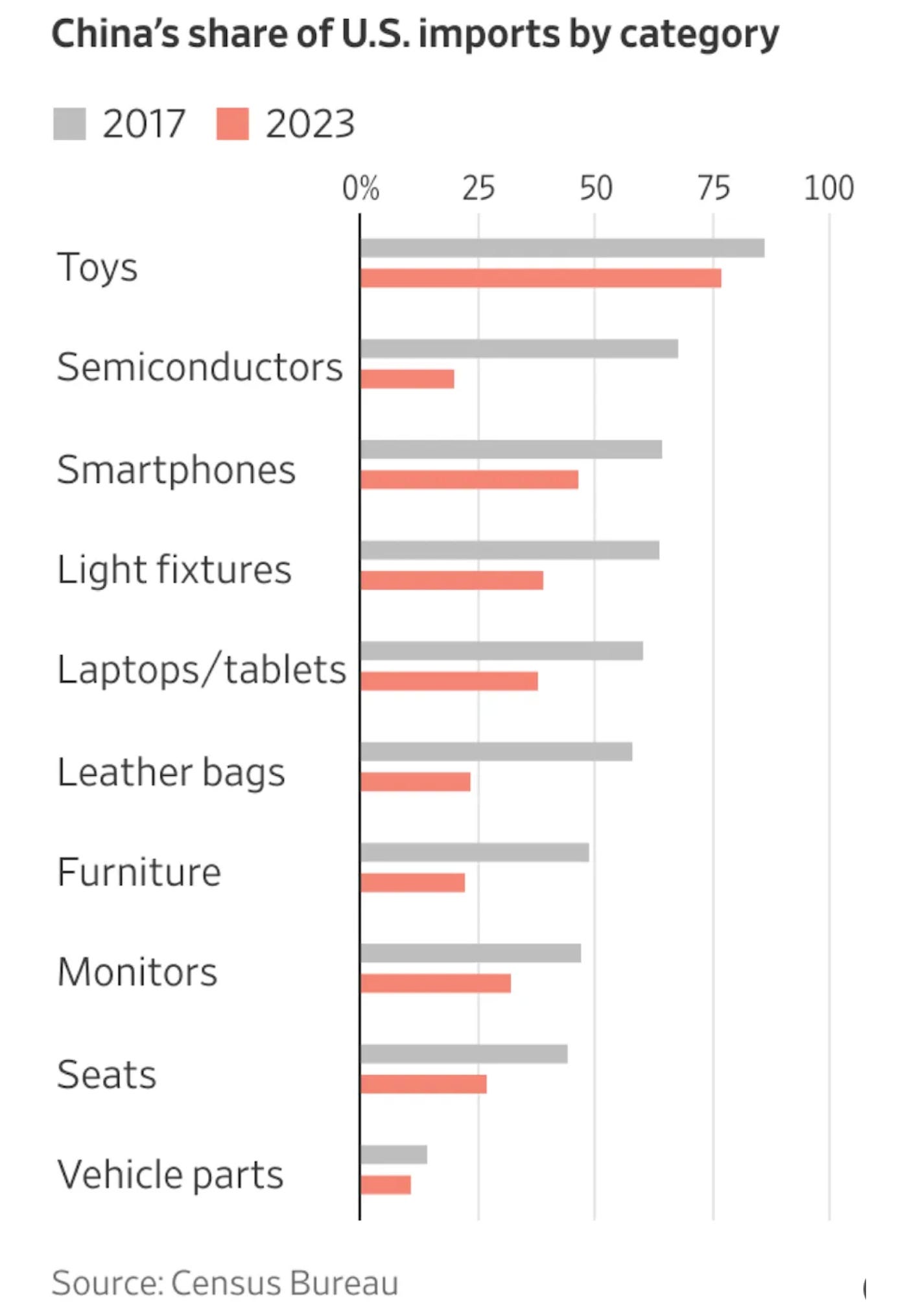

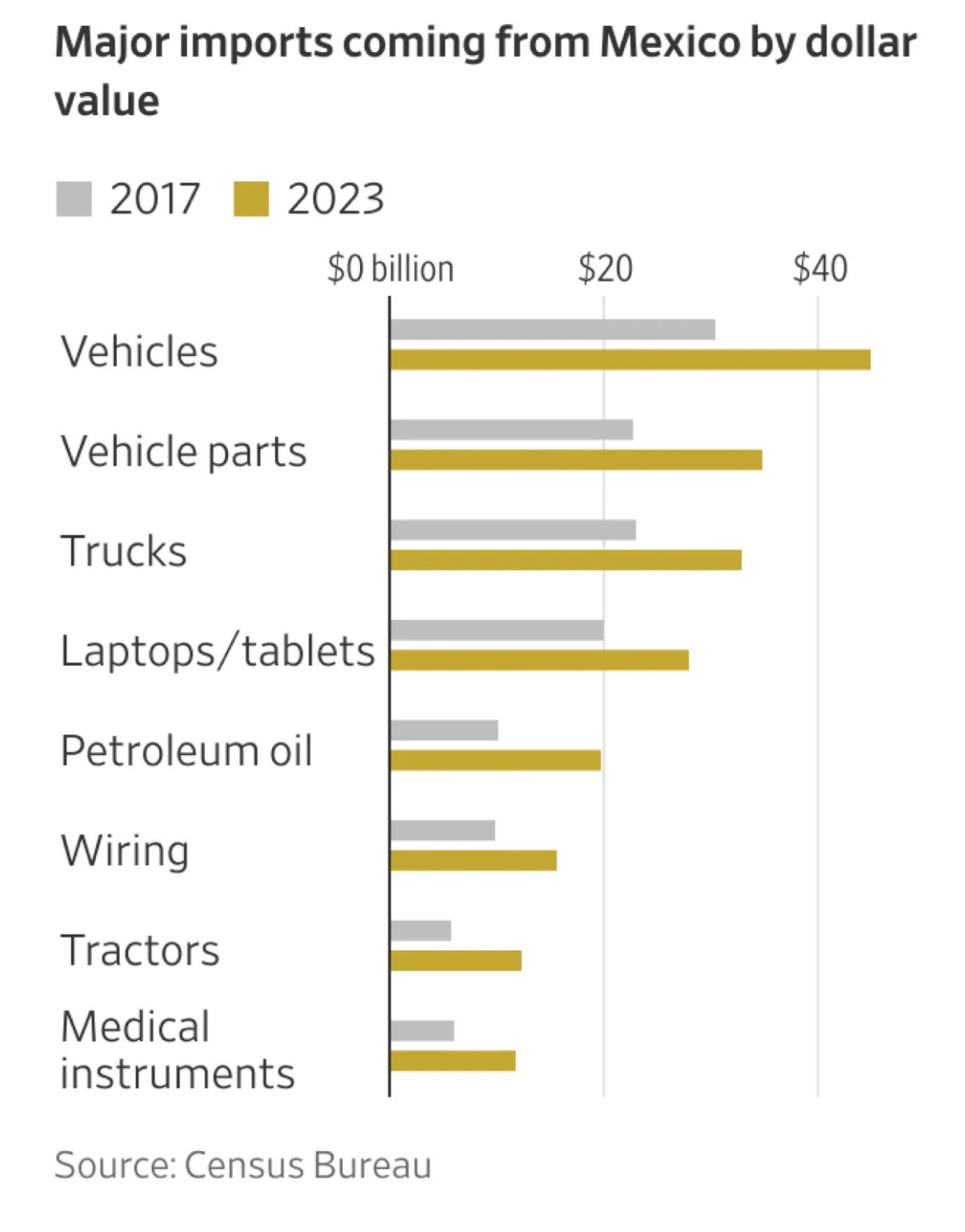

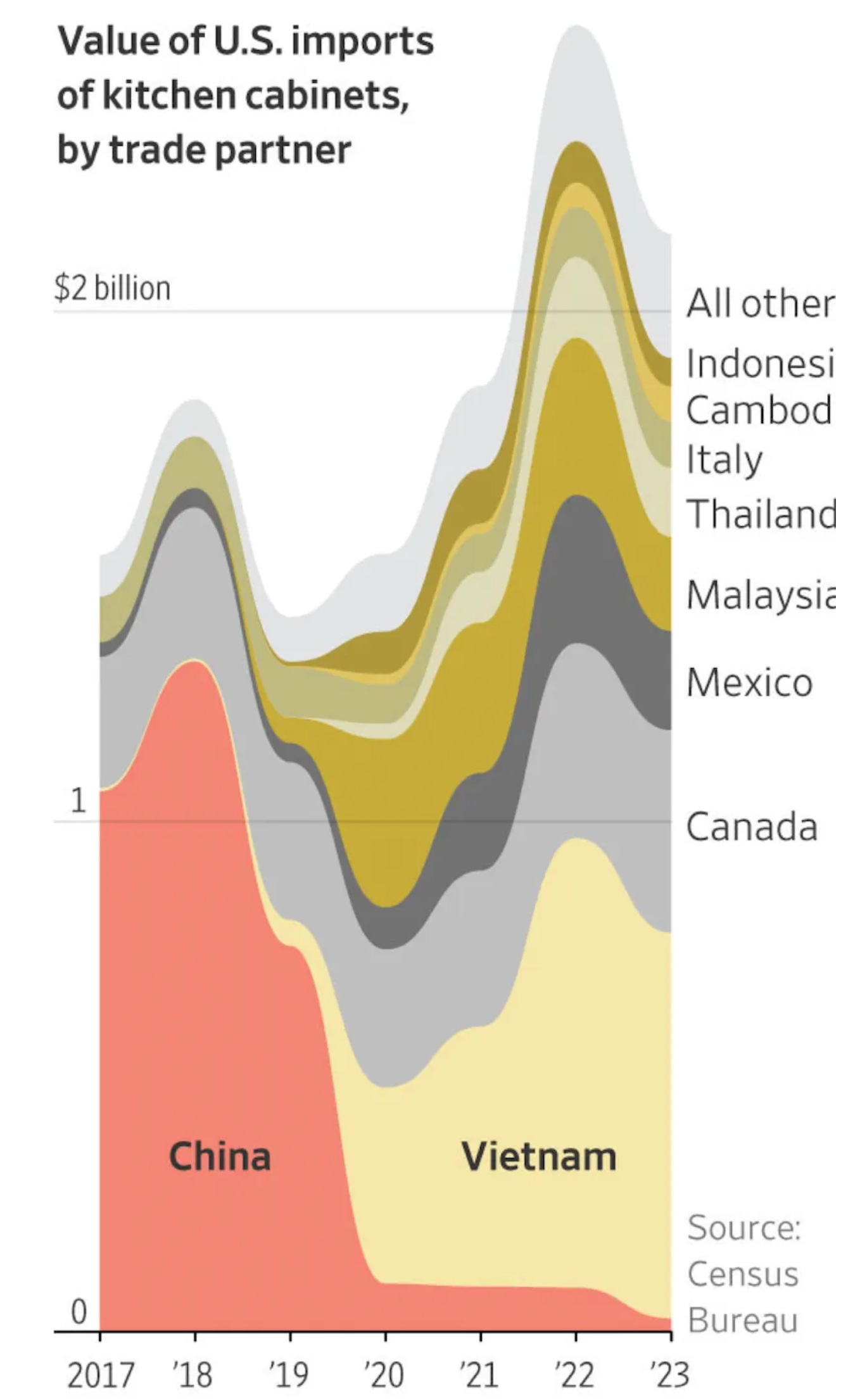

Most businesses have diversified globally, and the USA is no longer their only primary market. While China's share in global exports continues to grow, its share of US imports has declined.

Businesses that can't move their U.S.-bound operations entirely have shifted large parts of their supply chain to Vietnam, Mexico, Indonesia, or Malaysia. These markets would be more vulnerable to a 10% tariff! The charts show how the decline in China's exports to the USA has been offset by increases in ASEAN (particularly Vietnam) and Mexico. In most cases, it's the same Chinese companies or their partners handling manufacturing and assembly in these locations.

For companies like Apple that cannot quickly move manufacturing out of China (Apple will only have 10-15% of production outside China next year, given the difficulty of matching Chinese expertise, capability, scale, and cost), this becomes an American problem. Chinese manufacturers will pass the tariffs on to American consumers, who will pay more for iPhones. However, these companies likely expect to receive tariff exemptions from Trump, as they did previously, since raising prices on popular products like the iPhone would be politically tricky.

Additionally, the weaker RMB against the USD would offset any remaining tariff impact.

China’s strategy may make Trump happy—he gets the bragging rights for being tough on China without hurting American consumers’ pockets.

China appears to have developed an effective strategy to protect itself from Trump's policies and holds several strong negotiating positions:

Building positions that will help in negotiations with America

One key area where China has reduced its vulnerability is its agricultural supply chain dependence on the U.S., particularly for soybeans and grain:

Decreased U.S. Soybean Imports: China has significantly reduced its U.S. soybean imports from 40% of total imports in 2016 to 18% in 2024. Meanwhile, Brazil's share has grown from 46% to 76%.

Diversification of Grain Sources: Beyond soybeans, China has expanded its grain imports to include Argentina, Ukraine, and Australia, reducing U.S. dependence.

Policy Measures to Boost Trade: Anticipating potential U.S. tariffs, China has implemented policies to strengthen foreign trade by enhancing financing support for Chinese firms and expanding agricultural exports.

Strengthened Ties with Brazil: China has deepened its economic relationship with Brazil, which became its largest agricultural supplier in 2023, providing about 25% of China's agricultural imports.

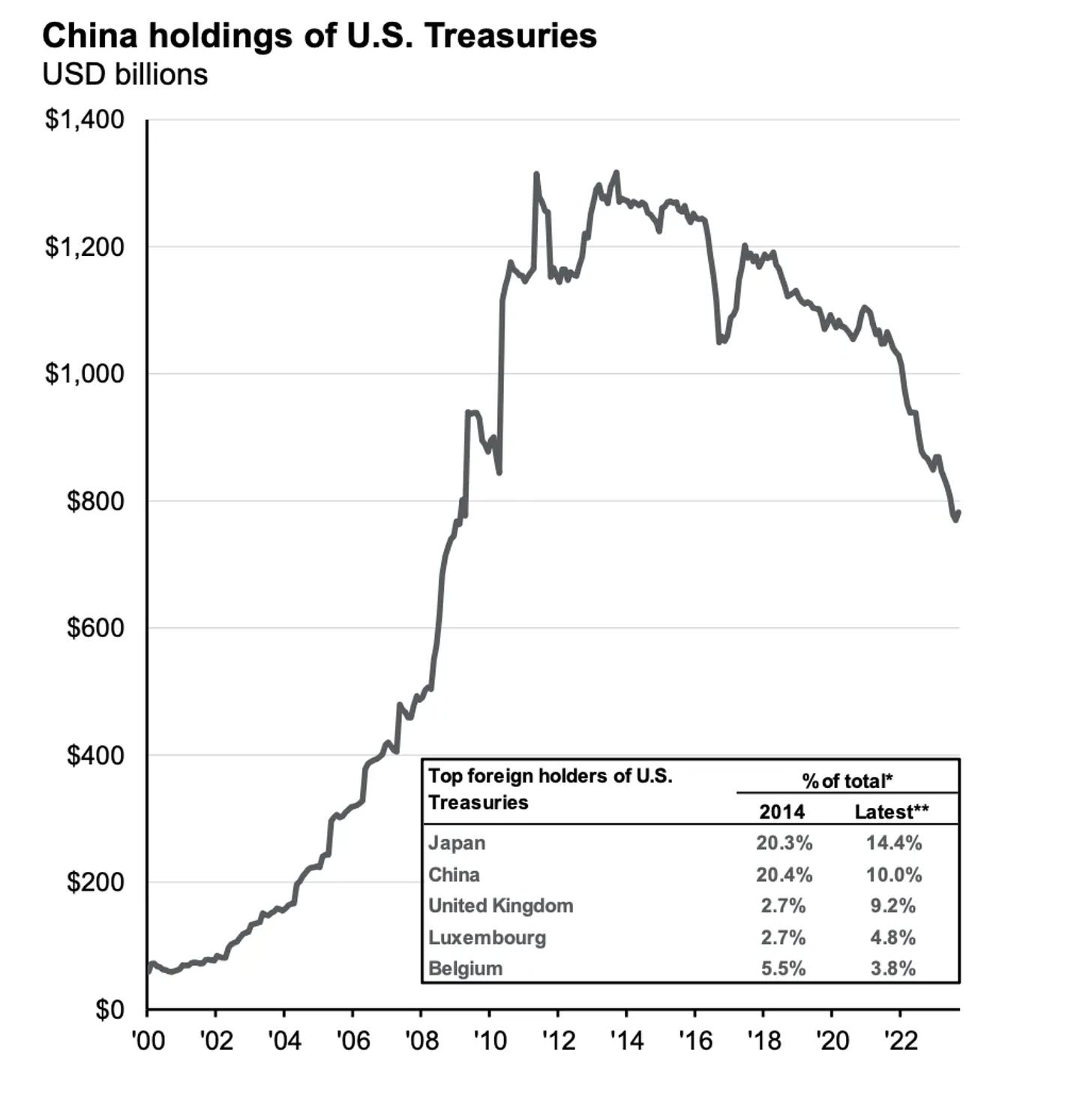

China remains a key holder of long-term U.S. debt, though it has cut its exposure by 50% since 2018. This maintains a credible threat—China could create market instability by selling U.S. Treasury bills in the event of a financial conflict, but it has de-risked itself by 50%.

China has prepared a detailed plan for reciprocal tariffs should Trump implement his proposed measures.

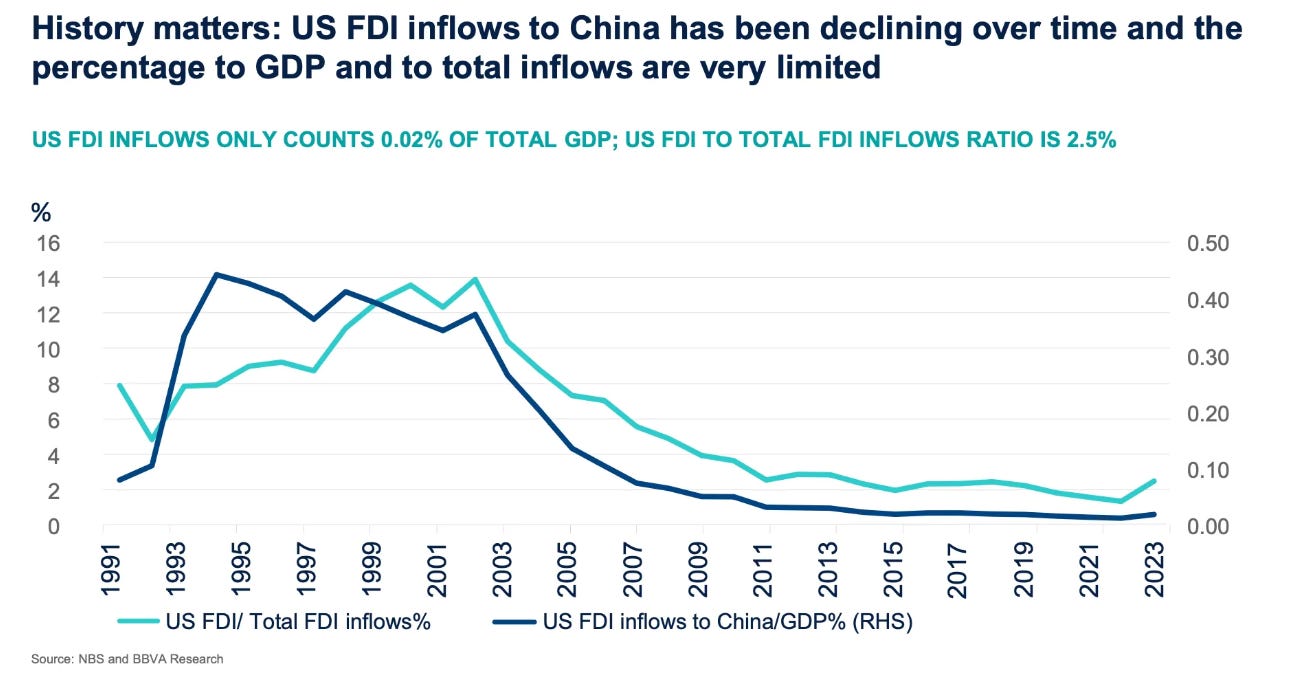

U.S. foreign direct investment in China has become minimal as China has reduced its dependence on American capital.

While the outcome of this tactical manoeuvring remains uncertain, China has significantly strengthened its position for any potential tariff dispute with the United States.

The more interesting question is the strategic question:

How can China position itself to achieve the Chinese dream of becoming the No. 1 economy in the world, along with being the technology leader?

To prepare for this battle, China has been working in five areas:

1. Increasing its global influence:

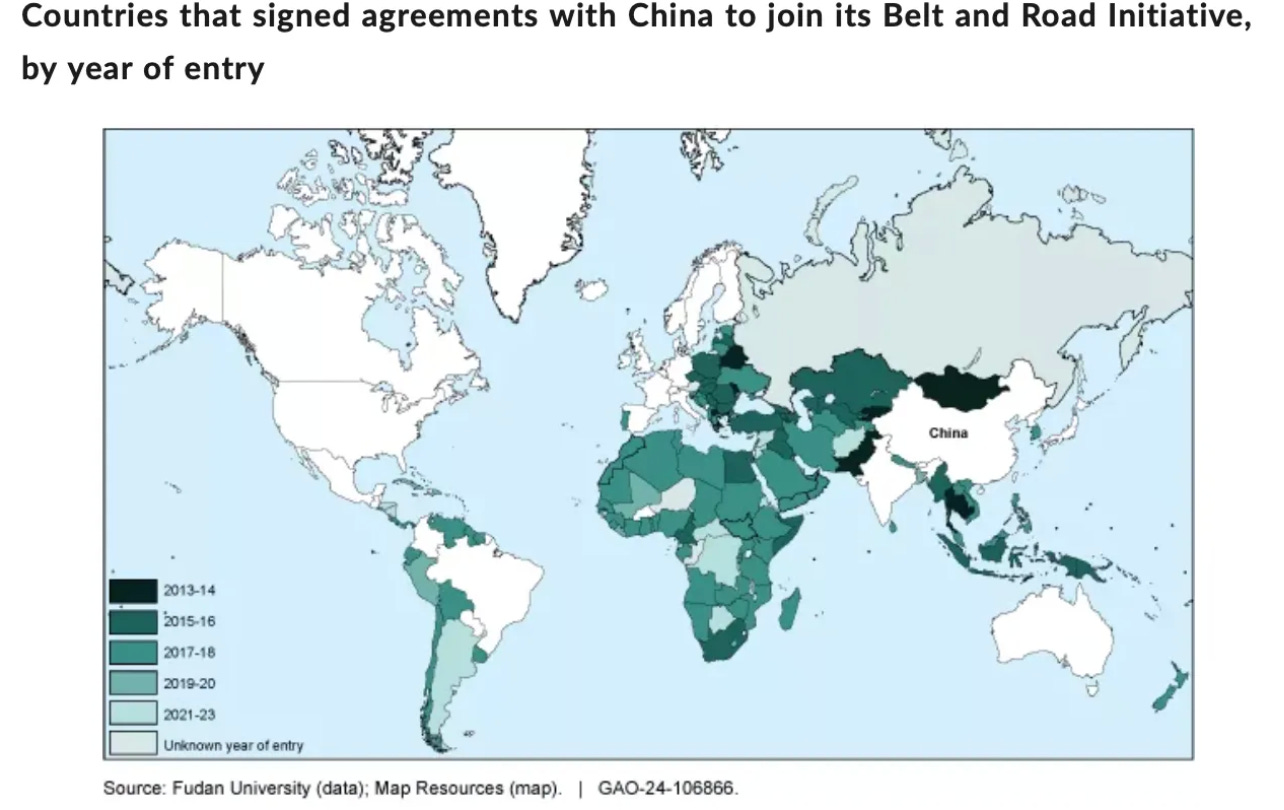

China has built strong strategic relationships with countries worldwide through the Belt and Road Initiative. As Western nations have turned inward and redirected resources to domestic issues, China has quietly filled this power vacuum.

China invested $679 billion in infrastructure projects across nearly 150 countries through its Belt and Road Initiative between 2013 and 2022. These investments have delivered meaningful economic impact while addressing critical infrastructure needs in developing countries. For comparison, the USA spent just $76 billion during this period.

This infrastructure investment complements China's broader trade relationships, as it has become the world's dominant trading partner.

China now conducts more trade with the EU, ASEAN, and other global partners than with the USA. Even if US trade stagnates or declines, China's economy can persist, mainly since it has established multiple third-country routes for its products to enter the American market.

2. China's Manhattan Project: Breaking Free from America's Semiconductor Supply Chain

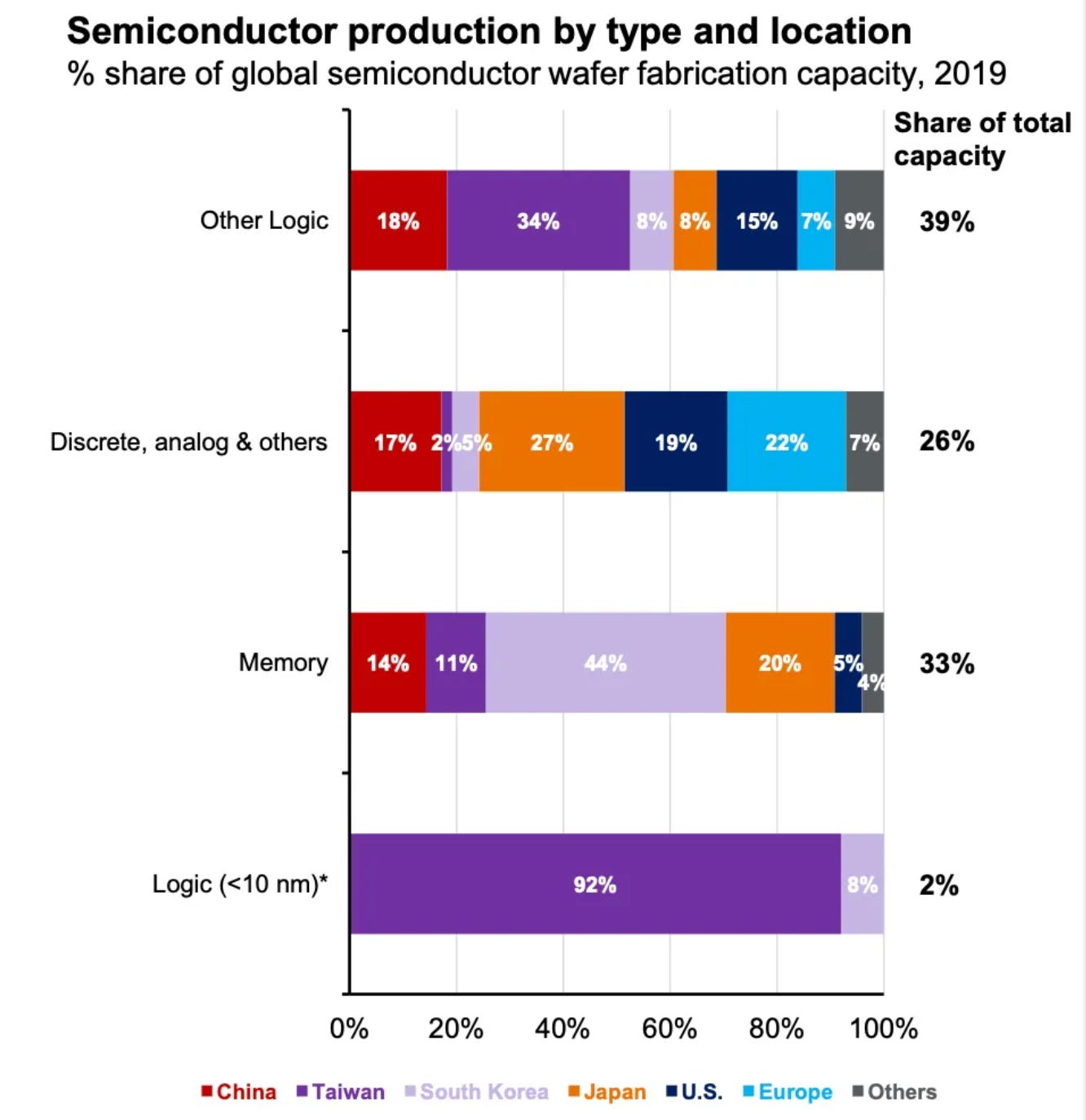

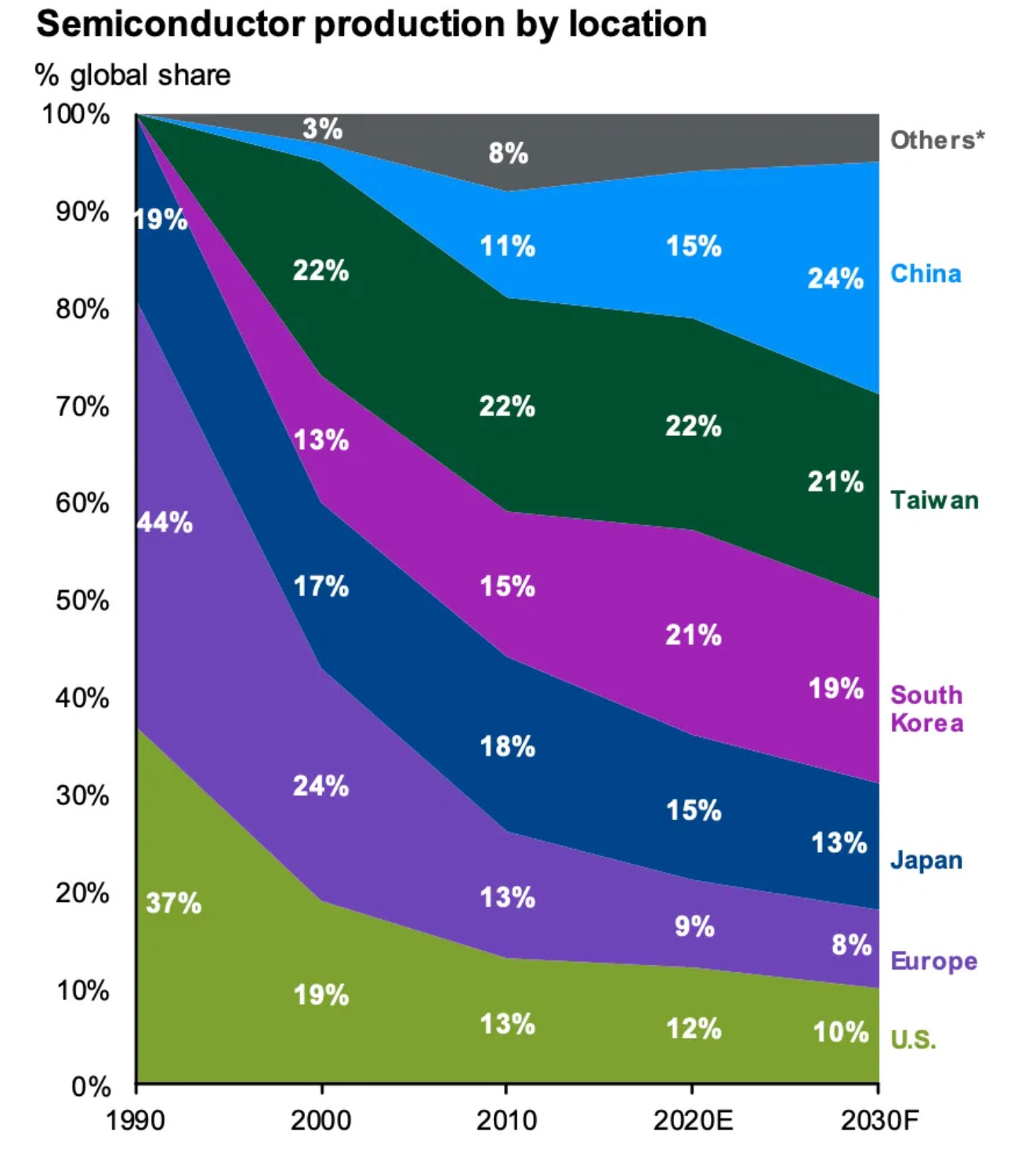

The USA recognizes semiconductors as its key leverage over Chinese growth and innovation. The semiconductor supply chain is highly concentrated, relying on technology originating in the USA. The leading players are foundries in Taiwan (TSMC) and Korea (Samsung), along with ASML (Netherlands) for lithography machines and software providers (primarily US and UK). Under this business model, companies design and manufacture their chips in Asian foundries. All cutting-edge logic chips smaller than 10 nm must go through this route. Despite massive investments, countries like China and Russia remain years behind, dependent on this supply chain for the advanced chips needed for AI and defence. This inability to produce cutting-edge chips poses a significant barrier to Chinese tech leadership.

In the short term, this is a significant problem for China.

However, staying true to its pattern of struggling over the years to overcome what it sees as ‘oppressive’ Western restrictions, China has developed a program showing early results.

EUV Lithography is the technology behind the most advanced chips, while DUV is its predecessor. Both are manufactured exclusively by ASML in the Netherlands—a Philips spin-off that relies on U.S. patents and the American company Cymer's light source technology. As the Netherlands is firmly aligned with Western allies, the U.S. successfully blocked ASML from supplying EUV machines to China in 2019. Despite this, China has used less advanced DUV machines to produce sophisticated AI chips through SMIC and Huawei, though with lower yields. In December 2024, the Biden administration extended the restrictions to include DUV machines.

With its vast resources, skilled workforce, and characteristic patience, China treats this challenge like its own Manhattan Project.

While China acknowledges its technological gap, catching up remains challenging as Western technology advances. China is exploring breakthrough technologies like nanolithography and electron beam lithography to address this.

The question isn't whether China will catch up but when—with estimates spanning from a few years to decades.

Once it does, China will have achieved what it sees as the "de-Americanization" of its chip supply chain.

In the long term, it could become a significant problem for America.

Meanwhile, true to form, China has now started to dominate the lower-end chip supply chain (logic chips >10 nm and memory chips) and is focused on moving up the value chain. Companies like SMIC and Huawei are emerging as the Chinese champions of the chipmaking world.

3. Starting to hit back

Since U.S. imports to China have declined, China has fewer options for counter-tariffs against the USA than in previous trade disputes. However, China's significant agricultural imports from America remain a powerful leverage point—any reduction could severely impact Trump's rural support base.

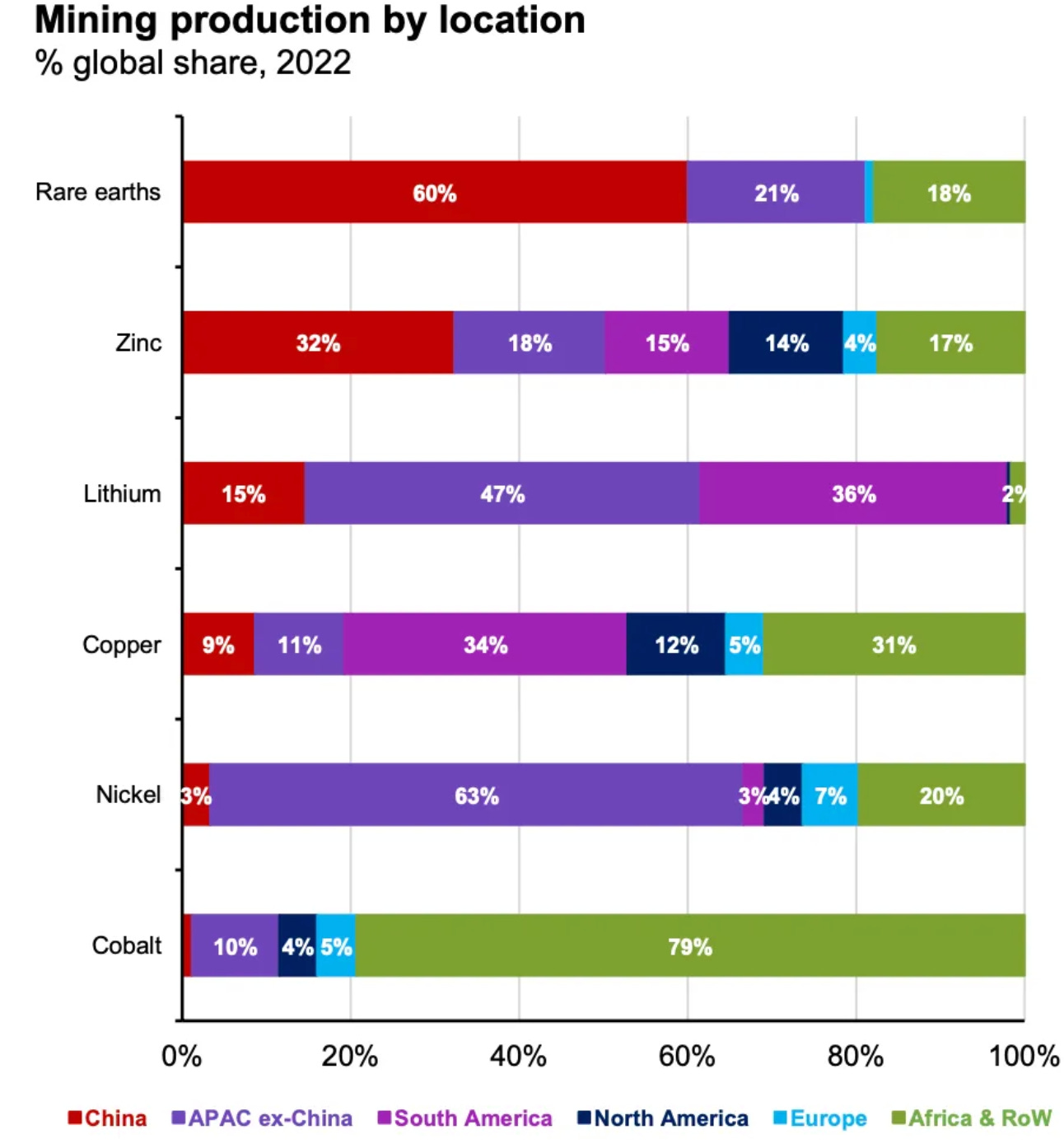

China also maintains strategic control over critical industrial materials. It dominates the global supply chain for rare earth elements and crucial metals, including nickel, cobalt, gallium, germanium, antimony, and superhard metals—all essential components in semiconductors, solar cells, fibre optics, ammunition, and weapons systems.

In December 2024, China enacted export restrictions on these materials to the USA and implemented stricter controls on graphite-related products, particularly affecting battery production. This move could significantly impact America's ability to replenish its military arsenal, which the Ukraine war has depleted. The USA faces a challenging supply chain disruption with no readily available alternative suppliers.

Notably, other major suppliers of lithium, cobalt, and similar materials are now more aligned with China's sphere of influence than America's. In a potential split, these countries may not necessarily side with America.

China holds significant leverage over major American corporations through their market dependency. Any disruption could impact their valuations and, by extension, the U.S. stock market. Key companies with substantial Chinese market exposure include Qualcomm (50%), Tesla (40%), Intel (27%), Apple (19%), GM (35%), Ford (15%), and various consumer companies ranging from 10-15%.

In 2023, China demonstrated its willingness to use this leverage by sanctioning Micron, a major U.S. microchip manufacturer, and barring its NAND chips from Chinese supply chains. Similar actions against other U.S. tech leaders like NVIDIA could prove highly disruptive, given that China represents about 40% of their sales.

China also maintains $700 billion in Treasury bills, which it could sell to destabilize the U.S. economy—though this nuclear option would be costly for China and likely reserved for extreme circumstances.

4. Winning the future battles that matter

While China lags in semiconductor technology, it leads in many other crucial global technologies. It plans to leverage these advantages aggressively.

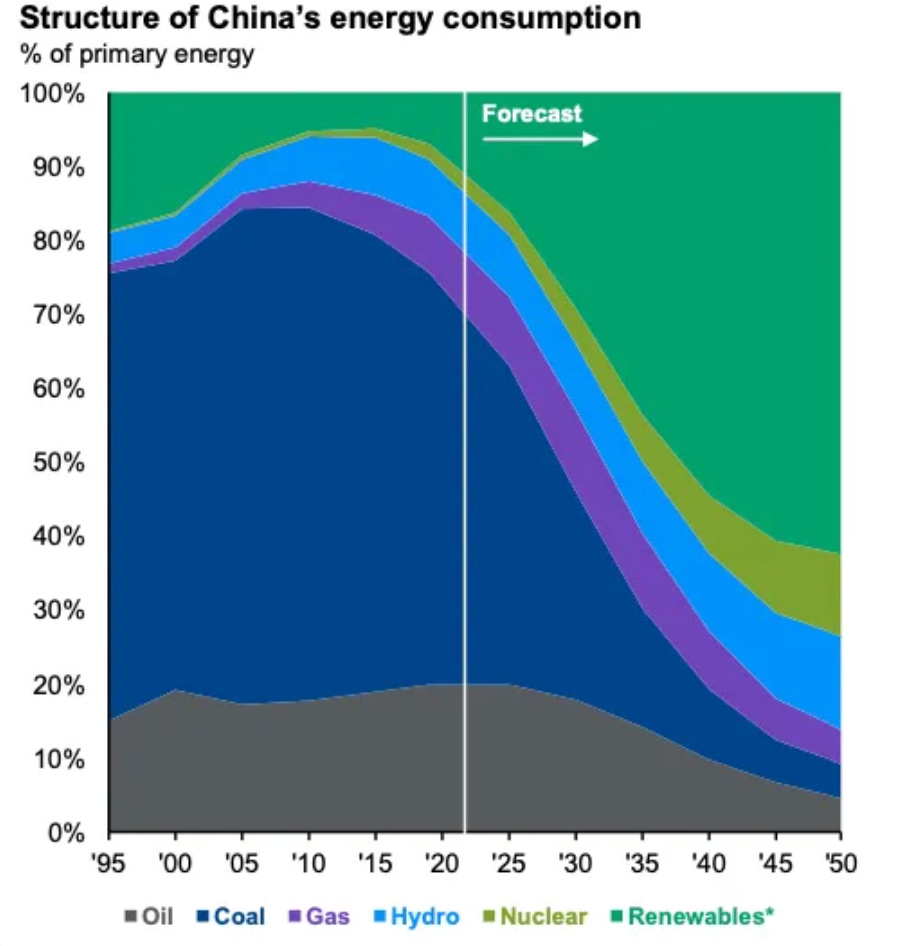

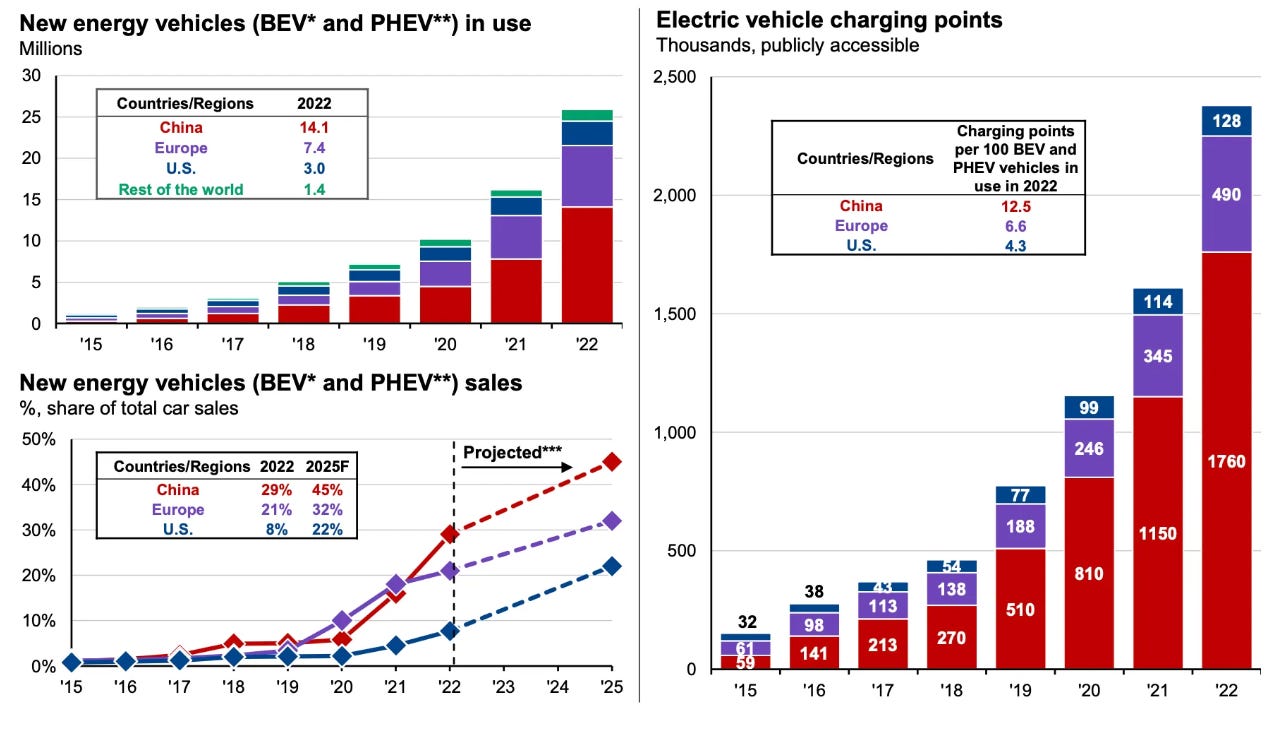

China has strategically invested in core technologies—including electric vehicles, renewable energy, power transmission equipment, and robotics—where it has built significant technological and scale advantages that could enable global market dominance.

I lived in Beijing from 2008 to 2015. When I arrived, most days felt like living in Mordor—the AQI regularly exceeded 1,000, and we viewed the world through a cloud of thick, noxious smog. The conditions mirrored Delhi's pollution levels at the time (which persist there today).

I witnessed the government's decisive actions to address this crisis during my years there. They implemented strict measures: alternating car usage through even/odd number plates, shutting down and modernizing non-compliant industries, transitioning to electric vehicles (which now make up 50% of car sales), shifting toward renewable energy sources, and launching an ambitious city-wide greening campaign.

The result is the "Beijing miracle," recognized by the United Nations Environmental Program. In 2021, Beijing recorded 288 blue-sky days of good air quality, with 115 days meeting the highest quality air standard.

China has been combating desertification in the Gobi and Taklamakan deserts. In late November 2024, China announced the completion of the "Great Green Wall"—a 46-year campaign that encircled its largest desert with more than 116,000 square miles of trees. This has increased China's forest cover from 10% in 1949 to 25%, helping curb sandstorms and improve air quality.

During my meetings in China, I encountered several companies focused on energy and renewables. Their scale and scope of ambition were remarkable.

This ambition stems from government-driven targets and financial incentives. The Chinese government skillfully uses capitalistic levers to guide company investments and behaviour.

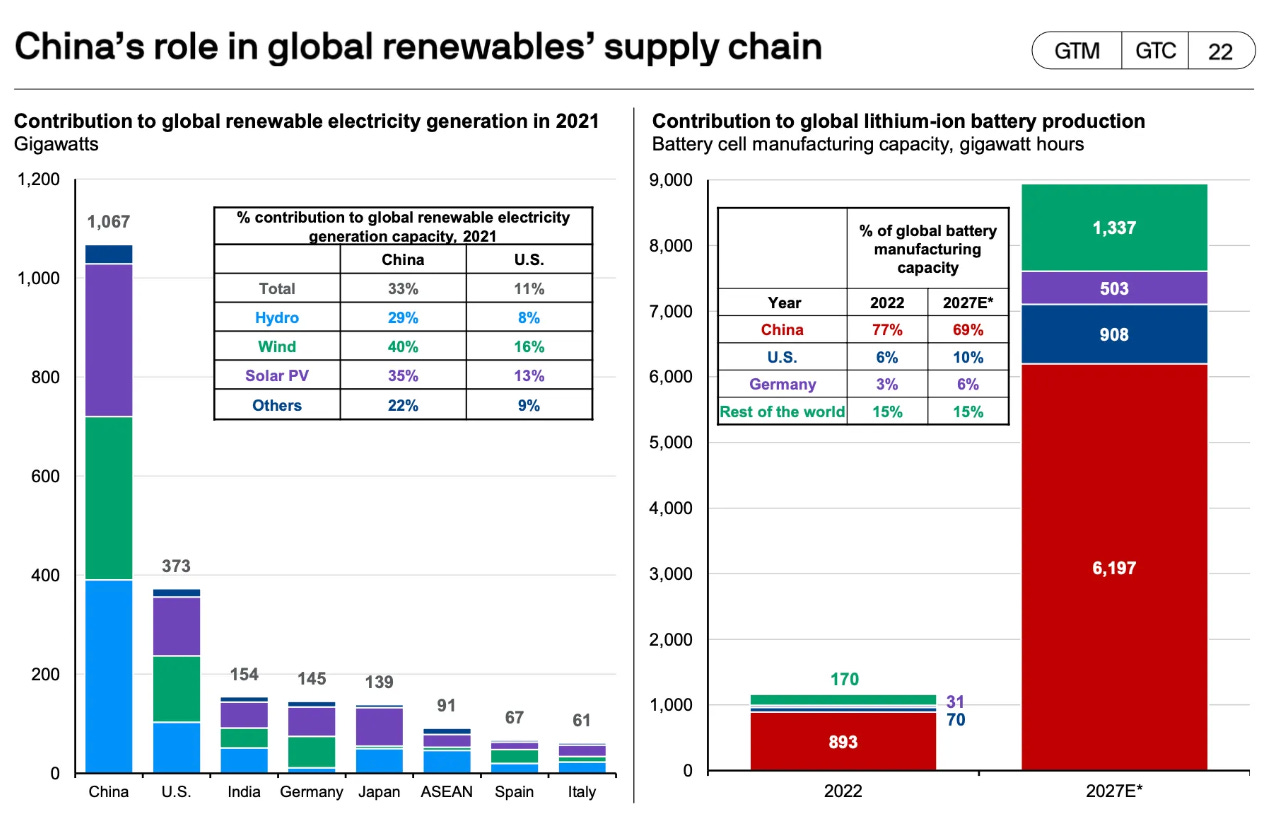

In 2023, China invested $890 billion in clean energy sectors—a 40% increase from 2022, representing a third of global green energy spending.

Its installed renewable energy capacity has surpassed 1.45 billion KWH, comprising 50% of its installed power generation capacity.

The country achieved its 2030 target of 1,200 GW of wind and solar capacity six years ahead of schedule.

Despite these advances, China faces significant challenges with its coal usage. Despite giant leaps in renewable sources, coal consumption hasn't decreased because the country's total energy needs continue to grow. As China develops more renewable capacity and supporting infrastructure—including storage and distribution systems—alongside nuclear power, it aims to tackle the crucial task of reducing coal consumption.

One of the meetings which most impressed me was with a company working on electricity grid technologies. Traditionally, power plants are built near cities, producing power lines and grids clustered around urban areas. However, wind and solar power may be generated far from cities in the new world. These sources are intermittent—dependent on weather conditions—and, when produced in vast quantities, create two significant challenges: storage and distribution. No amount of batteries alone can handle the storage needs, and distributing power across enormous distances while maintaining balanced energy levels is complex. Several Chinese companies are tackling these challenges at scale with advanced technologies. Their storage solutions are innovative—for example, using excess energy to pump water uphill and then converting it back to hydroelectric power when needed. They employ sophisticated AI algorithms to balance the load while building an extensive new grid to transport energy across China. The scale and scope of this effort is remarkable. Within two decades, China could achieve energy self-sufficiency through green technologies while exporting these capabilities globally.

China dominates the global lithium-ion battery supply chain, controlling over 75% of production capacity. This scale provides the industrial foundation for developing newer, more efficient battery technologies, positioning China strongly in the race for battery innovation—a crucial advantage for its electric vehicle industry.

Dominate Electrical Vehicles in China and globally

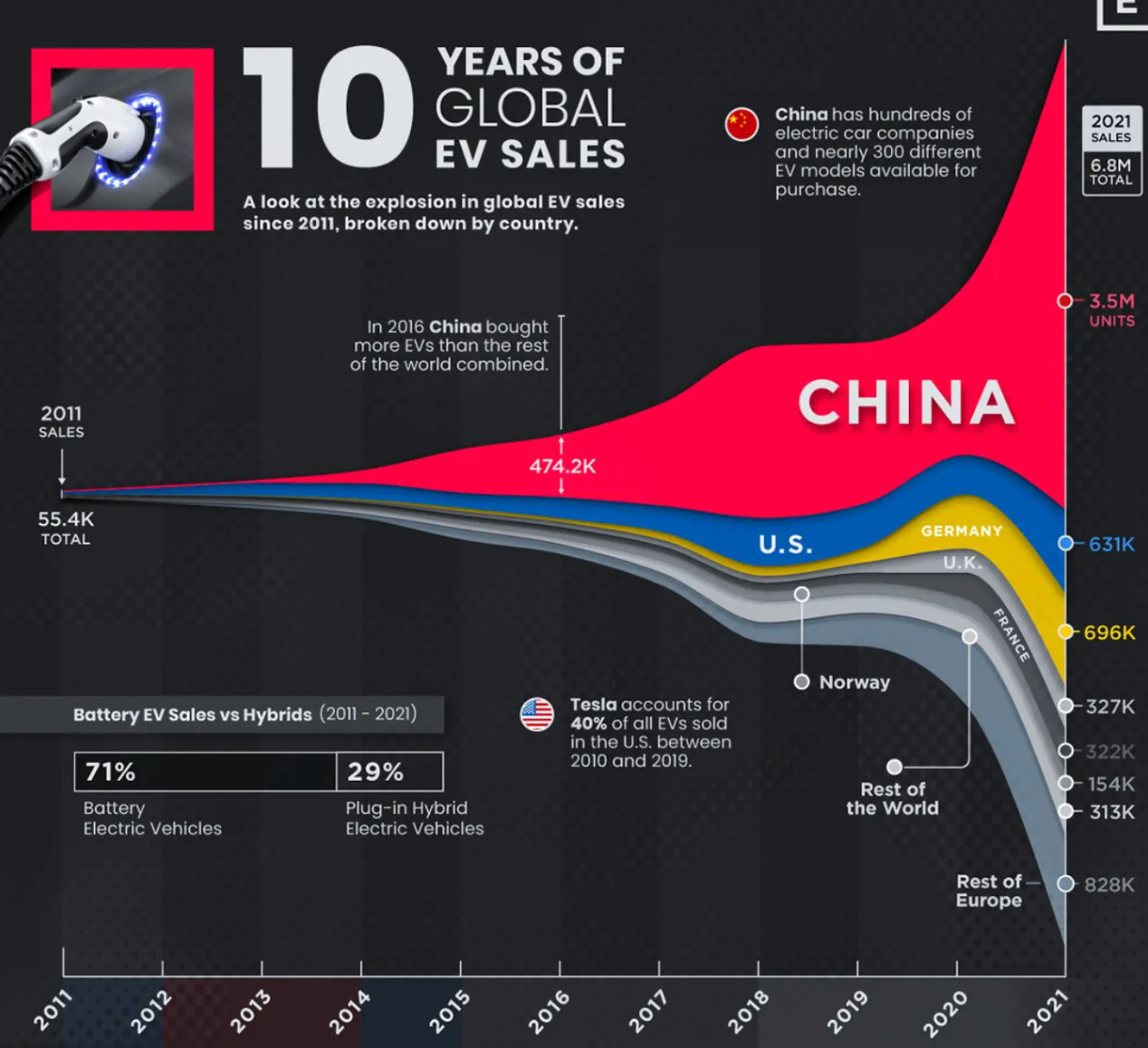

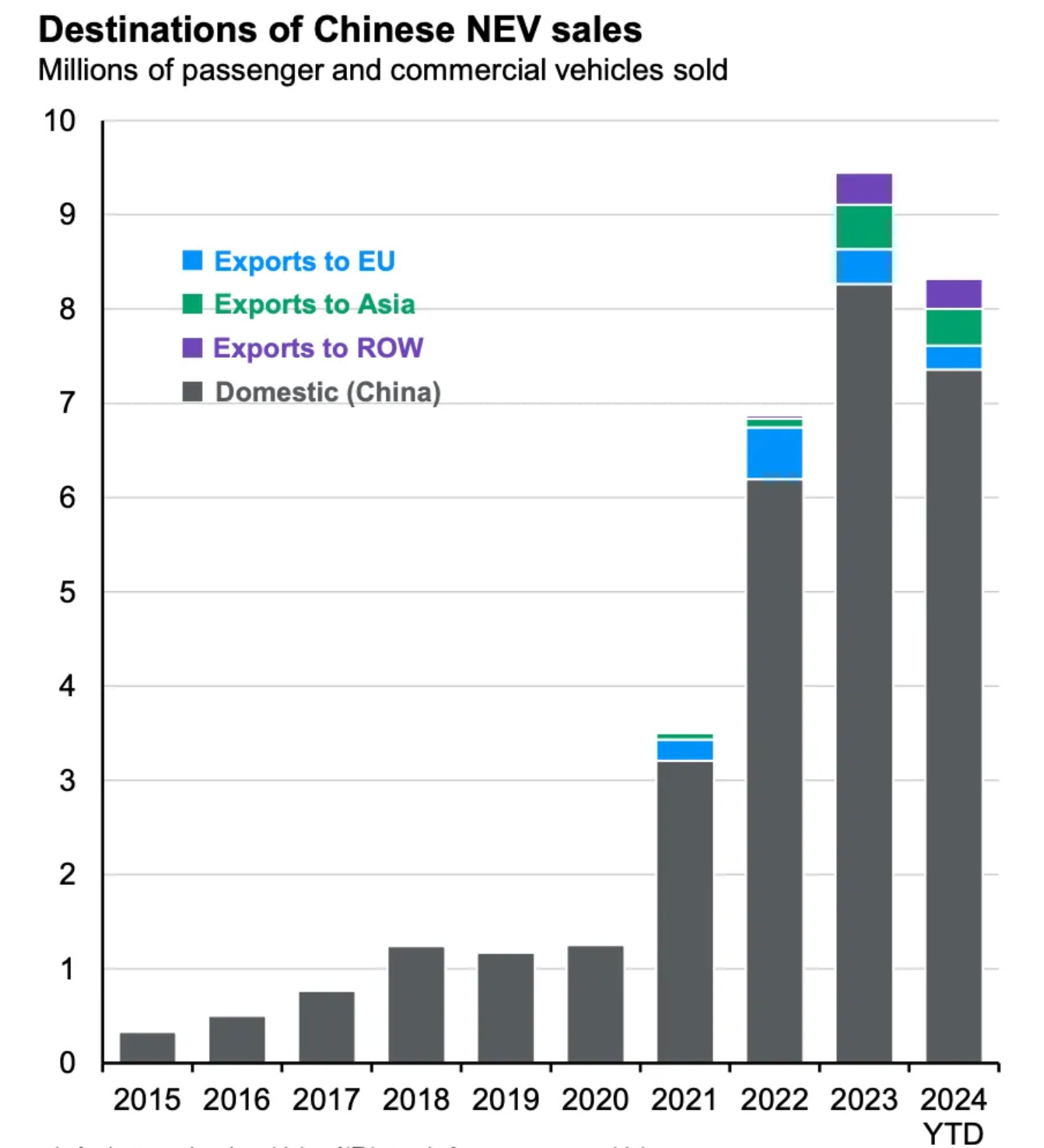

Approximately 90 million cars are sold annually, with 30 million in China alone.

Assuming a 10-year average lifespan, there are about 900 million cars worldwide. At an average price of $20,000 each, that's an $18 trillion market—and China is poised to capture a significant share.

Over the next 20 years, 95% of cars will be electric, translating to an average annual sales of 50 million electric vehicles.

Japanese, German, American, and European manufacturers dominated car sales. They developed proprietary engine technologies, and because these engines had high centres of gravity, they designed sophisticated suspension systems to maintain stability—creating highly specialized expertise.

But this expertise is now irrelevant. Electric cars don't rely on traditional engine technology.

The most successful electric cars are those designed as EVs from the ground up, incorporating cutting-edge battery technology, software, and AI. Integrated hardware + software companies make the best EVs, and Honda, Toyota, Volkswagen and Ford are not great Software companies.

This approach enabled Tesla to overtake established automakers.

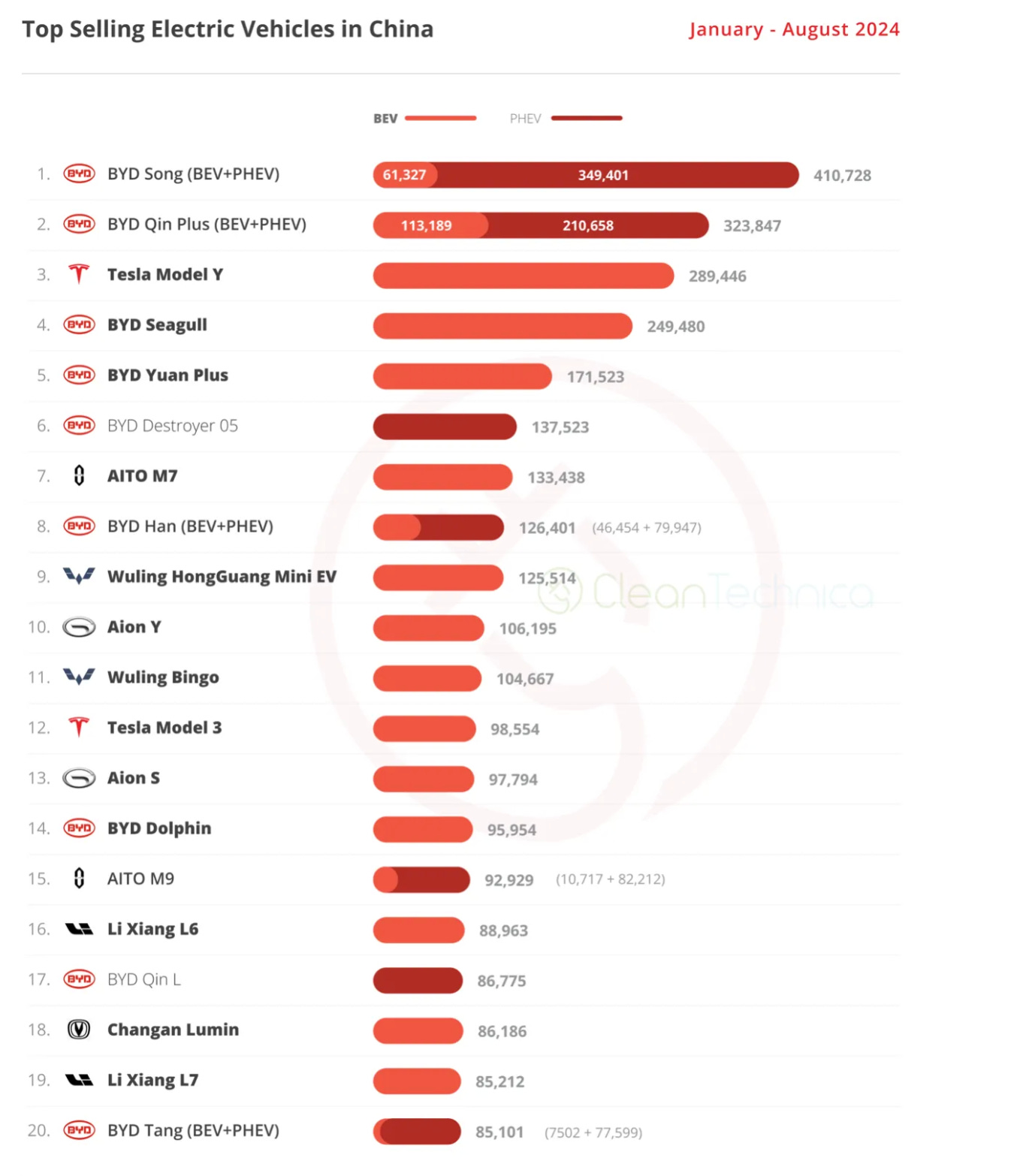

And now Chinese manufacturers have surpassed Tesla.

Without regulatory or tariff barriers, I believe all established European, American, Korean, and Japanese manufacturers face existential risk. Despite their hundred-billion-dollar revenues, these companies could face a Kodak or Nokia-style collapse—potentially falling to zero sales and bankruptcy.

I speak from experience with EVs. Since 2017, I've driven Teslas—first the Model X, then the 3, and now the Y. While I've been satisfied with my switch to electric vehicles and have tested various options, including BMW, Audi, Kia, and Hyundai EVs, I have always considered Tesla the pinnacle of EV development and technology.

Before my visit, I knew that China led the global EV market, as demonstrated by this chart.

My visit to China was eye-opening. I discovered at least 10 Chinese EV brands outperforming my Tesla in design and technical specifications. These vehicles achieve ranges beyond 650 km, and their charging systems can reach 50% capacity in 5-7 minutes. Nio's innovative system allows you to swap an empty battery for a full one in just 3 minutes.

I tested an XPeng, driving it through 20 km of Shanghai's most congested areas, which are teeming with pedestrians and cyclists. We also tested its autonomous driving capabilities with U-turns and navigation through an 8-exit roundabout during peak traffic—the car performed flawlessly.

Of the three models I examined, the most impressive was a 7-seater SUV that surpassed every German luxury vehicle I've seen. It featured a 32-inch TV for rear passengers, massage seats throughout, and a generative AI assistant responding to voice commands for everything from seat heating to window control and music—remarkably, all this at the same price as my Model Y in the UK.

Then there's the "budget" option—the Changan Deep Blue SL 3. Though larger than the Tesla Model 3, it costs just $16,000-$24,000. It delivers a 745 km range, 250 BHP, and accelerates from 0-60 mph in 5.9 seconds. The car has a 15-inch screen, heads-up display, premium leather seats, an excellent sound system, and L2 autopilot capabilities. And it looks like this:

The XPeng equivalent to the Model Y (mid-sized SUV) costs half what I paid in the UK yet offers twice the features and quality.

If this vehicle were available in the UK at Chinese prices or even at Tesla's prices, in my opinion, it could likely become the market leader here.

Even with a 30% tariff, these price differences are so substantial that European brands may struggle to compete.

What's more remarkable is that XPeng isn't even among China's top 10 EV manufacturers.

With CATL and BYD, China leads global battery technology.

Thanks to their massive scale advantages, Chinese manufacturers now produce the most affordable and highest-quality vehicles.

Without nationalistic protective measures, it's hard to see how the expensive, outdated American, German, Japanese, and Korean cars can survive this coming wave of competition. Their primary challenge is to remain viable outside China. They urgently need to innovate in both design and technology to stay relevant.

Companies like Volkswagen, Mercedes, BMW, Ford, and Toyota are titans in their home markets—they anchor entire ecosystems of suppliers and expertise while forming the backbone of the industrial heartland in Germany, America, and Japan. These companies' collapse would mean losing jobs, expertise, and national strength, ultimately weakening the West.

While protectionism might preserve these players in their home markets, it won't help them in China. None of the people I spoke to in China saw any reason to consider these once-prestigious "has-been" brands (their EVs were substandard, too). In October, BMW's Chinese sales plunged by a third, triggering a 61% drop in global profit. Volkswagen suffered a 60% sales decline from a 12% drop in China. GM just wrote down $5 billion from the value of its Chinese business.

Based on my visit, I expect these companies—which dominated China's car market for two decades with hundreds of billions in annual sales—to lose virtually all their Chinese business.

Though they blame a slowing Chinese economy, the real cause is China's accelerating innovation.

Put simply: Chinese cars are better and half the price.

Tesla recognizes this reality. To compete in China, they sell their cars at half their UK prices—a £46,990 car in the UK costs £28,000 in China.

And they're still losing to local manufacturers.

High tech battlefields

I recently visited my mobile phone provider's store in London and discussed why London's 4G and 5G networks are notably slow—even slower than networks in India. The salesperson explained that this resulted from the UK's Huawei ban, which was implemented without securing an adequate replacement. This decision slowed network deployment and led to lower-quality equipment and a 50% increase in costs.

As Western and Chinese companies and ecosystems grow apart, we face a concerning trade-off: limited access to leading technologies while paying premium prices to support less efficient companies shielded from Chinese competition in the name of national interest.

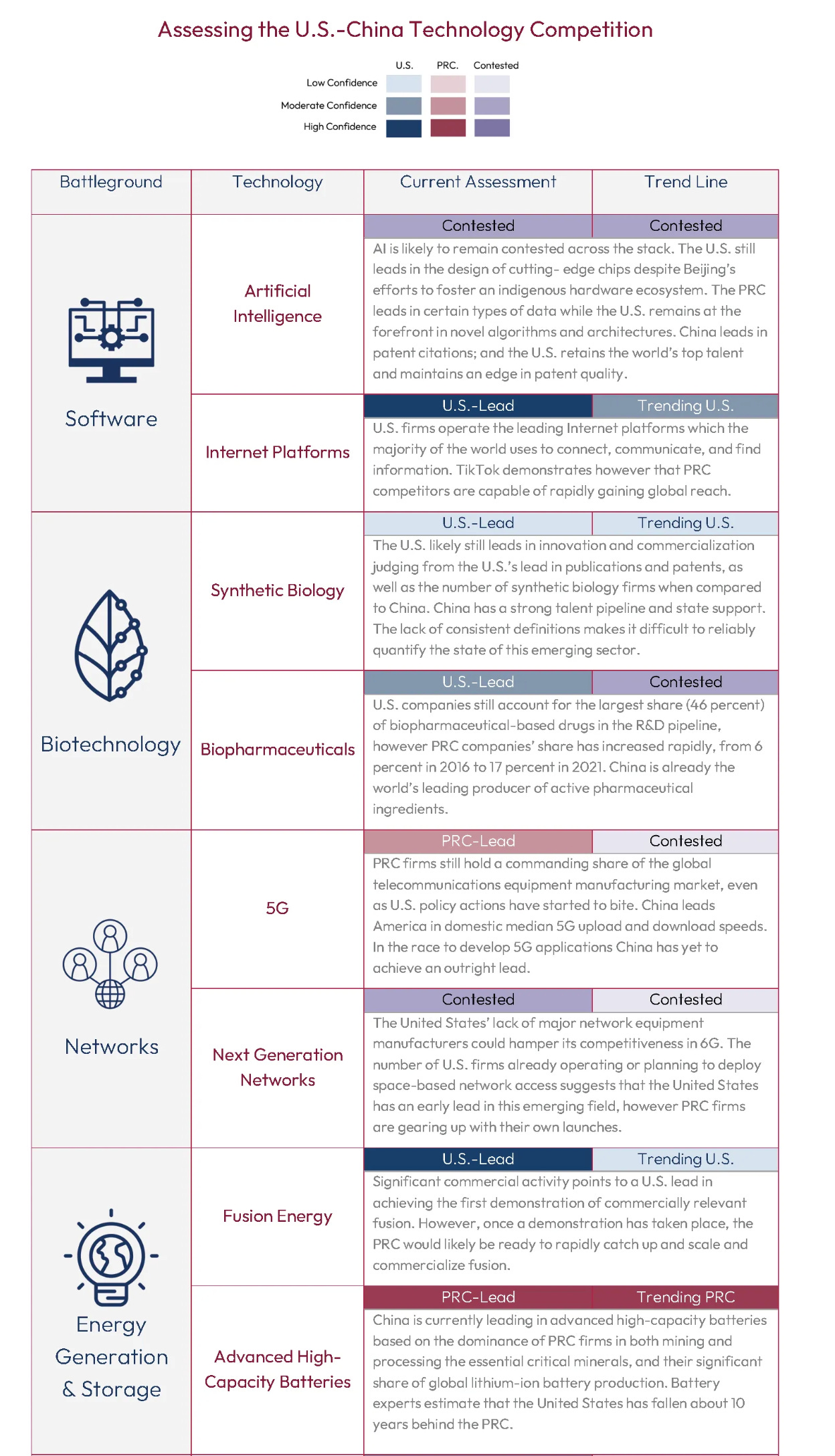

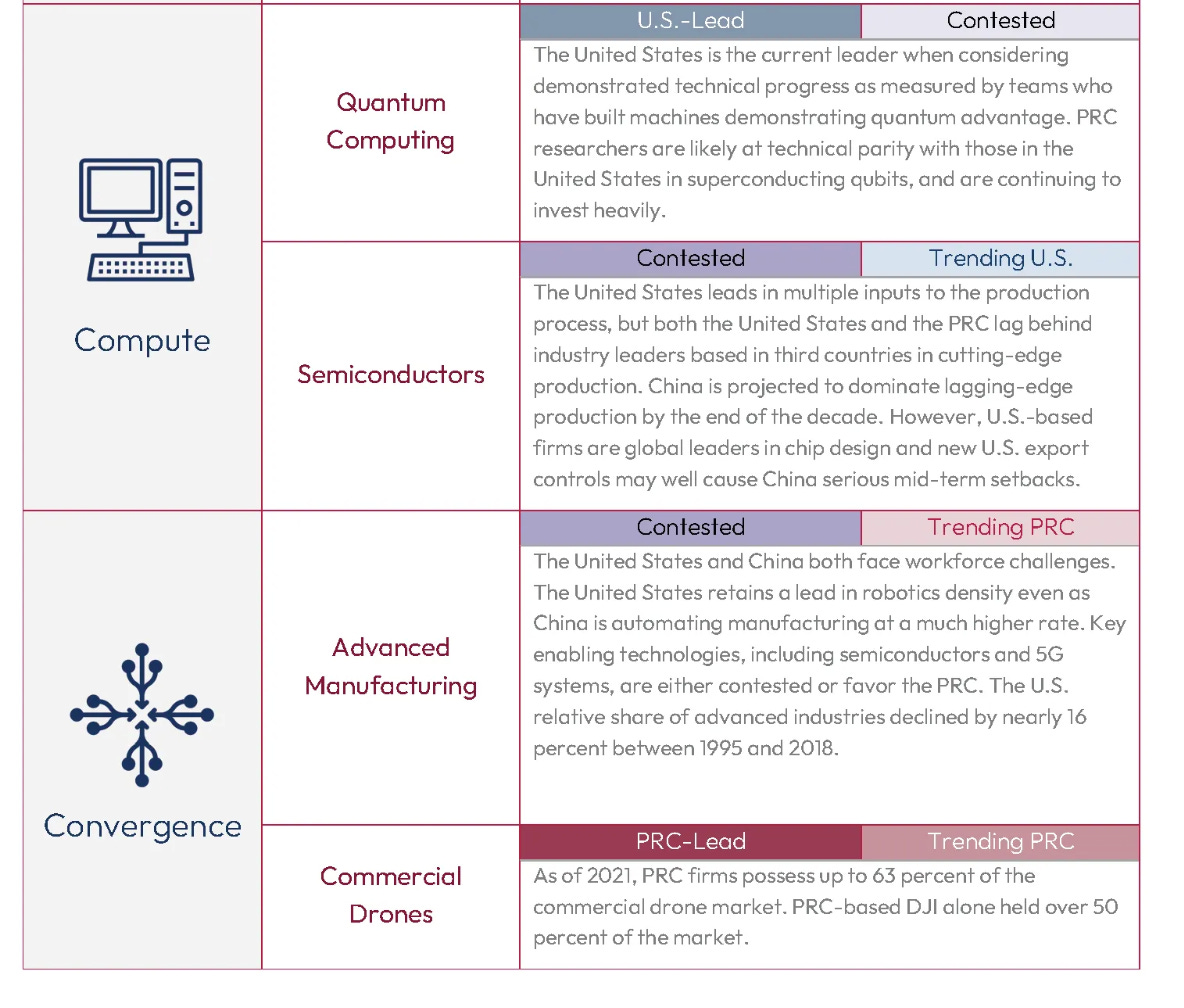

China leads globally in numerous technological domains, competing directly with America while maintaining a significant edge over Europe:

Artificial Intelligence (AI): Leads in facial recognition, natural language processing, and autonomous systems.

5G and Telecommunications: Controls global 5G infrastructure and sets industry standards.

Renewable Energy and EVs: World's largest producer of solar panels, wind turbines, and electric vehicles.

Quantum Technology: Pioneers quantum computing and secure communications.

Semiconductors: Rapidly developing domestic chip manufacturing capabilities.

E-commerce and FinTech: Operates a cashless economy through Alipay and WeChat Pay.

Drones and Robotics: Leads globally in civilian drone technology and industrial automation.

High-Speed Rail: Maintains the world's largest and most sophisticated network.

Space Exploration: Achieves lunar and Mars missions while operating its space station.

Biotechnology and Genomics: Pioneers gene editing and genomic sequencing.

Supercomputing: Creates some of the world's fastest supercomputers.

Energy Storage: Leads in battery production and grid technologies.

Blockchain Technology: Innovates with the Digital Yuan and blockchain applications.

Smart Cities and IoT: Deploys advanced Internet of Things and urban management systems.

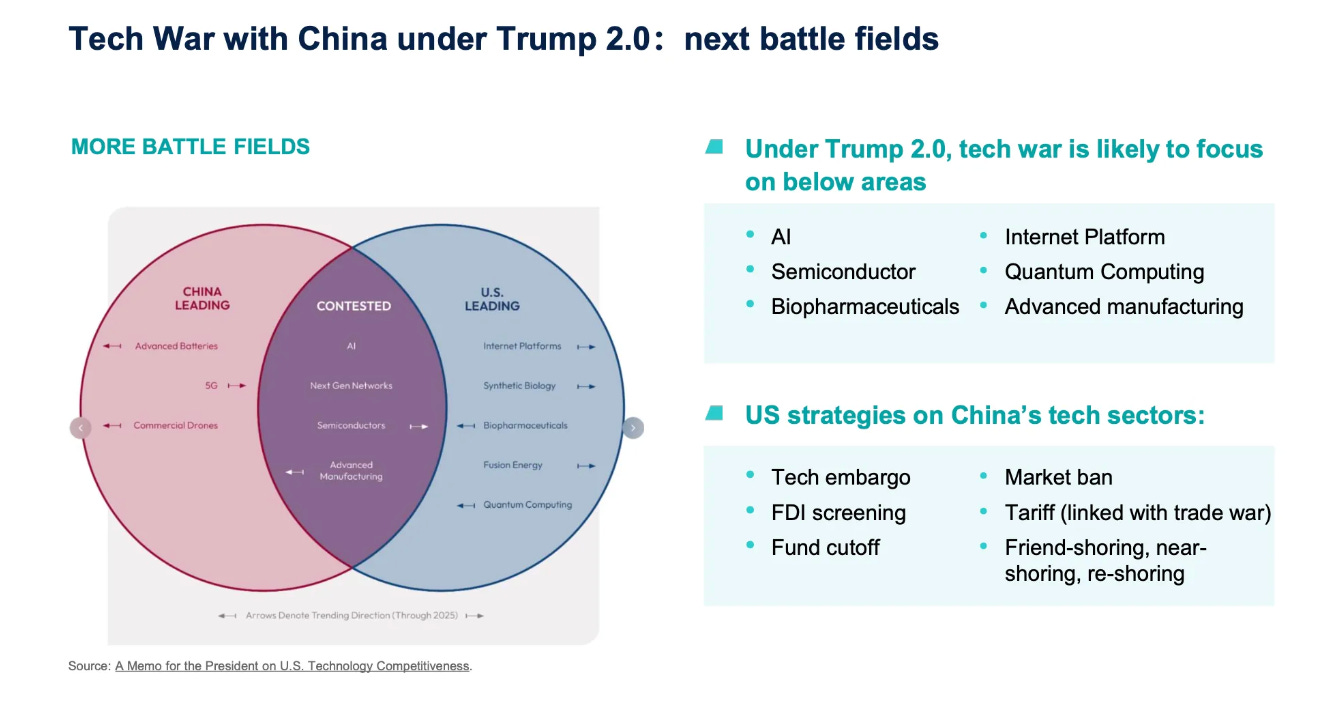

With Trump's potential return to office and emerging semiconductor conflicts, the tech war enters its second phase—centering on quantum computing, AI, advanced manufacturing, internet platforms, biopharmaceuticals, and dual-use technologies like drones and robotics.

Standards

A significant challenge emerging from the China-West divergence is defining technological standards. China and America will compete not only to establish these standards but also to drive their global adoption. This marks a significant shift from the past 25 years when we relied primarily on American-defined global standards. The change is already visible—consider Huawei, which developed its own mobile operating system after being blocked from American technologies. The possibility of Huawei creating something superior to iOS and Android isn't far-fetched, mainly since their Harmony OS aims to control an entire ecosystem of devices rather than just phones. We're already seeing the impact of this divergence in 5G technology, where the UK's networks have suffered in quality after excluding Chinese technology. The split is equally evident in social networks, where Western users lack the integrated functionality of WeChat, while Chinese users cannot access the latest Facebook or Google innovations.

A wave of Innovative Chinese companies winning first in China and then investing to win globally - across all kinds of sectors

Starbucks, BMW, Volkswagen, GM, Tesla, LVMH, Apple, Kering, Ermenegildo Zegna, Burberry, Shiseido—what's common between these brands?

All of them declined in China last quarter.

When these companies explain their China disasters in Western media, they offer a litany of complaints: weak consumer sentiment, poor business environment, and Chinese consumers' unwillingness to spend. Put simply, they claim it's not their fault—it's China's economy.

The unwritten subtext suggests that once China "sorts itself out," business will return to normal, and growth will resume.

This is NOT true.

Based on what I saw, there's a structural change underway.

When I lived in China, Chinese consumers aspired to Western brands. These brands were markers of quality and status—buying a Starbucks coffee meant you had "arrived."

Now, local Chinese brands are innovating across all segments. This innovation continuously drives better products, and over three to five years, brands offer products that are significantly superior.

Many years ago, I experienced this while running the Reckitt business in China. We aspired to function like a "Chinese company" and gave our JV partner a key role in reading the market and demanding a unique pipeline of innovative products that worked for China. We brought in a bone and joint supplement brand called Move Free through the cross-border route from the USA. Move Free was an established supplement brand in the USA with around $100 million in sales, while Chinese sales were zero. Every year, the Move Free global team would create one major innovation and perhaps another minor one. This cadence worked for American trade, which the company was geared for.

Our Chinese partner said he needed at least five innovations every year for the brand. This initially didn't sit well with the American team, who saw China as a small part of the business (with zero sales) and felt this was a wasted effort. We persisted, and the team in America responded admirably to the challenge and created this pipeline.

At the end of the fifth year, the Chinese business had iterated through 25 new launches, of which about half failed. The successful launches took the brand forward and improved the product and claims with each iteration. After five years, the range was much better in China than in the USA, which maintained its steady innovation pace. Today, the Chinese business for the brand is more than twice the size of the American business, and the brand leads in China.

Today, the same transformation is happening in cars—BYD has launched five vehicles for everyone from Tesla. Proya introduces innovations five times faster than L'Oréal in the same segment. Luckin and Cotti innovate more rapidly than Starbucks, with successes like their baijiu (Chinese white wine) flavoured coffee. China excels at leveraging its ecosystem to maintain efficient systems and low costs, resulting in better and cheaper products than their Western competitors.

This represents innovation along two dimensions: improved products with enhanced features plus lower costs.

The outcome becomes predictable when Western brands innovate slowly along a single dimension (matching their global business pace) while competing against Chinese players who innovate faster in two dimensions. After three years, Western products end up inferior and more expensive, and their brand reputation becomes their only remaining asset.

I observed a fascinating shift during this visit. Previously, my Chinese friends (who were generally upper-income) would look pityingly at those not using "prestigious" global brands like Starbucks. Now, they reserve that same pitying look for people driving BMWs or buying Starbucks coffee. When I asked about this change, they explained: "Nio/BYD makes better cars than BMW, and Luckin serves better coffee than Starbucks. These Chinese brands offer more features we value—and at half the price. It would be foolish to buy these overpriced legacy brands. If I bought them, people would think I'm out of touch—someone so caught up in outdated brand prestige that I ignore superior alternatives. They'd question my judgment. So I choose innovative Chinese brands instead, and I feel confident about that decision."

This phenomenon now spans all segments and categories. Chinese companies, forged in the world's most competitive market, have emerged with cutting-edge features, superior quality, and unbeatable costs.

These companies are expanding beyond China with their proven, innovative business models.

From industrial products to cars, B2B suppliers to component manufacturers, and consumer goods companies, they're establishing plants worldwide—across ASEAN (Vietnam, Indonesia, and Malaysia), Africa (Egypt, South Africa, Nigeria), Europe (Poland, Hungary, Bulgaria), and America (Mexico).

This spells trouble for Japanese, European, and American companies with strong businesses in the global south. Take Singapore, for example, where Japanese cars have historically dominated the market share by over 60%. That era is ending as Chinese cars rapidly capture ASEAN markets. These Chinese companies are aggressively investing in local manufacturing. BYD is planning factories in Hungary, Turkey, Thailand, Indonesia, Pakistan, and Mexico, and it has acquired Ford's Brazil facility. Meanwhile, Alibaba is establishing cloud centres across South Korea, the Philippines, and Malaysia. Shein is expanding its distribution and manufacturing presence in America and other countries. CATL is developing battery facilities in Germany, Hungary, and Spain. Even Angel Yeast is building factories in Egypt and Mexico.

China is acquiring valuable Western intellectual property and assets at bargain prices. Many small firms in European countries like Germany and the UK possess specialized IP and excellent craftsmanship but struggle due to their countries' deindustrialization. Chinese companies purchase these distressed assets at steep discounts, further cementing their dominance in high-quality manufacturing.

What will happen now?

As Ray Dalio notes, "Leading powers don't decline without a fight." America will fight to maintain its dominance.

I encourage you to watch the embedded video for his insights on transitions between great powers.

We're entering an era of fierce competition between the American dream and the Chinese struggle.

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

What should you do

To navigate China's evolving landscape, develop curiosity and adaptability. Study China's resilience, strategic patience, and ability to transform challenges into opportunities. Here are key actions to consider:

Watch the USA-China Dynamic: Stay informed about the relationship between these superpowers while maintaining a neutral stance in their geopolitical and economic competition.

Track Future Trends: Monitor emerging innovations from China reshaping global markets.

Prepare to compete with Chinese companies.

Stay alert to Chinese competitors in your industry. Don’t dismiss them before you understand them.

Study their innovation patterns and product development

Speed Matters: Rapid iteration is no longer optional. To compete, companies must embrace a culture of continuous innovation.

Cost Structures Are Critical: Chinese firms excel at balancing quality and affordability. Matching these efficiencies is vital.

Understand the Ecosystem: China’s competitive advantage often lies in its tightly integrated supply chains. Western firms must rethink siloed operations to remain competitive.

Assess Your Career Positioning:

Evaluate your career path if you work in sectors where China leads, such as electric vehicles or semiconductors

Consider strategic moves to more stable positions

Invest Strategically: Create a balanced portfolio combining Chinese opportunities with substantial US investments.

Travel to China: Experience China's technological advancement and progress in person.

Keep an Open Mind:

Form your own views, don’t blindly follow others

Be aware of bias and recognise propaganda on both sides

By embracing these approaches, you'll be better positioned to succeed in a world increasingly influenced by China.

Conclusion: The World Ahead

We are at a crossroads. The USA-China rivalry will define the next century, shaping global markets and the frameworks through which we understand growth, innovation, and resilience. The question is not whether this rivalry will intensify—it will—but how individuals and businesses choose to navigate it.

China’s story is one of struggle, resilience, and boundless ambition. Understanding it is not just about geopolitics—it’s about preparing for a world where the rules are rewritten, and opportunities arise from unexpected places.

Closing Thoughts: The Clash of the Chinese Struggle and the American Dream

The United States and China are locked in a struggle for dominance that will shape the next century. Two paths lie ahead—one leads to a more sharply divided world, where we appear to be heading. In this scenario, both America and China will decouple their supply chains, forcing the rest of the world to choose sides. Yet this isn't just about competition—it's about coexistence. Both nations have much to learn from each other, and they must also address shared challenges like a rising India and climate change. I hope pragmatists on both sides will prevail, reaching out to understand each other's perspectives.

The question for you is: How will you adapt? By understanding China's story of struggle, resilience, and innovation, you can position yourself to thrive in a world where the rules are changing—and the opportunities are endless.

This article draws from multiple sources (listed below), though the narrative reflects my personal views. I remain humble about my understanding of these complex issues and continue to learn and refine my perspective on China. I’m happy to be corrected on any mistakes.

While I've aimed to present both viewpoints objectively, readers on either side may find aspects of my analysis biased.

I've deliberately avoided discussing emotionally charged topics like sabre-rattling, territorial disputes, and potential military conflicts, as these often overshadow the crucial factual issues that deserve our attention.

This article does not give financial advice. Please consult your financial advisors before making any investing decisions.

Please comment if you enjoyed this post or have any thoughts to share. If you think this could be valuable to anyone else, please share it.

Sources and further reading

World Economics

IMF: https://www.imf.org/en/Publications/WEO/weo-database/2024/October/weo-report?c=924

UNCTAD: https://unctad.org/topic/investment/world-investment-report

World Bank: https://data.worldbank.org/country/china

Yale University :

https://epi.yale.edu

Macrotrends: https://www.macrotrends.net/global-metrics/countries/CHN/china/gdp-per-capita

Unesco: https://uis.unesco.org/en/country/cn

WEF: https://www.weforum.org/publications/the-global-competitiveness-report-2019/

Trading economics:

https://tradingeconomics.com/

US Government Accountability Office: https://www.gao.gov/blog/chinas-foreign-investments-significantly-outpace-united-states.-what-does-mean

https://prosperitydata360.worldbank.org/en/indicator/WB+CCDR+CC+SP+EXP+ZS

https://www.bbvaresearch.com/en/publicaciones/china-economic-outlook-november-2024/

Chip wars:

Rapaille, Clotaire. The Culture Code: An Ingenious Way to Understand Why People Around the World Live and Buy as They Do

Encircling the desert with trees: https://www.reuters.com/world/china/china-completes-3000-km-green-belt-around-its-biggest-desert-state-media-says-2024-11-29/

China sanctions US microchip maker: https://www.bbc.co.uk/news/business-65667746

Latest US Chip sanctions: https://www.theguardian.com/us-news/2024/dec/03/joe-biden-china-microchip-export-restrictions-law-changes

A Chinese perspective on the ‘Chip war’ https://thechinaacademy.org/2024-how-does-china-overcome-the-us-chip-sanctions/

https://www.reuters.com/business/us-companies-with-highest-exposure-china-2024-05-14/

The great Chinese Green Wall: https://widerimage.reuters.com/story/the-great-green-wall-chinas-farmers-push-back-the-desert-one-tree-at-a-time

Glossary and explanation of key terms

ASML: A Dutch company that makes advanced machines required to manufacture sophisticated computer chips. It's currently the only company capable of making certain types of chip-making equipment.

Belt and Road Initiative (BRI): China launched a global infrastructure development strategy to build trade routes and economic corridors connecting Asia with Europe and Africa.

Chip War: The ongoing technological and economic competition between nations (mainly the US and China) to control semiconductor manufacturing and technology.

Climate Change: Long-term shifts in global weather patterns and temperatures affecting environmental conditions.

Developing Countries: Nations with less developed industrial bases and lower Human Development Index than other countries.

Digital Yuan: China's official digital currency, part of their strategy to modernize financial systems.

Economic Corridors: Transportation routes between economic hubs designed to stimulate economic development.

Economic Decoupling: The separation of financial systems that were previously integrated, often due to geopolitical tensions.

Electric Vehicles (EVs): Automobiles that use electric motors for propulsion, an industry where China has a significant market share.

Foreign Direct Investment (FDI): When a company or individual from one country makes a business investment in another country.

GDP (Gross Domestic Product): The total monetary value of all finished goods and services produced within a country's borders in a specific period.

Green Belt: Environmental protection zones, referring to China's tree-planting projects to combat desertification.

Innovation Hub: Regions or cities known for high concentration of tech companies, research institutions, and talent pools.

Semiconductor: A material that conducts electricity under specific conditions, crucial for making electronic chips in computers, smartphones, and other devices.

Supply Chain: The network of organizations, people, activities, and resources producing and distributing goods.

Supply Chain Decoupling: Reducing dependency on specific countries (particularly China) for manufacturing and raw materials by diversifying suppliers or bringing production home.

Tech Sanctions are trade restrictions imposed by countries to limit access to advanced technology, particularly in strategic sectors like semiconductors.

Technological Decoupling: The separation of technology ecosystems between nations, particularly in critical sectors.

Western Perspective: The viewpoint and interpretation of events from North American and Western European standpoints.

Check out some of my other Frameworks on the Fast Frameworks Substack:

The delayed gratification framework for intelligent investing

The Fast Frameworks eBook+ Podcast: High-Impact Negotiation Frameworks Part 2-5

The Fast Frameworks eBook+ Podcast: High-Impact Negotiation Frameworks Part 1

Fast Frameworks: A.I. Tools - NotebookLM

The triple filter speech framework

High-Impact Negotiation Frameworks: 5/5 - pressure and unethical tactics

High-impact negotiation frameworks 4/5 - end-stage tactics

High-impact negotiation frameworks 3/5 - middle-stage tactics

High-impact negotiation frameworks 2/5 - early-stage tactics

High-impact negotiation frameworks 1/5 - Negotiating principles

Milestone 53 - reflections on completing 66% of the journey

The exponential growth framework

Fast Frameworks: A.I. Tools - Chatbots

Video: A.I. Frameworks by Aditya Sehgal

The job satisfaction framework

Fast Frameworks - A.I. Tools - Suno.AI

The Set Point Framework for Habit Change

The Plants Vs Buildings Framework

Spatial computing - a game changer with the Vision Pro

The 'magic' Framework for unfair advantage

Really fabulous compilation of data/graphs. China has planned and executed on long term strategic nation building superbly.

Thanks for an amazing reading Aditya. Loved the story flow backed with amazing insights .. the Chinese resilience coupled with their innovation leadership is exciting times for the world. One macro aspect I feel could be added is the China population trends and the aging society and its impact on the China story ?

Thanks again and so much to learn and continue reading here !